Intro

Discover expert 5 Tips for Call Covered California, navigating health insurance plans, subsidies, and enrollment with ease, using Medicaid, Obamacare, and affordable care options.

The importance of having health insurance cannot be overstated, as it provides financial protection against unexpected medical expenses and ensures access to necessary healthcare services. In California, one of the most popular health insurance marketplaces is Covered California, which offers a range of plans from various insurance companies. For individuals and families seeking to enroll in a health plan through Covered California, understanding the process and available options is crucial. This article will delve into the world of Covered California, providing valuable insights and tips for those looking to navigate the system effectively.

Navigating the healthcare system can be complex, especially for those who are new to health insurance or have limited experience with the process. Covered California is designed to make it easier for Californians to find and purchase health insurance that meets their needs and budget. With numerous plans available, ranging from catastrophic coverage to comprehensive plans with extensive benefits, there's an option for nearly everyone. However, selecting the right plan requires careful consideration of several factors, including premium costs, deductible amounts, copays, and the network of healthcare providers.

For individuals and families considering enrollment through Covered California, it's essential to understand the eligibility criteria, the application process, and the types of plans available. Additionally, being aware of the open enrollment periods, special enrollment opportunities, and the role of certified enrollment counselors can significantly simplify the process. Whether you're looking for coverage for yourself or your entire family, having the right information and support can make all the difference in securing the health insurance you need.

Understanding Covered California

Understanding Covered California is the first step towards making informed decisions about your health insurance. Covered California is the state's health insurance marketplace, where individuals, families, and small businesses can find and compare health insurance plans. The marketplace offers a range of plans from several insurance companies, each with its own set of benefits, network of providers, and costs. By understanding how Covered California works, you can better navigate the system and find a plan that fits your needs and budget.

Benefits of Using Covered California

The benefits of using Covered California include access to a wide range of health insurance plans, the ability to compare plans side by side, and the potential to qualify for financial assistance to lower your monthly premiums. Furthermore, Covered California plans must cover essential health benefits, including doctor visits, hospital stays, prescription drugs, and more, ensuring that you have comprehensive coverage when you need it.Eligibility and Application Process

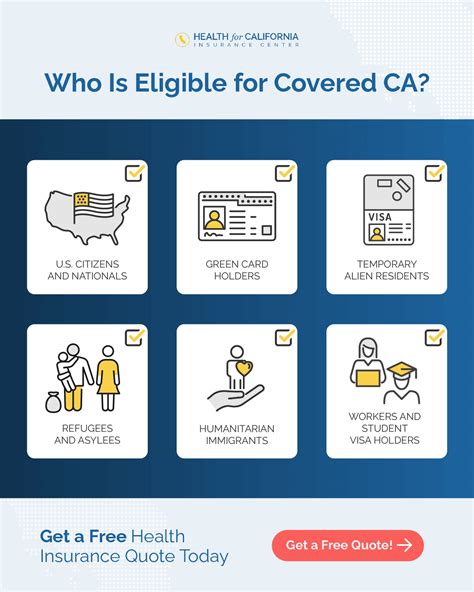

To enroll in a health plan through Covered California, you must meet certain eligibility criteria. Generally, you must be a California resident, be a U.S. citizen or lawfully present in the United States, and not be incarcerated. The application process involves creating an account on the Covered California website, filling out the application, and submitting it for review. You will need to provide personal and income information to determine if you qualify for financial assistance.

Types of Plans Available

Covered California offers various types of health insurance plans, categorized into metal tiers: Bronze, Silver, Gold, and Platinum. Each tier represents a different level of coverage, with Bronze plans offering the least comprehensive coverage at the lowest premiums and Platinum plans offering the most comprehensive coverage at the highest premiums. Understanding the differences between these plans and considering factors such as your health needs, budget, and preferred healthcare providers can help you choose the right plan for you.Open Enrollment and Special Enrollment

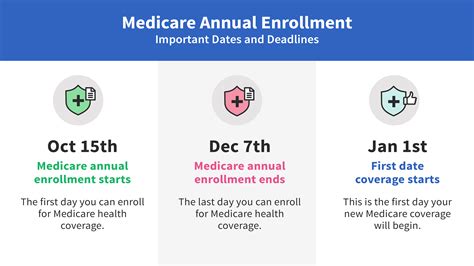

Covered California has an annual open enrollment period, usually from November to January, during which anyone can enroll in a health plan. Outside of this period, you may qualify for special enrollment if you experience a qualifying life event, such as losing your job-based coverage, getting married, having a baby, or moving to a new area. Understanding the rules surrounding open enrollment and special enrollment can help ensure you don't miss your opportunity to get covered.

Role of Certified Enrollment Counselors

Certified enrollment counselors play a vital role in helping individuals and families navigate the Covered California system. These counselors can provide personalized assistance with the application process, help you understand the different plans and their benefits, and even assist with renewing your coverage. Their expertise can be invaluable in making the enrollment process smoother and less intimidating.Tips for Navigating Covered California

Here are five tips for navigating Covered California effectively:

- Start Early: Don't wait until the last minute to explore your options and apply for coverage. Give yourself time to understand the plans, ask questions, and seek help if needed.

- Seek Professional Help: Certified enrollment counselors can provide free assistance and help you make informed decisions about your health insurance.

- Consider Your Health Needs: Think about your health care needs and those of your family. If you have ongoing health issues, you may want a plan with lower out-of-pocket costs for doctor visits and prescriptions.

- Compare Plans Carefully: Look beyond the premium costs. Consider the deductible, copays, coinsurance, and the network of providers for each plan.

- Review and Update Your Application: Ensure all the information on your application is accurate and up-to-date. This includes income, family size, and any changes in your eligibility for financial assistance.

Conclusion and Next Steps

In conclusion, navigating Covered California requires patience, understanding, and sometimes a little help. By following these tips and staying informed, you can find a health insurance plan that meets your needs and budget. Remember, health insurance is a crucial investment in your well-being and financial security. Take the time to explore your options, and don't hesitate to seek help when you need it.What is Covered California?

+Covered California is the state's health insurance marketplace where individuals, families, and small businesses can find and compare health insurance plans.

How do I apply for health insurance through Covered California?

+To apply, you create an account on the Covered California website, fill out the application, and submit it for review. You will need to provide personal and income information.

What are the metal tiers of health insurance plans offered by Covered California?

+The plans are categorized into Bronze, Silver, Gold, and Platinum tiers, representing different levels of coverage and premium costs.

We hope this information has been helpful in your journey to find the right health insurance plan through Covered California. If you have more questions or need further clarification on any of the points discussed, please don't hesitate to reach out. Share this article with friends and family who might also benefit from understanding how to navigate the Covered California system. Your feedback and comments are invaluable to us, and we look forward to hearing about your experiences with Covered California.