Intro

Reduce premiums with 5 ways to cut insurance costs, including policy optimization, risk reduction, and smart shopping, to save on auto, home, and life insurance rates.

Cutting insurance costs is a crucial step for individuals and businesses looking to manage their expenses effectively. Insurance, whether it's health, auto, home, or life, is a necessary expenditure that provides financial protection against unforeseen events. However, with the rising costs of premiums, it's becoming increasingly important to find ways to reduce these expenses without compromising on the quality of coverage. In this article, we will delve into the strategies that can help cut insurance costs, making insurance more affordable and manageable for everyone.

The importance of insurance cannot be overstated. It provides a safety net that helps individuals and families recover from financial setbacks due to accidents, illnesses, or natural disasters. However, the cost of insurance premiums can be a significant burden, especially for those on a tight budget. By understanding the factors that influence insurance premiums and implementing smart strategies, individuals can significantly reduce their insurance costs. This not only helps in saving money but also ensures that the coverage is tailored to meet specific needs without breaking the bank.

Insurance costs can vary widely depending on several factors, including the type of insurance, the level of coverage, the insured's risk profile, and the insurance provider. For instance, auto insurance premiums can be influenced by the driver's age, driving history, and the type of vehicle. Similarly, health insurance premiums can depend on the individual's health status, age, and lifestyle habits. By understanding these factors and how they impact insurance costs, individuals can make informed decisions to reduce their premiums. Whether it's by improving their risk profile, opting for a higher deductible, or shopping around for the best rates, there are numerous ways to cut insurance costs without sacrificing essential coverage.

Understanding Insurance Costs

Factors Influencing Insurance Premiums

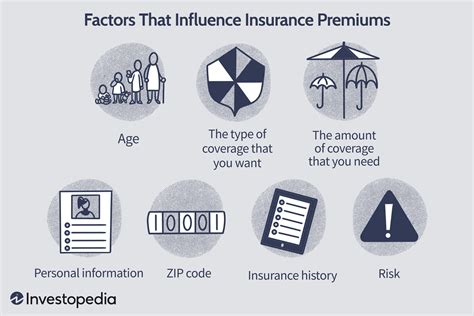

Several factors can influence insurance premiums, including: - Age: Older individuals may pay more for health and life insurance due to increased health risks. - Location: Auto and home insurance premiums can vary significantly depending on the location, with urban areas typically having higher premiums due to higher crime rates and more frequent claims. - Health Status: Pre-existing health conditions can increase health insurance premiums. - Driving History: A clean driving record can lower auto insurance premiums.Strategies to Cut Insurance Costs

Benefits of Cutting Insurance Costs

Cutting insurance costs can have numerous benefits, including: - Reduced financial burden: Lower premiums can free up more money in the budget for other expenses or savings. - Increased affordability: Making insurance more affordable can ensure that individuals and families maintain necessary coverage without financial strain. - Tailored coverage: By understanding the factors that influence premiums, individuals can tailor their coverage to meet their specific needs and budget.Implementing Cost-Cutting Measures

Steps to Lower Insurance Premiums

Steps to lower insurance premiums include: 1. **Assess Your Risk Profile**: Understand how your age, health, driving record, and other factors impact your premiums. 2. **Shop Around**: Compare rates from different insurance providers to find the best deal. 3. **Improve Your Risk Profile**: Make lifestyle changes or improvements that can lower your risk, such as exercising regularly or avoiding risky behaviors. 4. **Opt for a Higher Deductible**: If you can afford to pay more out-of-pocket in the event of a claim, opting for a higher deductible can lower your premiums. 5. **Bundle Policies**: Combining multiple policies with the same insurer can often result in discounts.Maintaining Adequate Coverage

Assessing Coverage Needs

Assessing coverage needs involves: - Evaluating current financial situations and potential risks. - Understanding the types of insurance available and what they cover. - Considering the level of deductible and premium that fits within the budget. - Reviewing and adjusting coverage as personal circumstances change.Conclusion and Next Steps

As you consider your insurance options and look for ways to cut costs, remember the importance of maintaining adequate coverage. Insurance is a critical component of financial planning, providing a safety net against unforeseen events. By being mindful of your coverage needs and taking steps to manage your insurance expenses, you can protect your financial well-being without breaking the bank. Take the first step today by assessing your current insurance situation, exploring your options, and making informed decisions that balance cost with coverage.

What are the primary factors that influence insurance premiums?

+Primary factors include age, health status, driving history, location, and the level of coverage chosen. These factors help insurers assess the risk of providing coverage and thus determine the premium amount.

How can shopping around help in cutting insurance costs?

+Shopping around allows you to compare rates and coverage options from different insurance providers. This comparison can help you find the best rate for the level of coverage you need, potentially saving you money on your premiums.

What are the benefits of bundling insurance policies with the same provider?

+Bundling policies, such as auto and home insurance, with the same provider can often result in discounts. This not only reduces the overall cost of insurance but also simplifies the management of your policies, as you'll have fewer accounts to keep track of.