Intro

Discover affordable health insurance options with our guide to the cheapest best health insurance plans, featuring affordable premiums, comprehensive coverage, and top-rated providers for individuals and families, ensuring quality medical care without breaking the bank.

The importance of having health insurance cannot be overstated. It provides financial protection against medical expenses, ensuring that individuals and families can access necessary healthcare without facing financial ruin. With the rising costs of healthcare, it's essential to find affordable health insurance options that meet your needs. In this article, we'll explore the cheapest best health insurance options available, discussing their benefits, working mechanisms, and steps to find the perfect plan for you.

Health insurance is a vital investment, providing peace of mind and protecting your finances from unexpected medical bills. Without health insurance, a single medical emergency can lead to financial devastation, causing individuals to accumulate debt or even file for bankruptcy. Moreover, health insurance encourages preventive care, allowing individuals to receive regular check-ups, screenings, and vaccinations, which can help prevent illnesses and detect health problems early on.

The cheapest best health insurance options vary depending on several factors, including age, location, income level, and health status. It's crucial to research and compares different plans, considering factors such as deductible, copayment, coinsurance, and out-of-pocket maximum. Additionally, individuals should look for plans that offer comprehensive coverage, including prescription medication, mental health services, and maternity care.

Cheap Health Insurance Options

- Short-term health insurance: These plans provide temporary coverage, typically for a few months, and are often cheaper than major medical plans.

- Catastrophic health insurance: These plans are designed for young adults or those who cannot afford other types of coverage, offering limited benefits at a lower cost.

- Medicaid: A government-sponsored program that provides health coverage to low-income individuals and families.

- Affordable Care Act (ACA) plans: Also known as Obamacare, these plans offer comprehensive coverage and are often subsidized by the government.

Benefits of Cheap Health Insurance

The benefits of cheap health insurance are numerous. Some of the most significant advantages include:- Financial protection: Health insurance provides a safety net against unexpected medical expenses, preventing financial ruin.

- Access to healthcare: With health insurance, individuals can access necessary medical care, including preventive services, diagnostic tests, and treatments.

- Peace of mind: Knowing that you have health insurance can provide peace of mind, reducing stress and anxiety related to medical expenses.

- Improved health outcomes: Health insurance encourages individuals to seek regular medical care, which can lead to better health outcomes and early detection of health problems.

Affordable Health Insurance Plans

- Health insurance marketplaces: These online platforms allow individuals to compare and purchase health insurance plans from different providers.

- Private insurance companies: Many private insurance companies offer affordable health insurance plans, both on and off the marketplace.

- Employer-sponsored plans: Many employers offer health insurance as a benefit to their employees, often at a lower cost than individual plans.

- Government programs: Medicaid, Medicare, and the Children's Health Insurance Program (CHIP) provide affordable health insurance options for eligible individuals and families.

How to Find the Cheapest Best Health Insurance

To find the cheapest best health insurance, follow these steps:- Research and compare plans: Use online tools to compare health insurance plans from different providers, considering factors such as premium, deductible, and out-of-pocket maximum.

- Check eligibility for subsidies: If you're eligible for subsidies, you may be able to reduce your premium costs.

- Consider short-term or catastrophic plans: If you're unable to afford major medical plans, short-term or catastrophic plans may provide temporary or limited coverage at a lower cost.

- Look for discounts: Some insurance companies offer discounts for certain groups, such as students, military personnel, or non-smokers.

- Read reviews and check ratings: Research the insurance company's reputation, customer service, and financial stability to ensure you're choosing a reliable provider.

Health Insurance for Specific Needs

- Family health insurance: Plans that cover spouses, children, and other dependents.

- Individual health insurance: Plans that cover a single person.

- Self-employed health insurance: Plans designed for self-employed individuals or small business owners.

- Medicare and Medicaid: Government-sponsored programs that provide health coverage to seniors, low-income individuals, and families.

Working Mechanisms of Health Insurance

Health insurance works by pooling risks and resources to provide financial protection against medical expenses. Here's a step-by-step explanation:- Premiums: Individuals or families pay premiums to the insurance company, which are used to fund medical expenses.

- Deductible: The insured individual or family pays a deductible, which is a set amount of money, before the insurance company begins to pay for medical expenses.

- Copayment and coinsurance: The insured individual or family pays a copayment or coinsurance, which is a percentage of the medical expenses, after meeting the deductible.

- Out-of-pocket maximum: The insured individual or family pays a maximum amount of money, known as the out-of-pocket maximum, for medical expenses during a policy period.

Health Insurance Costs and Savings

- Premium: The monthly or annual payment made to the insurance company.

- Deductible: The amount of money paid by the insured individual or family before the insurance company begins to pay for medical expenses.

- Out-of-pocket maximum: The maximum amount of money paid by the insured individual or family for medical expenses during a policy period.

- Subsidies: Government-sponsored subsidies that reduce premium costs for eligible individuals and families.

Practical Examples and Statistical Data

Here are some practical examples and statistical data to illustrate the importance of health insurance:- A study by the Kaiser Family Foundation found that individuals with health insurance are more likely to receive preventive care, including vaccinations and cancer screenings.

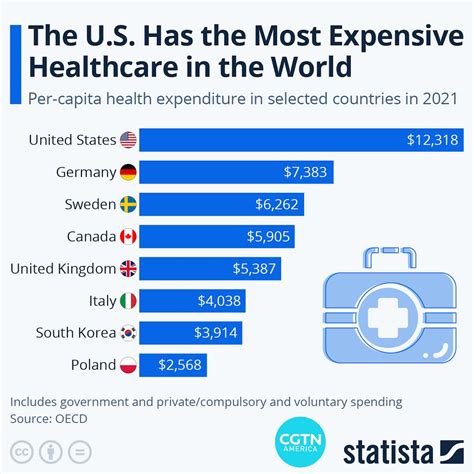

- According to the Centers for Medicare and Medicaid Services, the average annual premium for a benchmark health insurance plan in 2022 was $452 per month.

- A report by the National Association of Health Underwriters found that 70% of individuals who purchase health insurance through the marketplace receive subsidies to reduce their premium costs.

Conclusion and Next Steps

We invite you to share your thoughts and experiences with health insurance in the comments below. If you found this article helpful, please share it with your friends and family who may be searching for affordable health insurance options. Take the next step in protecting your health and finances by exploring the cheapest best health insurance options available to you.

What is the cheapest health insurance option?

+The cheapest health insurance option varies depending on several factors, including age, location, income level, and health status. However, short-term health insurance and catastrophic health insurance plans are often the most affordable options.

How do I find affordable health insurance?

+To find affordable health insurance, research and compare plans from different providers, consider short-term or catastrophic plans, and check eligibility for subsidies. You can also look for discounts and read reviews to ensure you're choosing a reliable provider.

What are the benefits of having health insurance?

+The benefits of having health insurance include financial protection against medical expenses, access to healthcare, peace of mind, and improved health outcomes. Health insurance also encourages preventive care, allowing individuals to receive regular check-ups, screenings, and vaccinations.

Can I get health insurance if I have a pre-existing condition?

+Yes, you can get health insurance if you have a pre-existing condition. The Affordable Care Act (ACA) prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

How do I apply for health insurance?

+To apply for health insurance, you can visit the health insurance marketplace, contact a licensed insurance agent, or apply directly through an insurance company's website. Be sure to research and compare plans, and check eligibility for subsidies before applying.