Intro

Discover affordable Cheap Health Insurance Options with low premiums, flexible plans, and comprehensive coverage, including medical, dental, and vision care, to suit individual and family needs, ensuring quality healthcare at budget-friendly rates.

The rising cost of healthcare in the United States has made it increasingly difficult for individuals and families to afford health insurance. With the constant changes in the healthcare landscape, it can be overwhelming to navigate the various options available. However, having health insurance is crucial to protect oneself from financial ruin in the event of a medical emergency. In this article, we will delve into the world of cheap health insurance options, exploring the various alternatives that can provide affordable coverage without breaking the bank.

The importance of health insurance cannot be overstated. It provides financial protection against unexpected medical expenses, allowing individuals to receive necessary treatment without incurring significant debt. Moreover, health insurance can help prevent medical bankruptcies, which are a leading cause of personal bankruptcy in the United States. With the numerous options available, it is essential to understand the different types of health insurance, their benefits, and their drawbacks. By doing so, individuals can make informed decisions about their health insurance needs and find affordable coverage that suits their budget.

The healthcare landscape has undergone significant changes in recent years, with the Affordable Care Act (ACA) being a major milestone. The ACA, also known as Obamacare, has made health insurance more accessible to millions of Americans. However, the rising costs of healthcare and insurance premiums have led to a growing demand for cheap health insurance options. Individuals and families are seeking affordable alternatives that can provide comprehensive coverage without breaking the bank. In response to this demand, insurance companies and healthcare providers have developed various options, including short-term health insurance, catastrophic plans, and health sharing programs.

Cheap Health Insurance Options

One of the most popular cheap health insurance options is short-term health insurance. These plans provide temporary coverage for a specified period, usually up to 12 months. Short-term plans are designed for individuals who are between jobs, waiting for employer-sponsored coverage to kick in, or need temporary coverage due to a change in life circumstances. They are often less expensive than major medical plans, but they may not provide the same level of coverage. Short-term plans typically do not cover pre-existing conditions, and they may have limited benefits, such as no coverage for maternity care or mental health services.

Short-Term Health Insurance

Short-term health insurance plans are available through private insurance companies and can be purchased directly or through a broker. These plans are not subject to the same regulations as major medical plans, which means they may not provide the same level of coverage. However, short-term plans can provide temporary financial protection against unexpected medical expenses. Some of the benefits of short-term health insurance include: * Lower premiums compared to major medical plans * Flexible coverage periods, ranging from a few months to a year * Quick application and approval process * Coverage can start as soon as the next dayMajor Medical Plans

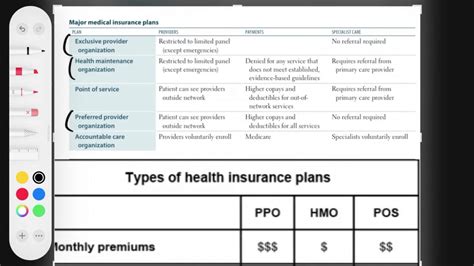

Major medical plans, also known as comprehensive plans, provide more extensive coverage than short-term plans. These plans are designed to provide long-term coverage and typically include benefits such as:

- Hospital stays and surgical services

- Doctor visits and outpatient care

- Prescription medication coverage

- Maternity care and mental health services Major medical plans are available through the Health Insurance Marketplace, employer-sponsored plans, and private insurance companies. These plans are subject to the regulations of the Affordable Care Act, which means they must provide essential health benefits and cannot deny coverage based on pre-existing conditions.

Catastrophic Plans

Catastrophic plans are a type of major medical plan that provides limited coverage at a lower cost. These plans are designed for individuals who are under the age of 30 or qualify for a hardship exemption. Catastrophic plans typically have lower premiums, but they also have higher deductibles and limited benefits. Some of the benefits of catastrophic plans include: * Lower premiums compared to comprehensive plans * Limited coverage for essential health benefits, such as hospital stays and doctor visits * Higher deductibles, which can range from $7,000 to $8,000 per year * Coverage for preventive care services, such as annual check-ups and screeningsHealth Sharing Programs

Health sharing programs are an alternative to traditional health insurance. These programs are based on a membership model, where individuals contribute a monthly share to cover the medical expenses of other members. Health sharing programs are often less expensive than traditional health insurance, but they may not provide the same level of coverage. Some of the benefits of health sharing programs include:

- Lower monthly contributions compared to health insurance premiums

- Coverage for unexpected medical expenses, such as hospital stays and surgical services

- Shared values and a sense of community among members

- Flexibility in choosing healthcare providers and services

Medicaid and CHIP

Medicaid and the Children's Health Insurance Program (CHIP) are government-sponsored health insurance programs that provide coverage to low-income individuals and families. These programs are designed to provide comprehensive coverage, including benefits such as: * Hospital stays and surgical services * Doctor visits and outpatient care * Prescription medication coverage * Maternity care and mental health services Medicaid and CHIP are available to individuals and families who meet specific income and eligibility requirements. These programs are often free or low-cost, making them an affordable option for those who qualify.Employer-Sponsored Plans

Employer-sponsored plans are a type of group health insurance that is offered through an employer. These plans are often more comprehensive than individual plans and may include benefits such as:

- Lower premiums compared to individual plans

- Comprehensive coverage, including essential health benefits

- Access to a network of healthcare providers

- Flexible spending accounts and health savings accounts Employer-sponsored plans are available to employees and their dependents, and they are often subsidized by the employer.

Self-Employed Health Insurance

Self-employed individuals and small business owners may face unique challenges when it comes to finding affordable health insurance. However, there are several options available, including: * Individual plans, which can be purchased through the Health Insurance Marketplace or private insurance companies * Group plans, which can be purchased through a small business or self-employed association * Health sharing programs, which can provide an alternative to traditional health insurance Self-employed individuals and small business owners may also be eligible for tax deductions on their health insurance premiums, which can help reduce the cost of coverage.Discounts and Subsidies

Discounts and subsidies can help make health insurance more affordable. Some of the discounts and subsidies available include:

- Advanced premium tax credits, which can help reduce the cost of health insurance premiums

- Cost-sharing reductions, which can help reduce the cost of deductibles and copays

- Medicaid and CHIP, which can provide free or low-cost coverage to low-income individuals and families

- Employer-sponsored plans, which can provide subsidized coverage to employees and their dependents

Health Insurance Marketplaces

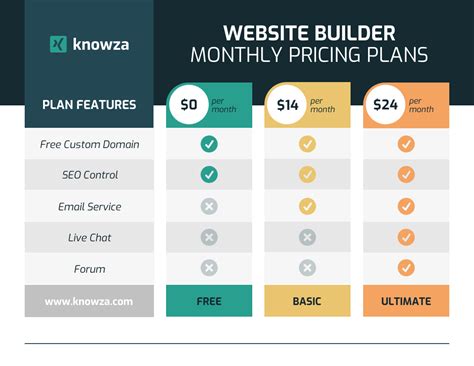

Health insurance marketplaces, such as Healthcare.gov, provide a platform for individuals and families to compare and purchase health insurance plans. These marketplaces offer a range of plans, including major medical plans, catastrophic plans, and short-term plans. Some of the benefits of using a health insurance marketplace include: * Easy comparison of plans and prices * Access to a range of plans and insurance companies * Eligibility for discounts and subsidies * Simple application and enrollment processChoosing the Right Plan

Choosing the right health insurance plan can be overwhelming, but it is essential to consider several factors, including:

- Premium cost and affordability

- Coverage and benefits, including essential health benefits

- Deductibles and copays, including out-of-pocket costs

- Network of healthcare providers, including primary care physicians and specialists

- Customer service and support, including claims processing and billing

Reading Reviews and Ratings

Reading reviews and ratings from other customers can provide valuable insights into the quality and reliability of a health insurance plan. Some of the factors to consider when reading reviews and ratings include: * Customer satisfaction, including overall experience and claims processing * Plan benefits and coverage, including essential health benefits * Premium cost and affordability, including discounts and subsidies * Network of healthcare providers, including primary care physicians and specialistsGetting Quotes and Comparing Plans

Getting quotes and comparing plans is essential to finding the right health insurance plan. Some of the factors to consider when comparing plans include:

- Premium cost and affordability, including discounts and subsidies

- Coverage and benefits, including essential health benefits

- Deductibles and copays, including out-of-pocket costs

- Network of healthcare providers, including primary care physicians and specialists

- Customer service and support, including claims processing and billing

Working with a Broker or Agent

Working with a broker or agent can provide valuable guidance and support when navigating the health insurance market. Some of the benefits of working with a broker or agent include: * Expert knowledge and guidance, including plan benefits and coverage * Access to a range of plans and insurance companies * Personalized service and support, including claims processing and billing * Help with application and enrollment, including eligibility and discountsWhat is the difference between short-term and major medical plans?

+Short-term plans provide temporary coverage for a specified period, usually up to 12 months, while major medical plans provide long-term coverage and typically include benefits such as hospital stays, doctor visits, and prescription medication coverage.

Can I purchase health insurance outside of the open enrollment period?

+Yes, you can purchase health insurance outside of the open enrollment period if you experience a qualifying life event, such as losing job-based coverage, getting married, or having a baby. You can also purchase short-term plans or catastrophic plans, which are available year-round.

How do I know if I qualify for Medicaid or CHIP?

+To qualify for Medicaid or CHIP, you must meet specific income and eligibility requirements. You can apply through your state's Medicaid agency or through the Health Insurance Marketplace to determine if you are eligible.

Can I purchase health insurance as a self-employed individual?

+Yes, as a self-employed individual, you can purchase health insurance through the Health Insurance Marketplace, private insurance companies, or through a small business or self-employed association. You may also be eligible for tax deductions on your health insurance premiums.

How do I choose the right health insurance plan for my needs?

+To choose the right health insurance plan, consider factors such as premium cost and affordability, coverage and benefits, deductibles and copays, network of healthcare providers, and customer service and support. You can also work with a broker or agent to help you navigate the health insurance market and find the best plan for your needs.

In

Conclusion and Final Thoughts