Intro

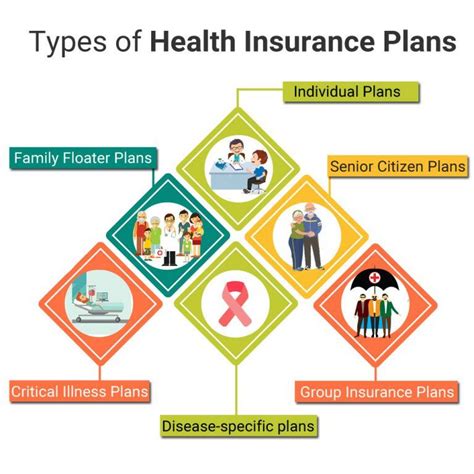

Health plans are an essential aspect of our lives, providing us with the necessary financial protection against medical expenses. With numerous health plans available in the market, it can be overwhelming to choose the right one. In this article, we will delve into the world of health plans, exploring their importance, benefits, and key features. We will also compare three popular health plans, highlighting their strengths and weaknesses, to help you make an informed decision.

The importance of health plans cannot be overstated. Medical emergencies can arise at any time, and the resulting expenses can be exorbitant. Health plans provide a safety net, ensuring that you receive the necessary medical care without breaking the bank. Moreover, health plans often offer preventive care services, such as routine check-ups and screenings, which can help detect health issues early on, reducing the risk of chronic diseases.

In recent years, the health insurance landscape has undergone significant changes, with the introduction of new plans and policies. The Affordable Care Act (ACA), also known as Obamacare, has expanded health insurance coverage to millions of Americans. However, the ACA has also introduced new complexities, making it challenging for individuals to navigate the health insurance market. To make sense of the various health plans available, it is essential to understand their key features, benefits, and drawbacks.

Introduction to Health Plans

Key Features of Health Plans

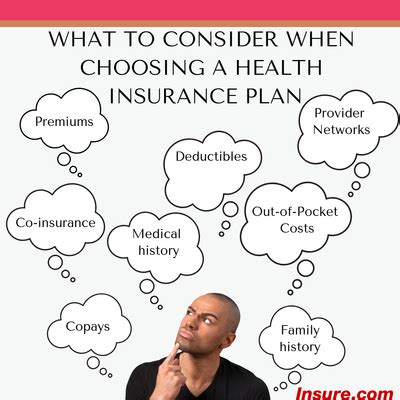

When selecting a health plan, it is crucial to consider several key features, including the network of providers, deductible, copayment, coinsurance, and out-of-pocket maximum. The network of providers refers to the list of doctors, hospitals, and other healthcare providers who participate in the plan. The deductible is the amount you must pay out-of-pocket before the plan begins to cover medical expenses. The copayment is the fixed amount you pay for each doctor visit or prescription, while coinsurance is the percentage of medical expenses you pay after meeting the deductible.Comparing Three Health Plans

- UnitedHealthcare: UnitedHealthcare is one of the largest health insurance companies in the United States, offering a wide range of plans, including individual and family plans, group plans, and Medicare plans. UnitedHealthcare plans often feature a large network of providers, including specialist and primary care physicians. However, some plans may have higher deductibles and copayments compared to other insurance companies.

- Blue Cross Blue Shield: Blue Cross Blue Shield is another prominent health insurance company, offering plans in all 50 states. Blue Cross Blue Shield plans often feature a wide range of providers, including hospitals and specialist physicians. However, some plans may have limited coverage for certain medical services, such as dental and vision care.

- Kaiser Permanente: Kaiser Permanente is a non-profit health insurance company that offers a unique approach to healthcare. Kaiser Permanente plans often feature a closed network of providers, which can result in lower costs and more coordinated care. However, this closed network may limit your access to certain specialist physicians or hospitals.

Benefits and Drawbacks of Each Plan

When comparing the three health plans, it is essential to consider their benefits and drawbacks. UnitedHealthcare plans often offer a wide range of providers and flexible plan options, but may have higher deductibles and copayments. Blue Cross Blue Shield plans often feature a large network of providers and comprehensive coverage, but may have limited coverage for certain medical services. Kaiser Permanente plans often offer lower costs and more coordinated care, but may have limited access to certain specialist physicians or hospitals.Choosing the Right Health Plan

Practical Tips for Selecting a Health Plan

Here are some practical tips for selecting a health plan: * Research the plan's network of providers to ensure it includes your primary care physician and any specialist physicians you may need to see. * Compare the plan's deductible, copayment, coinsurance, and out-of-pocket maximum to ensure they are affordable for you. * Consider the plan's coverage for medical services, such as dental and vision care, to ensure it meets your needs. * Read reviews and ask for recommendations from friends, family, or healthcare professionals to get a sense of the plan's quality and customer service.Conclusion and Next Steps

Final Thoughts

As you navigate the complex world of health insurance, remember that it is essential to prioritize your health and financial well-being. By taking the time to research and compare different health plans, you can ensure that you have the necessary coverage to protect yourself and your loved ones. Don't hesitate to reach out to insurance companies, healthcare professionals, or patient advocates for guidance and support.What is the difference between a deductible and a copayment?

+A deductible is the amount you must pay out-of-pocket before the plan begins to cover medical expenses, while a copayment is the fixed amount you pay for each doctor visit or prescription.

How do I choose the right health plan for my needs?

+Consider your individual needs and priorities, such as the network of providers, deductible, copayment, coinsurance, and out-of-pocket maximum, to choose the right health plan for you.

What is the Affordable Care Act (ACA), and how does it affect health insurance?

+The Affordable Care Act (ACA), also known as Obamacare, is a federal law that expanded health insurance coverage to millions of Americans, introducing new regulations and requirements for health insurance companies.

We hope this article has provided you with valuable insights and information to help you navigate the complex world of health insurance. If you have any questions or comments, please don't hesitate to share them below. Share this article with your friends and family to help them make informed decisions about their health insurance. Take the first step towards protecting your health and financial well-being by exploring different health plans and finding the one that best suits your needs.