Intro

Discover affordable health care insurance options, including low-cost plans, cheap policies, and budget-friendly coverage, to save on medical expenses and find inexpensive healthcare solutions.

The cost of health care in the United States can be overwhelming, with many individuals and families struggling to afford even the most basic medical services. The financial burden of health care can be particularly challenging for those who are self-employed, work part-time, or have pre-existing medical conditions. However, there are inexpensive health care insurance options available that can provide individuals and families with the medical coverage they need without breaking the bank.

One of the primary reasons why health care insurance is so expensive is the high cost of medical services. Hospitals, doctors, and other medical providers charge high fees for their services, which are then passed on to insurance companies. These costs are typically reflected in the premiums that individuals and families pay for their health insurance coverage. However, there are ways to reduce these costs and find more affordable health insurance options. For example, individuals can shop around for insurance quotes, consider lower-cost plans with higher deductibles, and take advantage of tax credits and subsidies.

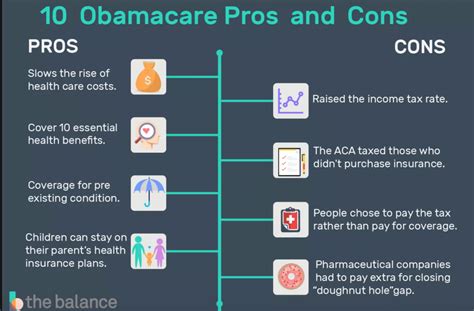

The Affordable Care Act (ACA), also known as Obamacare, has made it possible for millions of Americans to access affordable health insurance. The ACA has expanded Medicaid coverage, allowed young adults to stay on their parents' insurance plans until age 26, and prohibited insurance companies from denying coverage due to pre-existing conditions. Additionally, the ACA has created health insurance marketplaces where individuals and families can compare and purchase insurance plans from different providers. These marketplaces offer a range of plans with varying levels of coverage and premiums, allowing individuals to choose the plan that best fits their needs and budget.

Inexpensive Health Care Insurance Options

There are several inexpensive health care insurance options available, including short-term health insurance, catastrophic health insurance, and health maintenance organization (HMO) plans. Short-term health insurance plans provide temporary coverage for a limited period, usually up to 12 months. These plans are often less expensive than major medical plans but may not provide as comprehensive coverage. Catastrophic health insurance plans, on the other hand, provide limited coverage at a lower cost, with higher deductibles and out-of-pocket costs. HMO plans, which require individuals to receive medical care from a specific network of providers, can also be more affordable than other types of plans.

Types of Inexpensive Health Care Insurance

Inexpensive health care insurance options can be categorized into several types, including: * Short-term health insurance: provides temporary coverage for a limited period * Catastrophic health insurance: provides limited coverage at a lower cost, with higher deductibles and out-of-pocket costs * HMO plans: requires individuals to receive medical care from a specific network of providers * High-deductible health plans (HDHPs): requires individuals to pay a higher deductible before insurance coverage kicks in * Discount health plans: provides discounts on medical services, but does not provide comprehensive coverageBenefits of Inexpensive Health Care Insurance

Inexpensive health care insurance options can provide several benefits, including:

- Lower premiums: inexpensive health insurance plans often have lower premiums than major medical plans

- Access to medical care: inexpensive health insurance plans can provide individuals with access to necessary medical care, even if they have a limited budget

- Preventive care: many inexpensive health insurance plans cover preventive care services, such as annual physicals and screenings

- Financial protection: inexpensive health insurance plans can provide financial protection against unexpected medical expenses

How to Choose an Inexpensive Health Care Insurance Plan

Choosing an inexpensive health care insurance plan can be challenging, but there are several factors to consider. These include: * Premium cost: the monthly premium cost of the plan * Deductible: the amount that individuals must pay out-of-pocket before insurance coverage kicks in * Copayment: the amount that individuals must pay for each medical service * Coinsurance: the percentage of medical costs that individuals must pay * Network: the network of medical providers that participate in the planTips for Finding Inexpensive Health Care Insurance

There are several tips for finding inexpensive health care insurance, including:

- Shopping around: comparing insurance quotes from different providers

- Considering lower-cost plans: looking into plans with higher deductibles and out-of-pocket costs

- Taking advantage of tax credits and subsidies: using tax credits and subsidies to reduce premium costs

- Negotiating with providers: negotiating with medical providers to reduce costs

- Using health savings accounts (HSAs): using HSAs to set aside money for medical expenses

Common Mistakes to Avoid When Choosing an Inexpensive Health Care Insurance Plan

There are several common mistakes to avoid when choosing an inexpensive health care insurance plan, including: * Not reading the fine print: failing to understand the terms and conditions of the plan * Not considering the network: failing to consider the network of medical providers that participate in the plan * Not calculating the total cost: failing to calculate the total cost of the plan, including premiums, deductibles, and out-of-pocket costs * Not considering the quality of care: failing to consider the quality of care provided by the planInexpensive Health Care Insurance for Specific Groups

Inexpensive health care insurance options are available for specific groups, including:

- Self-employed individuals: individuals who are self-employed may be able to find inexpensive health insurance plans through professional associations or trade organizations

- Part-time workers: part-time workers may be able to find inexpensive health insurance plans through their employers or through individual marketplaces

- Students: students may be able to find inexpensive health insurance plans through their schools or universities

- Low-income individuals: low-income individuals may be able to find inexpensive health insurance plans through Medicaid or other government programs

Resources for Finding Inexpensive Health Care Insurance

There are several resources available for finding inexpensive health care insurance, including: * Health insurance marketplaces: online marketplaces where individuals can compare and purchase insurance plans * Insurance brokers: licensed insurance professionals who can help individuals find and purchase insurance plans * Professional associations: organizations that provide insurance benefits to members * Government programs: programs such as Medicaid and the Children's Health Insurance Program (CHIP) that provide health insurance coverage to low-income individuals and familiesConclusion and Next Steps

In conclusion, inexpensive health care insurance options are available for individuals and families who are struggling to afford medical services. By shopping around, considering lower-cost plans, and taking advantage of tax credits and subsidies, individuals can find affordable health insurance coverage. It is essential to carefully consider the terms and conditions of any insurance plan, including the premium cost, deductible, copayment, and coinsurance. Additionally, individuals should consider the network of medical providers that participate in the plan and the quality of care provided.

We encourage readers to share their experiences with inexpensive health care insurance options and to ask questions about the topic. Please comment below or share this article with others who may be interested in learning more about affordable health insurance. By working together, we can make health care more accessible and affordable for everyone.

What is the difference between short-term and long-term health insurance?

+Short-term health insurance provides temporary coverage for a limited period, usually up to 12 months, while long-term health insurance provides comprehensive coverage for an extended period, usually several years or a lifetime.

Can I purchase inexpensive health care insurance if I have a pre-existing condition?

+Yes, the Affordable Care Act (ACA) prohibits insurance companies from denying coverage due to pre-existing conditions. However, some inexpensive health insurance plans may not provide comprehensive coverage for pre-existing conditions, so it is essential to carefully review the plan's terms and conditions.

How can I find inexpensive health care insurance as a self-employed individual?

+Self-employed individuals can find inexpensive health insurance plans through professional associations or trade organizations, or by shopping around on individual marketplaces. Additionally, self-employed individuals may be eligible for tax credits and subsidies to reduce premium costs.