Intro

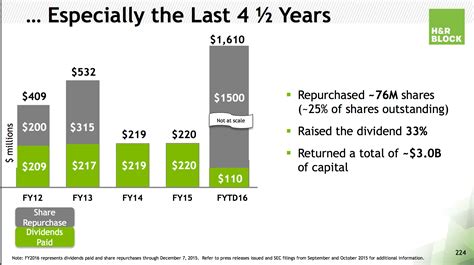

Book a Schedule Hr Block Appointment online for tax preparation, consulting, and planning services, including audit support and financial guidance from expert tax professionals, ensuring accurate and efficient tax filing and maximizing refunds.

Scheduling an appointment with H&R Block is a convenient way to ensure that you receive personalized tax preparation services from experienced professionals. With numerous locations across the United States, H&R Block offers a range of services designed to cater to various tax needs, from simple to complex returns. Whether you are an individual, a small business owner, or a self-employed entrepreneur, H&R Block's expert tax preparers can guide you through the tax preparation process, ensuring you take advantage of all eligible deductions and credits.

The importance of tax preparation cannot be overstated, as it directly impacts your financial situation. Proper tax planning and preparation can help you avoid costly mistakes, minimize your tax liability, and maximize your refund. H&R Block's tax professionals are well-versed in the latest tax laws and regulations, ensuring that your tax return is prepared accurately and efficiently. By scheduling an appointment with H&R Block, you can trust that your tax needs are being handled by knowledgeable and experienced professionals who are committed to providing exceptional service.

In today's fast-paced world, managing your time effectively is crucial. Scheduling an appointment with H&R Block allows you to plan ahead, ensuring that you allocate sufficient time for your tax preparation needs. This approach helps alleviate the stress associated with last-minute tax filing, providing you with peace of mind knowing that your taxes are being handled by experts. Furthermore, by choosing H&R Block, you can benefit from their extensive resources and support, including access to tax tips, guides, and educational materials designed to help you navigate the complexities of tax preparation.

Scheduling an H&R Block Appointment

Scheduling an appointment with H&R Block is a straightforward process that can be completed online, over the phone, or in person at a local office. To schedule an appointment online, simply visit the H&R Block website and use their office locator tool to find a location near you. Once you have selected your preferred location, you can choose a date and time that suits your schedule, and then fill out a brief form to provide some basic information about your tax preparation needs. This online process is convenient, easy to use, and allows you to schedule an appointment at a time that fits your busy schedule.

Benefits of Scheduling an Appointment

Scheduling an appointment with H&R Block offers several benefits, including personalized service, expertise, and convenience. By scheduling an appointment, you can ensure that you receive one-on-one attention from a tax professional who will take the time to understand your unique tax situation and provide tailored advice and guidance. Additionally, H&R Block's tax preparers are trained to identify potential tax savings opportunities that you may not be aware of, helping you to minimize your tax liability and maximize your refund.How to Prepare for Your H&R Block Appointment

To make the most of your H&R Block appointment, it is essential to prepare in advance. This includes gathering all necessary documents and information related to your tax return, such as W-2 forms, 1099 forms, receipts for deductions, and any other relevant tax-related documents. Having these documents organized and readily available will help your tax preparer to efficiently prepare your tax return, ensuring that you take advantage of all eligible deductions and credits.

Documents to Bring to Your Appointment

Some of the key documents to bring to your H&R Block appointment include: - W-2 forms from your employer - 1099 forms for freelance or contract work - Interest statements from banks and investments - Charitable donation receipts - Medical expense receipts - Business expense records (if self-employed) - Last year's tax return (if applicable)H&R Block Services and Pricing

H&R Block offers a range of services designed to cater to various tax needs, including tax preparation, audit support, and small business tax services. The pricing for these services varies depending on the complexity of your tax return and the specific services you require. However, H&R Block is committed to providing transparent and competitive pricing, ensuring that you receive exceptional value for your money.

H&R Block Tax Preparation Services

Some of the tax preparation services offered by H&R Block include: - Personal tax preparation: H&R Block's expert tax preparers will guide you through the tax preparation process, ensuring that your tax return is prepared accurately and efficiently. - Self-employed tax preparation: If you are self-employed, H&R Block can help you navigate the complexities of business tax preparation, ensuring that you take advantage of all eligible business deductions. - Small business tax preparation: H&R Block's tax professionals can assist with tax preparation for small businesses, including partnerships, S corporations, and C corporations.H&R Block Audit Support

In the event of an audit, H&R Block's audit support services can provide you with the guidance and representation you need. Their experienced tax professionals will work with you to understand the audit process, gather necessary documents, and represent you in communications with the IRS. This support can help alleviate the stress and uncertainty associated with an audit, providing you with peace of mind knowing that your tax situation is being handled by experts.

H&R Block Audit Support Services

Some of the audit support services offered by H&R Block include: - Audit representation: H&R Block's tax professionals will represent you in communications with the IRS, ensuring that your rights are protected and your tax situation is accurately represented. - Audit guidance: H&R Block can provide you with guidance and support throughout the audit process, helping you to understand your rights and responsibilities. - Audit preparation: If you are facing an audit, H&R Block can help you prepare by gathering necessary documents and information, ensuring that you are well-prepared for the audit process.H&R Block Tax Tips and Resources

H&R Block offers a range of tax tips and resources designed to help you navigate the complexities of tax preparation. Their website features a wealth of information on tax-related topics, including tax planning, tax deductions, and tax credits. Additionally, H&R Block's tax professionals are available to provide personalized guidance and advice, ensuring that you receive the support you need to manage your tax situation effectively.

H&R Block Tax Tips

Some of the tax tips offered by H&R Block include: - Take advantage of tax deductions: H&R Block's tax professionals can help you identify eligible tax deductions, ensuring that you minimize your tax liability and maximize your refund. - Plan ahead: By planning ahead, you can ensure that you are prepared for tax season, reducing the stress and uncertainty associated with last-minute tax filing. - Stay organized: Keeping your tax-related documents and information organized can help you to efficiently prepare your tax return, ensuring that you take advantage of all eligible deductions and credits.H&R Block Customer Support

H&R Block is committed to providing exceptional customer support, ensuring that you receive the help you need to manage your tax situation effectively. Their customer support team is available to answer your questions, provide guidance and advice, and address any concerns you may have. Whether you are preparing your tax return, facing an audit, or simply have questions about tax-related topics, H&R Block's customer support team is here to help.

H&R Block Customer Support Services

Some of the customer support services offered by H&R Block include: - Phone support: H&R Block's customer support team is available to answer your questions and provide guidance over the phone. - Email support: You can also contact H&R Block's customer support team via email, receiving timely and helpful responses to your questions and concerns. - In-person support: If you prefer to meet in person, H&R Block's tax professionals are available to provide guidance and advice at a location near you.What documents do I need to bring to my H&R Block appointment?

+To prepare for your H&R Block appointment, you should gather all necessary documents and information related to your tax return, including W-2 forms, 1099 forms, receipts for deductions, and any other relevant tax-related documents.

How do I schedule an appointment with H&R Block?

+You can schedule an appointment with H&R Block online, over the phone, or in person at a local office. Simply visit the H&R Block website, use their office locator tool to find a location near you, and then choose a date and time that suits your schedule.

What services does H&R Block offer?

+H&R Block offers a range of services designed to cater to various tax needs, including tax preparation, audit support, and small business tax services. Their expert tax preparers can guide you through the tax preparation process, ensuring that your tax return is prepared accurately and efficiently.

In conclusion, scheduling an appointment with H&R Block is a convenient and effective way to manage your tax situation. By choosing H&R Block, you can trust that your tax needs are being handled by knowledgeable and experienced professionals who are committed to providing exceptional service. Whether you are an individual, a small business owner, or a self-employed entrepreneur, H&R Block's expert tax preparers can guide you through the tax preparation process, ensuring that you take advantage of all eligible deductions and credits. We invite you to share your experiences with H&R Block, ask questions, or seek advice on how to navigate the complexities of tax preparation. By working together, we can help you achieve your financial goals and ensure that your tax situation is managed effectively.