Intro

Discover how HSA accounts work, utilizing tax-free savings for medical expenses, offering flexible healthcare funding, and providing long-term investment growth options.

Health Savings Accounts, or HSAs, have become increasingly popular in recent years due to their potential to help individuals save money on healthcare expenses while also providing a tax-advantaged way to save for retirement. With the rising costs of healthcare, it's essential to understand how HSAs work and how they can benefit you. In this article, we'll delve into the world of HSAs, exploring their benefits, working mechanisms, and steps to get started.

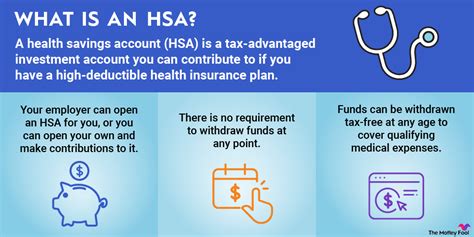

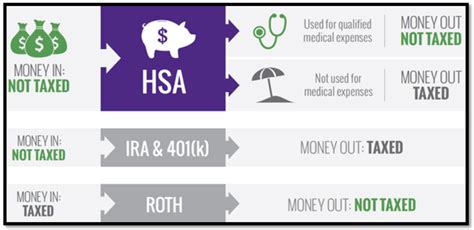

The importance of HSAs lies in their ability to help individuals with high-deductible health plans (HDHPs) save money on healthcare expenses. By setting aside pre-tax dollars in an HSA, individuals can reduce their taxable income, lowering their tax liability. Moreover, HSAs offer a triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. This makes HSAs an attractive option for those looking to save for healthcare expenses while also building a safety net for retirement.

As the healthcare landscape continues to evolve, it's crucial to stay informed about the benefits and workings of HSAs. With the help of HSAs, individuals can take control of their healthcare expenses, making informed decisions about their health and financial well-being. Whether you're an individual or an employer, understanding how HSAs work can help you make the most of this valuable benefit. So, let's dive into the world of HSAs and explore their benefits, working mechanisms, and steps to get started.

What are HSA Accounts?

Benefits of HSA Accounts

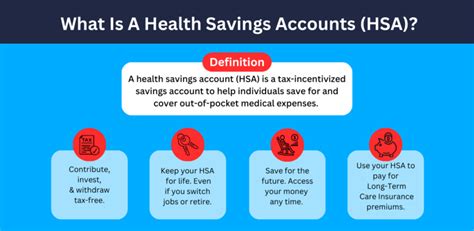

The benefits of HSA accounts are numerous. Some of the key benefits include: * Tax-deductible contributions: Contributions to an HSA are tax-deductible, reducing your taxable income and lowering your tax liability. * Tax-free earnings: Earnings on HSA investments grow tax-free, allowing your savings to grow faster. * Tax-free withdrawals: Withdrawals from an HSA for qualified medical expenses are tax-free, providing a source of funds for healthcare expenses without incurring taxes. * Portability: HSAs are portable, meaning you can take them with you if you change jobs or retire. * Investment options: Many HSA providers offer investment options, allowing you to grow your savings over time.How Do HSA Accounts Work?

Steps to Get Started with HSA Accounts

Getting started with HSA accounts is relatively straightforward. Here are the steps to follow: * **Check your eligibility**: Ensure you have an HDHP and are not enrolled in any other health insurance plan. * **Choose an HSA provider**: Research and select an HSA provider that meets your needs, considering factors such as fees, investment options, and customer service. * **Set up your account**: Complete the application process and set up your HSA account. * **Make contributions**: Contribute to your HSA on a regular basis, taking advantage of the tax-deductible benefits. * **Invest your funds**: Consider investing your HSA funds to grow your savings over time.HSA Account Rules and Regulations

HSA Account Fees and Expenses

HSA account fees and expenses can vary depending on the provider and the specific account. Some common fees to consider include: * **Maintenance fees**: Some HSA providers charge maintenance fees, which can range from $10 to $50 per year. * **Investment fees**: If you invest your HSA funds, you may be subject to investment fees, such as management fees or trading fees. * **Withdrawal fees**: Some HSA providers charge withdrawal fees, which can range from $10 to $50 per withdrawal.HSA Account Investment Options

HSA Account Portability

One of the key benefits of HSA accounts is their portability. This means you can take your HSA with you if you change jobs or retire. To ensure portability, it's essential to: * **Keep accurate records**: Keep accurate records of your HSA contributions, investments, and withdrawals. * **Choose a portable HSA provider**: Select an HSA provider that offers portable accounts, allowing you to take your HSA with you if you change jobs or retire.HSA Account FAQs

What is an HSA account?

+An HSA account is a tax-advantaged savings account designed to help individuals with high-deductible health plans (HDHPs) save money on healthcare expenses.

How do I contribute to an HSA account?

+You can contribute to an HSA account on a tax-deductible basis, reducing your taxable income and lowering your tax liability.

What are the benefits of HSA accounts?

+The benefits of HSA accounts include tax-deductible contributions, tax-free earnings, and tax-free withdrawals for qualified medical expenses.

In summary, HSA accounts offer a valuable way to save money on healthcare expenses while also providing a tax-advantaged way to save for retirement. By understanding how HSA accounts work and following the steps to get started, you can take control of your healthcare expenses and build a safety net for the future. We invite you to share your thoughts and experiences with HSA accounts in the comments below. Have you considered opening an HSA account? What benefits or challenges have you encountered? Let's start a conversation and explore the world of HSA accounts together!