Intro

Discover 5 affordable insurance tips to reduce premiums, including budget-friendly options, policy comparisons, and smart coverage choices, helping you save money on auto, health, and life insurance plans.

The world of insurance can be daunting, with numerous options and complex policies that often leave individuals feeling overwhelmed. However, having the right insurance coverage is crucial for protecting one's financial well-being and providing peace of mind. Despite its importance, many people struggle to find affordable insurance options that fit within their budgets. The good news is that there are several strategies and tips that can help make insurance more affordable without sacrificing essential coverage.

Insurance is a vital component of personal finance, offering a safety net against unforeseen events such as accidents, illnesses, and natural disasters. Without adequate insurance, individuals and families risk facing financial ruin in the event of an emergency. This highlights the need for affordable insurance solutions that cater to diverse needs and financial situations. By understanding the insurance market, exploring different types of insurance, and applying smart shopping strategies, consumers can secure the coverage they need at prices they can afford.

The pursuit of affordable insurance begins with education and awareness. Consumers need to understand what they are buying and how different policies compare in terms of coverage, premiums, and benefits. This involves researching insurance providers, reading policy documents carefully, and seeking advice from insurance professionals when necessary. Moreover, the insurance landscape is constantly evolving, with new products and services emerging that can offer better value and more tailored solutions for individuals and businesses. Staying informed about these developments can help consumers make the most of their insurance investments.

Understanding Insurance Basics

To navigate the complex world of insurance effectively, it's essential to grasp some fundamental concepts. This includes understanding the types of insurance available, such as health, life, auto, and home insurance, each designed to protect against different risks. Additionally, consumers should be familiar with insurance terminology, including premiums, deductibles, co-payments, and coverage limits, as these elements directly impact the cost and value of insurance policies. By having a solid understanding of these basics, individuals can make informed decisions about their insurance needs and identify the most affordable options.

Types of Insurance

Insurance comes in many forms, each catering to specific needs and risks. Health insurance, for example, covers medical expenses, while life insurance provides a financial safety net for dependents in the event of the policyholder's death. Auto insurance protects against vehicle-related damages and liabilities, and home insurance safeguards against losses related to one's home. Understanding the purpose and benefits of each type of insurance helps consumers choose the right coverage for their circumstances.Affordable Insurance Strategies

Several strategies can make insurance more affordable. One of the most effective approaches is to shop around, comparing rates and policies from different insurance providers to find the best value. Additionally, bundling multiple insurance policies with the same insurer can often lead to discounts. Raising deductibles can also lower premium costs, although this means paying more out-of-pocket in the event of a claim. Furthermore, maintaining a good credit score and avoiding unnecessary coverage can help reduce insurance expenses.

Shopping for Insurance

The process of shopping for insurance involves more than just comparing prices. Consumers should evaluate the financial strength and customer service reputation of insurance companies, as well as the specifics of what each policy covers and excludes. Reading reviews and asking for referrals from friends, family, or professional advisors can provide valuable insights. It's also crucial to understand the claims process and how efficiently an insurer handles payouts.Customizing Your Insurance

One-size-fits-all insurance policies rarely meet the unique needs of every individual or business. Customizing insurance coverage involves assessing specific risks and selecting policies that address those risks effectively. For instance, a homeowner in a flood-prone area may need additional flood insurance, while a driver with a clean record might opt for a usage-based auto insurance policy that rewards safe driving habits. By tailoring insurance coverage to individual circumstances, consumers can ensure they have the right protection without paying for unnecessary features.

Assessing Risks

Assessing personal and professional risks is a critical step in customizing insurance coverage. This includes considering factors such as health, lifestyle, location, and occupation. For businesses, risk assessment might involve evaluating operational hazards, supply chain vulnerabilities, and potential liabilities. By understanding these risks, individuals and businesses can select insurance policies that provide adequate protection and avoid over-insuring against unlikely events.Utilizing Technology for Insurance Savings

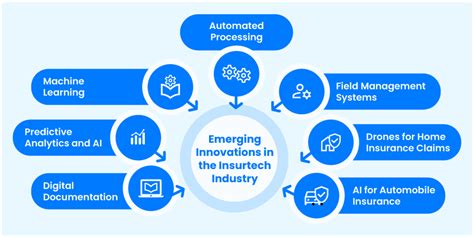

Technology has transformed the insurance industry, offering consumers more convenient, efficient, and cost-effective ways to manage their insurance needs. Online platforms and mobile apps enable quick comparisons of insurance quotes, streamlined policy management, and access to a wide range of insurance products. Additionally, telematics devices and mobile apps can monitor driving habits, health metrics, and other behaviors, potentially leading to personalized insurance rates and discounts for low-risk individuals.

Digital Insurance Tools

Digital tools and platforms have made it easier for consumers to navigate the insurance market. Insurance comparison websites, for example, allow users to input their details and receive tailored quotes from multiple insurers. Furthermore, many insurance companies offer online portals where policyholders can view their policies, make payments, and file claims. Leveraging these digital resources can simplify the insurance process and help consumers find more affordable options.Navigating Insurance Regulations and Policies

Insurance is heavily regulated, with laws and guidelines varying by country, state, or region. Understanding these regulations is essential for ensuring compliance and making the most of available insurance options. Consumers should be aware of their rights and responsibilities under insurance contracts, including how to file complaints and appeal claim decisions. Moreover, staying updated on changes in insurance laws and policies can help individuals and businesses adapt their insurance strategies to maximize benefits and minimize costs.

Insurance Policy Exclusions

Insurance policies often come with exclusions—specific situations or events that are not covered. It's vital for consumers to understand what is excluded from their policies to avoid unexpected surprises when filing a claim. Common exclusions might include pre-existing medical conditions in health insurance, certain types of natural disasters in home insurance, or high-risk driving behaviors in auto insurance. By recognizing these exclusions, individuals can seek additional coverage if necessary and better manage their risks.Seeking Professional Advice

Given the complexity of the insurance market, seeking advice from professionals can be highly beneficial. Insurance agents and brokers can provide personalized guidance, helping consumers navigate the process of selecting and purchasing insurance. They can also offer insights into the latest insurance products and strategies for reducing premiums. Additionally, financial advisors can integrate insurance planning into overall financial strategies, ensuring that insurance coverage aligns with broader financial goals and risk management objectives.

Building a Relationship with Your Insurer

Building a positive relationship with your insurance provider can lead to better service, more personalized advice, and potentially, more favorable policy terms. This involves maintaining open communication, promptly addressing any issues or concerns, and demonstrating a commitment to risk management and safety. By fostering a strong relationship, individuals and businesses can ensure they receive the support they need when dealing with claims or other insurance-related matters.In conclusion, finding affordable insurance requires a combination of knowledge, strategy, and diligence. By understanding the basics of insurance, exploring different types of coverage, and utilizing smart shopping and customization strategies, consumers can protect their assets and well-being without breaking the bank. As the insurance landscape continues to evolve, staying informed and adaptable will be key to securing the best possible insurance deals. Whether you're a seasoned insurance buyer or just starting to explore your options, the right approach can lead to significant savings and enhanced peace of mind.

What are the main types of insurance?

+The main types of insurance include health, life, auto, and home insurance, each designed to protect against different risks and provide financial security in various aspects of life.

How can I make my insurance more affordable?

+To make your insurance more affordable, consider shopping around for quotes, bundling policies, raising your deductibles, and maintaining a good credit score. Additionally, customizing your coverage to fit your specific needs can help avoid unnecessary expenses.

What is the importance of understanding insurance basics?

+Understanding insurance basics, including types of insurance, policy terms, and how insurance works, is crucial for making informed decisions about your coverage. It helps you navigate the insurance market effectively, identify the right policies for your needs, and manage your risks more efficiently.

We invite you to share your thoughts and experiences with finding affordable insurance. Your insights can help others in their search for the right coverage. Feel free to comment below, share this article with someone who might find it helpful, or explore more topics related to personal finance and insurance to continue your journey towards financial stability and security.