Intro

Discover the best health insurance options with our expert guide to finding your ideal health plan, including affordable coverage, medical benefits, and wellness programs to suit your needs.

Finding the right health plan can be a daunting task, especially with the numerous options available in the market. It's essential to understand the importance of having a suitable health plan, as it can significantly impact your physical and financial well-being. A good health plan provides financial protection against unexpected medical expenses, ensuring that you receive the necessary treatment without breaking the bank. Moreover, it offers peace of mind, allowing you to focus on your health and wellness without worrying about the costs.

In today's fast-paced world, it's easy to overlook the significance of health insurance until it's too late. Many individuals and families have learned the hard way that medical expenses can quickly add up, leading to financial difficulties and even bankruptcy. However, with the right health plan, you can avoid such situations and ensure that you receive quality medical care when you need it most. Whether you're an individual, a family, or an employer looking to provide health benefits to your employees, finding the right health plan is crucial for maintaining good health and financial stability.

The process of finding a health plan can be overwhelming, especially for those who are new to health insurance. With so many options available, it's challenging to determine which plan best suits your needs and budget. Additionally, the complexity of health insurance terminology and the various types of plans can make it difficult to make an informed decision. Nevertheless, it's essential to take the time to research and understand the different types of health plans, their benefits, and their limitations. By doing so, you can make an informed decision and choose a plan that provides the necessary coverage and protection for you and your loved ones.

Understanding Health Plan Options

When it comes to health plans, there are several options to choose from, each with its unique features and benefits. The most common types of health plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Exclusive Provider Organization (EPO) plans, and Point of Service (POS) plans. HMO plans, for instance, require you to receive medical care from a specific network of providers, except in emergency situations. PPO plans, on the other hand, offer more flexibility, allowing you to see any healthcare provider, both in-network and out-of-network, although out-of-network care typically costs more.

Types of Health Plans

Understanding the different types of health plans is crucial for making an informed decision. Here are some of the most common types of health plans: * HMO (Health Maintenance Organization) plans * PPO (Preferred Provider Organization) plans * EPO (Exclusive Provider Organization) plans * POS (Point of Service) plans * HDHP (High-Deductible Health Plan) plans Each type of plan has its advantages and disadvantages, and it's essential to consider your specific needs and circumstances when choosing a plan.Benefits of Health Plans

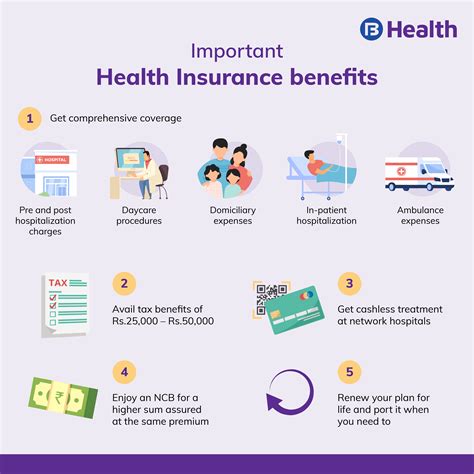

Having a health plan provides numerous benefits, including financial protection, access to quality medical care, and peace of mind. With a health plan, you can avoid unexpected medical expenses, which can quickly add up and lead to financial difficulties. Additionally, health plans often provide preventive care services, such as routine check-ups, screenings, and vaccinations, which can help prevent illnesses and detect health problems early. Moreover, many health plans offer additional benefits, such as dental and vision coverage, mental health services, and wellness programs, which can improve your overall health and well-being.

Preventive Care Services

Preventive care services are an essential component of health plans, as they can help prevent illnesses and detect health problems early. Some common preventive care services include: * Routine check-ups and physical exams * Screenings for diseases, such as cancer and diabetes * Vaccinations, such as flu shots and HPV vaccines * Health screenings, such as blood pressure and cholesterol tests These services can help you stay healthy and detect potential health problems before they become serious.How to Choose a Health Plan

Choosing a health plan can be a daunting task, but there are several steps you can take to make the process easier. First, it's essential to assess your health needs and budget. Consider your medical history, current health status, and any ongoing health needs. Additionally, think about your budget and what you can afford to pay for premiums, deductibles, and out-of-pocket expenses. Next, research different health plans and compare their benefits, limitations, and costs. Look for plans that offer comprehensive coverage, including preventive care services, hospitalization, and prescription medication. Finally, read reviews and ask for referrals from friends, family, or healthcare providers to get a sense of the plan's reputation and quality of care.

Steps to Choose a Health Plan

Here are some steps to follow when choosing a health plan: 1. Assess your health needs and budget 2. Research different health plans and compare their benefits and costs 3. Consider the plan's network of providers and whether they include your current healthcare providers 4. Look for plans that offer additional benefits, such as dental and vision coverage 5. Read reviews and ask for referrals from friends, family, or healthcare providersCommon Mistakes to Avoid

When choosing a health plan, there are several common mistakes to avoid. One of the most significant mistakes is not carefully reading and understanding the plan's benefits and limitations. It's essential to take the time to review the plan's summary of benefits and coverage, as well as the policy documents, to ensure you understand what is covered and what is not. Another mistake is not considering the plan's network of providers and whether they include your current healthcare providers. Additionally, it's crucial to avoid choosing a plan based solely on cost, as cheaper plans may not provide the necessary coverage and benefits.

Mistakes to Avoid

Here are some common mistakes to avoid when choosing a health plan: * Not carefully reading and understanding the plan's benefits and limitations * Not considering the plan's network of providers * Choosing a plan based solely on cost * Not reviewing the plan's policy documents and summary of benefits and coverage * Not asking questions or seeking clarification on any concerns or doubtsConclusion and Next Steps

In conclusion, finding the right health plan is a crucial decision that can significantly impact your physical and financial well-being. By understanding the different types of health plans, their benefits, and their limitations, you can make an informed decision and choose a plan that provides the necessary coverage and protection for you and your loved ones. Remember to take the time to research and compare different health plans, consider your health needs and budget, and avoid common mistakes. If you're still unsure or have questions, don't hesitate to seek guidance from a licensed insurance agent or broker.

Now that you've learned about the importance of health plans and how to choose the right one, it's time to take action. Start by researching different health plans and comparing their benefits and costs. Consider your health needs and budget, and don't hesitate to ask questions or seek clarification on any concerns or doubts. By taking the time to find the right health plan, you can ensure that you and your loved ones receive the necessary medical care and financial protection.

What is the difference between an HMO and a PPO plan?

+An HMO plan requires you to receive medical care from a specific network of providers, except in emergency situations. A PPO plan, on the other hand, offers more flexibility, allowing you to see any healthcare provider, both in-network and out-of-network, although out-of-network care typically costs more.

How do I choose the right health plan for my family?

+To choose the right health plan for your family, consider your family's health needs and budget. Research different health plans and compare their benefits, limitations, and costs. Look for plans that offer comprehensive coverage, including preventive care services, hospitalization, and prescription medication.

What is the importance of preventive care services in health plans?

+Preventive care services, such as routine check-ups, screenings, and vaccinations, are essential for maintaining good health and detecting potential health problems early. They can help prevent illnesses, reduce the risk of chronic diseases, and improve overall health and well-being.

We hope this article has provided you with valuable information and insights on finding the right health plan. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with your friends and family to help them make informed decisions about their health insurance. Take the first step towards protecting your health and financial well-being by choosing the right health plan today!