Intro

Explore family health insurance plan options, including individual, group, and employer-sponsored plans, to find affordable coverage for medical, dental, and vision care, and secure your familys well-being with the right policy.

As the backbone of society, families play a crucial role in shaping the future. Ensuring the well-being and health of family members is of utmost importance, and one of the most effective ways to do this is by investing in a comprehensive family health insurance plan. With the ever-rising costs of medical care, having a suitable insurance plan can provide peace of mind and financial security in the face of unexpected medical expenses. In this article, we will delve into the world of family health insurance plans, exploring the various options available, their benefits, and what to consider when selecting the right plan for your loved ones.

The importance of family health insurance cannot be overstated. Medical emergencies can arise at any time, and without adequate coverage, the financial burden can be overwhelming. A family health insurance plan helps to mitigate this risk, providing access to quality medical care while protecting your family's financial stability. Moreover, many insurance plans offer preventive care services, such as routine check-ups and screenings, which can help detect health issues early on, reducing the risk of more severe and costly problems down the line.

In today's fast-paced world, families come in all shapes and sizes, and their health insurance needs can vary greatly. Some families may have young children, while others may have elderly members or individuals with pre-existing medical conditions. Fortunately, there are numerous family health insurance plan options available, catering to diverse needs and budgets. From traditional indemnity plans to more modern, consumer-driven health plans, the choices can be daunting. However, by understanding the different types of plans, their advantages, and disadvantages, you can make an informed decision that suits your family's unique requirements.

Types of Family Health Insurance Plans

When it comes to family health insurance plans, there are several types to consider. Each plan has its characteristics, benefits, and drawbacks, which are essential to understand before making a decision. Some of the most common types of family health insurance plans include:

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, offer a traditional approach to health insurance. With this type of plan, you pay a premium, and in return, the insurance company reimburses you for a portion of your medical expenses. Indemnity plans provide a high degree of flexibility, allowing you to choose your healthcare providers and services. However, they often come with higher out-of-pocket costs, such as deductibles and copays.

Managed Care Plans

Managed care plans, including Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), have become increasingly popular in recent years. These plans aim to control costs by creating networks of healthcare providers who agree to offer discounted services to plan members. Managed care plans typically have lower premiums than indemnity plans but may limit your choice of healthcare providers.

Consumer-Driven Health Plans

Consumer-driven health plans (CDHPs) are designed to give you more control over your healthcare spending. These plans often combine a high-deductible health plan with a health savings account (HSA) or health reimbursement arrangement (HRA). CDHPs can be more cost-effective than traditional plans, but they may require you to pay more out-of-pocket for medical services.

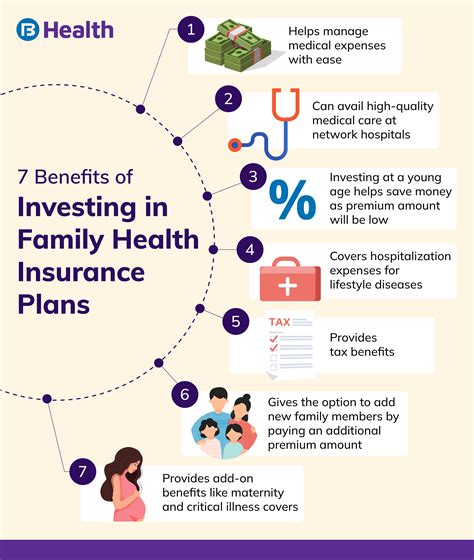

Benefits of Family Health Insurance Plans

Family health insurance plans offer numerous benefits, including:

- Financial protection against unexpected medical expenses

- Access to quality healthcare services and providers

- Preventive care services, such as routine check-ups and screenings

- Tax benefits, such as premium deductions and HSA contributions

- Peace of mind, knowing that your loved ones are protected in case of a medical emergency

Key Considerations When Selecting a Family Health Insurance Plan

When choosing a family health insurance plan, there are several factors to consider. Some of the key considerations include:

- Premium costs: Calculate the total premium cost, including any additional fees or charges.

- Network of providers: Check if your preferred healthcare providers are part of the plan's network.

- Deductibles and copays: Understand the out-of-pocket costs associated with the plan, including deductibles, copays, and coinsurance.

- Coverage and benefits: Review the plan's coverage and benefits, including any exclusions or limitations.

- Maximum out-of-pocket expenses: Determine the maximum amount you may need to pay for medical expenses in a given year.

How to Choose the Right Family Health Insurance Plan

Choosing the right family health insurance plan can be a daunting task, but by following these steps, you can make an informed decision:

- Assess your family's needs: Consider the age, health, and medical requirements of your family members.

- Research different plans: Compare various plans, including their benefits, drawbacks, and costs.

- Evaluate the network of providers: Check if your preferred healthcare providers are part of the plan's network.

- Calculate the total cost: Determine the total premium cost, including any additional fees or charges.

- Review the plan's coverage and benefits: Understand the plan's coverage and benefits, including any exclusions or limitations.

Family Health Insurance Plan Options for Small Businesses and Self-Employed Individuals

Small businesses and self-employed individuals often face unique challenges when it comes to providing family health insurance for their employees or dependents. Some options to consider include:

- Group health insurance plans: Small businesses can purchase group health insurance plans, which offer discounted rates for multiple employees.

- Association health plans: Self-employed individuals and small businesses can join association health plans, which pool resources to negotiate better rates with insurance providers.

- Private health insurance plans: Individuals and families can purchase private health insurance plans, which offer more flexibility and customization options.

Family Health Insurance Plan Options for Low-Income Families

Low-income families often struggle to access affordable family health insurance plans. Some options to consider include:

- Medicaid: A government-sponsored health insurance program for low-income individuals and families.

- Children's Health Insurance Program (CHIP): A government-sponsored health insurance program for children from low-income families.

- Subsidized health insurance plans: The Affordable Care Act (ACA) offers subsidized health insurance plans for low-income individuals and families.

Conclusion and Next Steps

In conclusion, family health insurance plans are a vital investment for any family. By understanding the different types of plans, their benefits, and drawbacks, you can make an informed decision that suits your family's unique requirements. Whether you're a small business owner, self-employed individual, or low-income family, there are various options available to ensure your loved ones receive the medical care they need. Take the first step today and explore the different family health insurance plan options to find the perfect fit for your family.

We invite you to share your thoughts and experiences with family health insurance plans in the comments below. If you found this article helpful, please consider sharing it with your friends and family who may be searching for the right health insurance plan. Together, we can ensure that every family has access to quality, affordable healthcare.

What is the difference between an HMO and a PPO?

+An HMO (Health Maintenance Organization) is a type of health insurance plan that requires you to receive medical care from a specific network of providers. A PPO (Preferred Provider Organization) is a type of health insurance plan that allows you to receive medical care from both in-network and out-of-network providers, although out-of-network care typically costs more.

Can I customize my family health insurance plan to meet my family's specific needs?

+Yes, many insurance providers offer customizable family health insurance plans that allow you to tailor your coverage to meet your family's unique needs. You can often choose from a range of deductibles, copays, and coverage levels to create a plan that suits your budget and requirements.

How do I know if my family qualifies for Medicaid or CHIP?

+To determine if your family qualifies for Medicaid or CHIP, you can visit your state's Medicaid website or contact your local Medicaid office. They will guide you through the eligibility criteria and application process. Typically, eligibility is based on income level, family size, and other factors.