Intro

Compare HMO vs PPO health plans, understanding network coverage, out-of-pocket costs, and provider flexibility, to choose the best plan for your needs, considering factors like premiums, deductibles, and copays.

When it comes to choosing a health insurance plan, two of the most popular options are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans. Both types of plans have their own set of benefits and drawbacks, and understanding the differences between them is crucial to making an informed decision. In this article, we will delve into the world of HMO and PPO health plans, exploring their characteristics, advantages, and disadvantages.

The importance of selecting the right health insurance plan cannot be overstated. With the rising costs of healthcare, having a comprehensive insurance plan can help protect individuals and families from financial ruin in the event of a medical emergency. Moreover, a good health insurance plan can provide access to quality healthcare services, preventive care, and specialized treatments. As the healthcare landscape continues to evolve, it is essential to stay informed about the various types of health insurance plans available, including HMO and PPO plans.

In recent years, the demand for health insurance plans has increased significantly, driven by the Affordable Care Act (ACA) and the growing awareness of the importance of health insurance. As a result, insurance companies have responded by offering a wide range of plans, each with its unique features and benefits. HMO and PPO plans are two of the most popular types of health insurance plans, and understanding their differences is critical to making an informed decision.

Introduction to HMO Plans

Key Features of HMO Plans

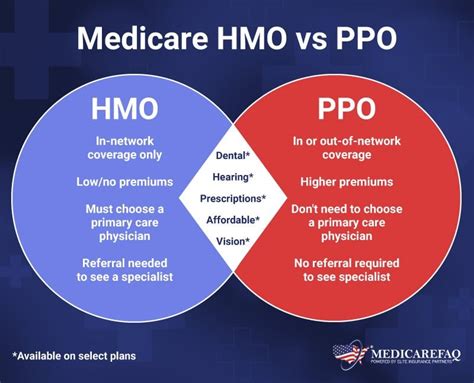

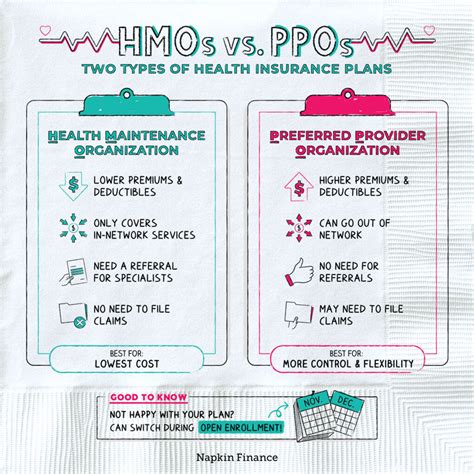

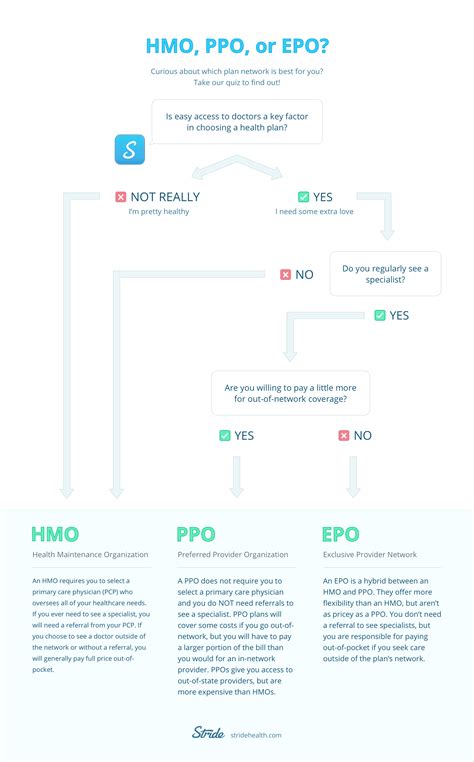

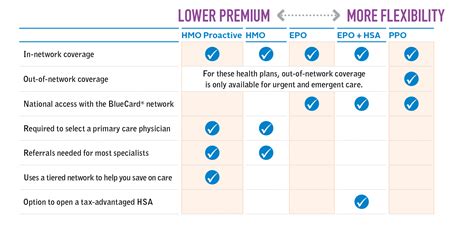

Some of the key features of HMO plans include: * A network of participating healthcare providers * A primary care physician (PCP) who coordinates care * Referrals required to see specialists * Lower out-of-pocket costs for policyholders * Emphasis on preventive care and early interventionIntroduction to PPO Plans

Key Features of PPO Plans

Some of the key features of PPO plans include: * A larger network of participating healthcare providers * No requirement to choose a primary care physician (PCP) * No referrals needed to see specialists * Higher out-of-pocket costs for policyholders * More flexibility in choosing healthcare providersComparison of HMO and PPO Plans

Advantages and Disadvantages of HMO Plans

Some of the advantages of HMO plans include: * Lower out-of-pocket costs * Emphasis on preventive care * Coordinated care through a PCP Some of the disadvantages of HMO plans include: * Limited network of providers * Referrals required to see specialists * Less flexibility in choosing healthcare providersAdvantages and Disadvantages of PPO Plans

Some of the advantages of PPO plans include: * Larger network of providers * No referrals needed to see specialists * More flexibility in choosing healthcare providers Some of the disadvantages of PPO plans include: * Higher out-of-pocket costs * More complex billing and administrative processes * Less emphasis on preventive careChoosing Between HMO and PPO Plans

Considerations for Families and Individuals

For families and individuals, the choice between HMO and PPO plans depends on several factors, including: * Size of the family * Age and health status of family members * Budget and financial situation * Healthcare needs and preferencesCost Comparison of HMO and PPO Plans

Factors Affecting Premium Costs

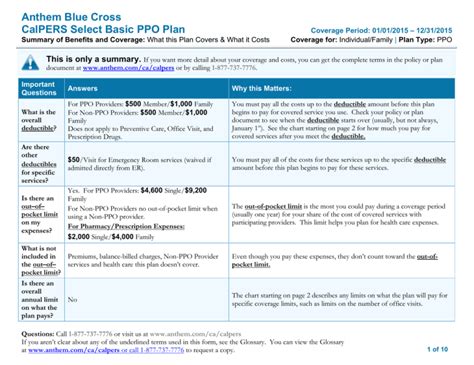

Some of the factors that affect premium costs include: * Age and health status of policyholders * Location and cost of living * Type of plan and level of coverage * Insurance company and network of providersNetwork and Provider Considerations

Importance of Provider Network

The provider network is a critical factor in choosing a health insurance plan. Policyholders should consider: * Size and diversity of the network * Quality of care and patient satisfaction * Availability of specialists and subspecialists * Location and accessibility of providersPreventive Care and Wellness

Importance of Preventive Care

Preventive care is critical to maintaining good health and preventing chronic diseases. Policyholders should consider: * Coverage for routine check-ups and screenings * Access to wellness programs and health education * Incentives for healthy behaviors and lifestyle choicesWhat is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of flexibility and freedom in choosing healthcare providers. HMO plans require policyholders to choose a primary care physician (PCP) and follow referrals, while PPO plans allow policyholders to see any healthcare provider, both in-network and out-of-network, without the need for a referral.

Which type of plan is better for families with young children?

+HMO plans may be a good choice for families with young children, as they often have an emphasis on preventive care and coordinated care through a PCP. However, PPO plans may also be a good option, depending on the family's specific needs and preferences.

Can I change from an HMO plan to a PPO plan?

+Yes, policyholders can often change from an HMO plan to a PPO plan during the annual open enrollment period or due to a qualifying life event, such as a change in employment or marriage. However, the specific rules and regulations may vary depending on the insurance company and the policy.

How do I choose the right health insurance plan for my needs?

+Policyholders should consider their healthcare needs, budget, and preferences when choosing a health insurance plan. It's essential to research the plan's network of providers, coverage, and costs, as well as read reviews and check ratings to ensure access to quality care.

What is the role of a primary care physician (PCP) in an HMO plan?

+A primary care physician (PCP) plays a critical role in an HMO plan, serving as the policyholder's primary point of contact and coordinating their care. The PCP is responsible for providing routine care, making referrals to specialists, and managing the policyholder's overall health.

In conclusion, choosing between HMO and PPO plans requires careful consideration of several factors, including healthcare needs, budget, and preferences. By understanding the differences between these two types of plans, policyholders can make an informed decision and select a plan that meets their unique needs. We invite readers to share their experiences and insights on HMO and PPO plans, and to ask questions or seek clarification on any aspect of these plans. By working together, we can navigate the complex world of health insurance and make informed decisions about our healthcare.