Intro

Compare HMO vs PPO health insurance plans with 5 expert tips, exploring network coverage, out-of-pocket costs, and provider flexibility to make informed decisions about managed care, copays, and deductibles.

When it comes to choosing a health insurance plan, two of the most popular options are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). Both have their own set of benefits and drawbacks, and selecting the right one can be overwhelming. In this article, we will delve into the world of HMO and PPO, exploring their differences, advantages, and disadvantages, to help you make an informed decision.

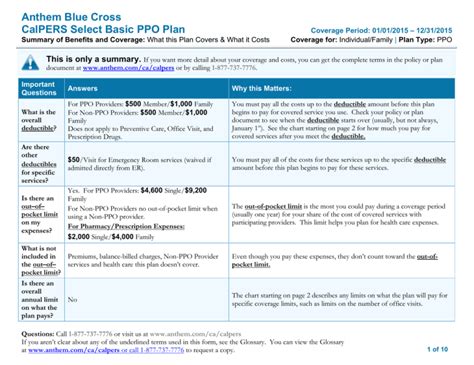

HMO and PPO plans are two distinct types of health insurance plans that cater to different needs and preferences. HMO plans are known for their affordability and emphasis on preventive care, while PPO plans offer more flexibility and freedom to choose healthcare providers. Understanding the nuances of each plan is crucial in making the right choice for yourself and your family.

The importance of choosing the right health insurance plan cannot be overstated. With the rising costs of healthcare, having a suitable plan can help you save money, receive quality care, and enjoy peace of mind. In this article, we will provide you with 5 HMO vs PPO tips to help you navigate the complex world of health insurance and make an informed decision.

Understanding HMO Plans

Benefits of HMO Plans

Some of the benefits of HMO plans include: * Lower premiums and out-of-pocket costs * Emphasis on preventive care, which can help prevent illnesses and reduce healthcare costs in the long run * Coordination of care by a primary care physician, which can lead to better health outcomes * Access to a network of healthcare providers, including specialists and hospitalsUnderstanding PPO Plans

Benefits of PPO Plans

Some of the benefits of PPO plans include: * Flexibility to choose any healthcare provider, both in-network and out-of-network * No need for a referral from a primary care physician to see a specialist * Access to a wider network of healthcare providers, including specialists and hospitals * Ability to see a specialist without a referral, which can be beneficial for individuals with chronic conditionsKey Differences Between HMO and PPO Plans

Some of the key differences between HMO and PPO plans include:

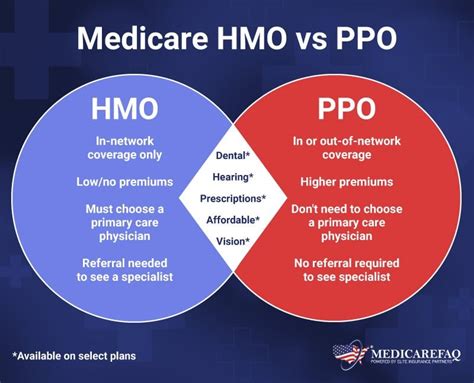

- Network restrictions: HMO plans typically require you to see healthcare providers within a specific network, while PPO plans allow you to see any healthcare provider, both in-network and out-of-network.

- Referral requirements: HMO plans often require a referral from a primary care physician to see a specialist, while PPO plans do not.

- Out-of-pocket costs: HMO plans often have lower out-of-pocket costs compared to PPO plans, but PPO plans may offer more comprehensive coverage.

5 HMO vs PPO Tips

Here are 5 HMO vs PPO tips to help you make an informed decision: 1. **Assess your healthcare needs**: Consider your healthcare needs and preferences when choosing between HMO and PPO plans. If you have a chronic condition or require frequent specialist visits, a PPO plan may be a better option. 2. **Evaluate the network**: Consider the network of healthcare providers offered by each plan. If you have a preferred healthcare provider, make sure they are part of the network. 3. **Compare costs**: Compare the premiums, deductibles, and out-of-pocket costs of each plan. HMO plans are often more affordable, but PPO plans may offer more comprehensive coverage. 4. **Consider flexibility**: Consider the level of flexibility you need in a health insurance plan. If you want the freedom to choose any healthcare provider, a PPO plan may be a better option. 5. **Read reviews and ask questions**: Read reviews from other policyholders and ask questions to ensure you understand the plan's benefits, limitations, and requirements.Real-World Examples

Another example is if you have a preferred healthcare provider who is not part of the HMO network. With a PPO plan, you can still see your preferred provider, although you may pay a higher out-of-pocket cost. With an HMO plan, you may need to choose a new healthcare provider within the network.

Making an Informed Decision

By following these 5 HMO vs PPO tips and considering your individual needs and circumstances, you can make an informed decision and choose the right health insurance plan for yourself and your family.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of flexibility and freedom to choose healthcare providers. HMO plans require you to choose a primary care physician and obtain referrals to see specialists, while PPO plans allow you to see any healthcare provider, both in-network and out-of-network.

Which plan is more affordable, HMO or PPO?

+HMO plans are often more affordable than PPO plans, with lower premiums and out-of-pocket costs. However, PPO plans may offer more comprehensive coverage and flexibility, which can be worth the extra cost for some individuals.

Can I see a specialist with an HMO plan without a referral?

+Typically, no, you cannot see a specialist with an HMO plan without a referral from your primary care physician. However, some HMO plans may offer self-referral options or other flexible arrangements, so it's essential to check the plan's benefits and limitations.

We hope this article has provided you with valuable insights and information to help you make an informed decision when choosing between HMO and PPO plans. Remember to consider your healthcare needs, budget, and preferences, and don't hesitate to ask questions or seek advice from a licensed insurance agent or broker. By doing your research and evaluating your options carefully, you can choose the right health insurance plan for yourself and your family, and enjoy peace of mind knowing that you're protected in case of unexpected medical expenses.