Intro

Calculate your return on investment effortlessly with our guide, featuring ROI analysis, investment tracking, and profit calculation tools to maximize your financial gains and make informed decisions.

The concept of Return on Investment, or ROI, is a crucial metric for businesses and individuals alike, as it helps to evaluate the financial success of an investment. Calculating ROI can be a daunting task, especially for those without a background in finance. However, with the right tools and knowledge, finding your ROI can be a straightforward process. In this article, we will delve into the world of ROI, exploring its importance, benefits, and providing a step-by-step guide on how to calculate it.

The importance of ROI cannot be overstated, as it provides a clear picture of an investment's performance. By calculating ROI, individuals and businesses can make informed decisions about where to allocate their resources, maximizing their returns and minimizing their losses. Moreover, ROI helps to identify areas of improvement, allowing for adjustments to be made to optimize investment strategies. Whether you're a seasoned investor or just starting out, understanding ROI is essential for achieving financial success.

In today's fast-paced business environment, calculating ROI is more important than ever. With the rise of digital marketing and e-commerce, companies are constantly looking for ways to measure the effectiveness of their campaigns and investments. ROI provides a clear and concise way to evaluate the success of these initiatives, helping businesses to refine their strategies and stay ahead of the competition. As we navigate the complexities of the modern business landscape, finding your ROI has become an essential skill for anyone looking to succeed.

Understanding ROI

Benefits of Calculating ROI

Calculating ROI offers numerous benefits, including the ability to evaluate investment performance, identify areas for improvement, and make informed decisions about resource allocation. By understanding the ROI of different investments, individuals and businesses can optimize their portfolios, maximizing their returns and minimizing their losses. Additionally, calculating ROI helps to build credibility and trust with stakeholders, providing a clear and transparent picture of an investment's performance.Calculating ROI

Steps to Calculate ROI

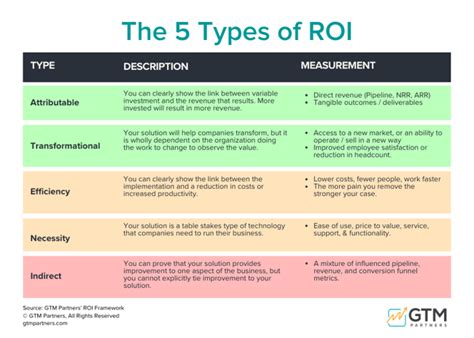

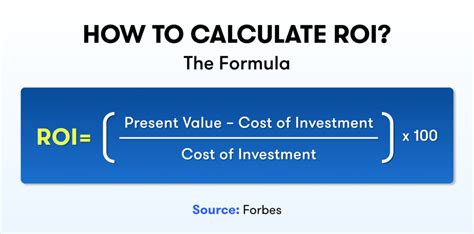

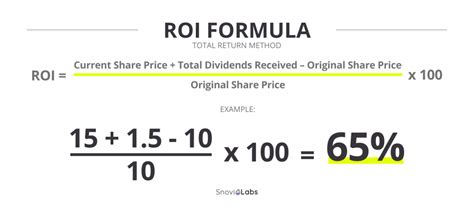

To calculate ROI, follow these simple steps: * Determine the gain from the investment by subtracting the initial investment from the final value of the investment. * Calculate the total cost of the investment, including the initial investment and any additional costs. * Use the ROI formula to calculate the ROI: (Gain from Investment - Cost of Investment) / Cost of Investment * 100. * Express the result as a percentage by multiplying by 100.Types of ROI

Examples of ROI

To illustrate the concept of ROI, let's consider a few examples: * A company invests $100,000 in a marketing campaign, resulting in a 20% increase in sales. The ROI of this investment would be 20%, indicating a strong return on investment. * An individual invests $10,000 in a stock, which increases in value to $12,000 over the course of a year. The ROI of this investment would be 20%, indicating a strong return on investment. * A non-profit organization invests $50,000 in a community development project, resulting in a significant improvement in the quality of life for local residents. The ROI of this investment would be difficult to quantify, but could be evaluated in terms of its social impact.Challenges of Calculating ROI

Overcoming Challenges

To overcome these challenges, it's essential to: * Use robust data and analytics to support ROI calculations. * Develop clear and concise metrics to evaluate investment performance. * Consider using alternative metrics, such as social or environmental ROI, to evaluate investments with intangible benefits.Best Practices for Calculating ROI

Common Mistakes to Avoid

To avoid common mistakes when calculating ROI, it's essential to: * Avoid using incomplete or inaccurate data. * Consider all costs associated with an investment, including indirect costs. * Avoid using simplistic or overly complex ROI calculations. * Regularly review and update ROI calculations to ensure accuracy and relevance.Conclusion and Next Steps

We invite you to share your thoughts and experiences with calculating ROI in the comments section below. Have you struggled with calculating ROI in the past? What strategies have you used to overcome challenges and ensure accurate calculations? Share your insights and help others to improve their ROI calculation skills.

What is ROI and why is it important?

+ROI, or Return on Investment, is a metric used to evaluate the financial success of an investment. It's essential for making informed decisions about financial resources and optimizing investment portfolios.

How do I calculate ROI?

+To calculate ROI, use the formula: (Gain from Investment - Cost of Investment) / Cost of Investment * 100. This will give you a clear picture of an investment's performance.

What are some common challenges when calculating ROI?

+Common challenges include difficulty in quantifying benefits, limited data, and complexity of investments. To overcome these challenges, use robust data and analytics, develop clear metrics, and consider alternative metrics.