Intro

Discover Group Health Plan Benefits, including medical, dental, and vision coverage, with advantages like tax savings, employee retention, and preventive care, promoting overall wellness and financial security for businesses and employees alike.

Group health plans are a type of health insurance coverage that is offered to a group of people, typically employees of a company or members of an organization. These plans are designed to provide comprehensive medical coverage to the members of the group, and they often offer a range of benefits that can help to improve the health and well-being of the group members. In this article, we will explore the benefits of group health plans, including the types of coverage they offer, how they work, and the advantages they provide to both employers and employees.

Group health plans are an essential part of the employee benefits package offered by many employers. They provide a range of benefits, including medical, dental, and vision coverage, as well as access to wellness programs and other health-related services. These plans are designed to help employees maintain their physical and mental health, which can lead to increased productivity, reduced absenteeism, and improved job satisfaction. Additionally, group health plans can help to attract and retain top talent, as they are often seen as a valuable benefit by employees.

The benefits of group health plans are numerous, and they can have a significant impact on the health and well-being of employees. For example, studies have shown that employees who have access to group health plans are more likely to receive regular medical check-ups, which can help to prevent illnesses and detect health problems early. They are also more likely to take advantage of wellness programs, such as fitness classes and health screenings, which can help to improve their overall health and well-being. Furthermore, group health plans can provide employees with access to mental health services, which can help to reduce stress and improve their mental health.

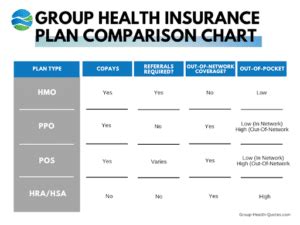

Types of Group Health Plans

There are several types of group health plans available, each with its own unique features and benefits. Some common types of group health plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). HMOs, for example, require members to receive medical care from a specific network of providers, while PPOs offer more flexibility and allow members to see any healthcare provider they choose. EPOs, on the other hand, offer a combination of the two, with a network of preferred providers and the option to see out-of-network providers at a higher cost.

Health Maintenance Organizations (HMOs)

HMOs are a type of group health plan that requires members to receive medical care from a specific network of providers. These plans often have lower premiums than other types of plans, but they may have more restrictions on the types of services that are covered. For example, HMOs may require members to see a primary care physician before seeking specialized care, and they may not cover out-of-network care except in emergency situations.Preferred Provider Organizations (PPOs)

PPOs are a type of group health plan that offers more flexibility than HMOs. These plans have a network of preferred providers, but members are not required to see only those providers. Instead, they can see any healthcare provider they choose, although they may pay more for out-of-network care. PPOs often have higher premiums than HMOs, but they offer more freedom and flexibility.Exclusive Provider Organizations (EPOs)

EPOs are a type of group health plan that offers a combination of the benefits of HMOs and PPOs. These plans have a network of preferred providers, but members can also see out-of-network providers at a higher cost. EPOs often have lower premiums than PPOs, but they may have more restrictions on the types of services that are covered.How Group Health Plans Work

Group health plans work by pooling the resources of a group of people to purchase health insurance coverage. The group, which is typically made up of employees or members of an organization, pays a premium to the insurance company, which then provides coverage to the members of the group. The premium is often split between the employer and the employees, although the exact split can vary depending on the plan.

The process of enrolling in a group health plan typically begins with the employer or organization selecting a plan and negotiating the terms of the coverage with the insurance company. The employer or organization then communicates the details of the plan to the employees or members, who can choose to enroll in the plan during an open enrollment period. Once enrolled, members can access the plan's benefits, including medical, dental, and vision coverage, as well as wellness programs and other health-related services.

Benefits of Group Health Plans for Employers

Group health plans can provide a range of benefits to employers, including:- Attracting and retaining top talent: Group health plans are often seen as a valuable benefit by employees, and they can help to attract and retain top talent.

- Improving employee health and productivity: Group health plans can help to improve employee health and productivity, which can lead to increased job satisfaction and reduced absenteeism.

- Reducing healthcare costs: Group health plans can help to reduce healthcare costs by pooling the resources of a group of people to purchase health insurance coverage.

- Enhancing employee benefits package: Group health plans can enhance the employee benefits package, making it more competitive and attractive to potential employees.

Benefits of Group Health Plans for Employees

Group health plans can also provide a range of benefits to employees, including:- Access to comprehensive medical coverage: Group health plans can provide access to comprehensive medical coverage, including doctor visits, hospital stays, and prescription medications.

- Reduced out-of-pocket costs: Group health plans can help to reduce out-of-pocket costs, including deductibles, copays, and coinsurance.

- Improved health and well-being: Group health plans can help to improve health and well-being by providing access to wellness programs and other health-related services.

- Increased job satisfaction: Group health plans can increase job satisfaction by providing a valuable benefit that can help to attract and retain top talent.

Advantages of Group Health Plans

Group health plans have a number of advantages, including:

- Lower premiums: Group health plans can have lower premiums than individual health plans, since the risk is spread across a larger group of people.

- Broader coverage: Group health plans can provide broader coverage than individual health plans, including coverage for pre-existing conditions and maternity care.

- Simplified administration: Group health plans can simplify administration, since the employer or organization handles the paperwork and communication with the insurance company.

- Increased bargaining power: Group health plans can provide increased bargaining power, since the group can negotiate with the insurance company to secure better rates and coverage.

Disadvantages of Group Health Plans

While group health plans have a number of advantages, they also have some disadvantages, including:- Limited provider choice: Group health plans may have limited provider choice, since members are often required to see providers within the plan's network.

- Higher costs for out-of-network care: Group health plans may have higher costs for out-of-network care, since members may be required to pay more for care received outside of the plan's network.

- Administrative burden: Group health plans can be administratively burdensome, since the employer or organization must handle the paperwork and communication with the insurance company.

- Limited flexibility: Group health plans may have limited flexibility, since members may be required to see providers within the plan's network and may not have the option to customize their coverage.

Common Group Health Plan Services

Group health plans often provide a range of services, including:

- Medical coverage: Group health plans can provide medical coverage, including doctor visits, hospital stays, and prescription medications.

- Dental coverage: Group health plans can provide dental coverage, including routine cleanings, fillings, and crowns.

- Vision coverage: Group health plans can provide vision coverage, including eye exams, glasses, and contact lenses.

- Wellness programs: Group health plans can provide wellness programs, including fitness classes, health screenings, and nutrition counseling.

- Mental health services: Group health plans can provide mental health services, including counseling and therapy.

Preventive Care Services

Group health plans often provide preventive care services, including:- Routine check-ups: Group health plans can provide routine check-ups, including annual physicals and health screenings.

- Vaccinations: Group health plans can provide vaccinations, including flu shots and other immunizations.

- Screenings: Group health plans can provide screenings, including mammograms, colonoscopies, and other tests.

- Health education: Group health plans can provide health education, including nutrition counseling, fitness classes, and stress management.

Group Health Plan Costs

The cost of group health plans can vary widely, depending on a number of factors, including the size of the group, the age and health of the members, and the level of coverage. Employers may pay a portion of the premium, while employees may pay a portion through payroll deductions.

The costs of group health plans can be broken down into several components, including:

- Premiums: The premium is the monthly or annual payment made to the insurance company to secure coverage.

- Deductibles: The deductible is the amount that members must pay out-of-pocket before the plan begins to pay.

- Copays: The copay is the amount that members must pay for each doctor visit or prescription medication.

- Coinsurance: The coinsurance is the percentage of the cost that members must pay for each service.

Factors Affecting Group Health Plan Costs

A number of factors can affect the cost of group health plans, including:- Group size: The size of the group can affect the cost of the plan, since larger groups may be able to negotiate better rates.

- Age and health of members: The age and health of the members can affect the cost of the plan, since older or less healthy members may be more expensive to cover.

- Level of coverage: The level of coverage can affect the cost of the plan, since more comprehensive coverage may be more expensive.

- Location: The location of the group can affect the cost of the plan, since healthcare costs can vary widely from one region to another.

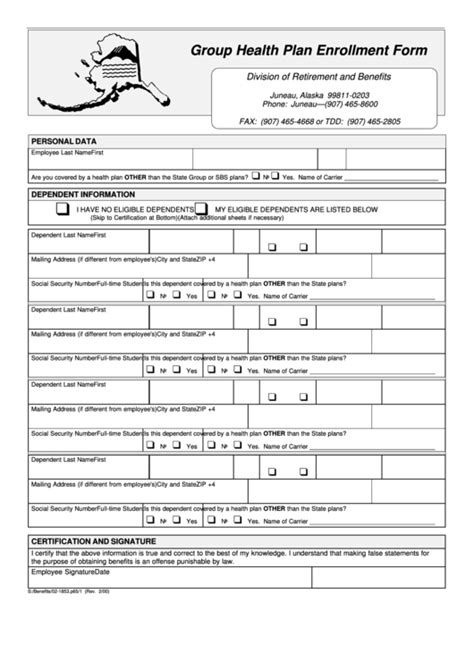

Group Health Plan Enrollment

The process of enrolling in a group health plan typically begins with the employer or organization selecting a plan and negotiating the terms of the coverage with the insurance company. The employer or organization then communicates the details of the plan to the employees or members, who can choose to enroll in the plan during an open enrollment period.

The open enrollment period is typically a specified period of time during which employees or members can enroll in the plan or make changes to their coverage. This period may be annual or semi-annual, depending on the plan.

Eligibility Requirements

To be eligible for a group health plan, employees or members typically must meet certain requirements, such as:- Being a full-time employee: Employees may be required to work a certain number of hours per week to be eligible for the plan.

- Meeting a waiting period: Employees may be required to wait a certain period of time before becoming eligible for the plan.

- Being a member of the organization: Members of the organization may be required to meet certain eligibility requirements, such as paying dues or attending meetings.

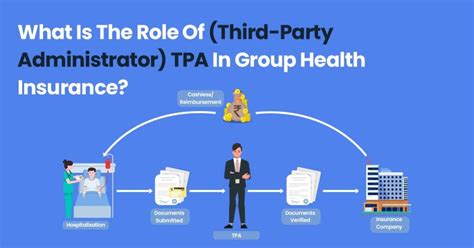

Group Health Plan Administration

The administration of a group health plan can be complex, involving a number of tasks and responsibilities, including:

- Plan selection: The employer or organization must select a plan that meets the needs of the group.

- Enrollment: The employer or organization must enroll employees or members in the plan and communicate the details of the coverage.

- Premium payment: The employer or organization must pay the premium to the insurance company.

- Claims processing: The employer or organization must process claims and resolve any issues that may arise.

Plan Documents

Group health plans are required to provide certain documents to employees or members, including:- Summary plan description: The summary plan description is a document that summarizes the terms of the plan, including the benefits, eligibility requirements, and premium costs.

- Plan document: The plan document is a detailed document that outlines the terms of the plan, including the benefits, eligibility requirements, and premium costs.

- Certificate of coverage: The certificate of coverage is a document that provides proof of coverage and outlines the terms of the plan.

What is a group health plan?

+A group health plan is a type of health insurance coverage that is offered to a group of people, typically employees of a company or members of an organization.

How do group health plans work?

+Group health plans work by pooling the resources of a group of people to purchase health insurance coverage. The group pays a premium to the insurance company, which then provides coverage to the members of the group.

What are the benefits of group health plans?

+The benefits of group health plans include access to comprehensive medical coverage, reduced out-of-pocket costs, and improved health and well-being. Group health plans can also provide a range of services, including wellness programs, mental health services, and preventive care services.

We hope this article has provided you with a comprehensive understanding of group health plans and their benefits. If you have any further questions or would like to learn more about group health plans, please don't hesitate to comment below or share this article with your friends and family. Additionally, if you are an employer or organization looking to offer a group health plan to your employees or members, we encourage you to research and compare different plans to find the one that best meets your needs and budget.