Intro

Explore family health insurance options, including affordable plans, medical coverage, and provider networks, to find the best fit for your loved ones wellbeing and budget.

Family health insurance is a crucial aspect of securing the well-being and financial stability of loved ones. With the ever-increasing costs of medical care, having a comprehensive health insurance plan in place can provide peace of mind and protect against unexpected expenses. In this article, we will delve into the world of family health insurance options, exploring the various types of plans, their benefits, and what to consider when selecting the right coverage for your family.

The importance of family health insurance cannot be overstated. Medical emergencies can arise at any moment, and without proper coverage, the financial burden can be overwhelming. Moreover, regular health check-ups and preventive care are essential for maintaining good health, and a family health insurance plan can help make these services more accessible and affordable. As we navigate the complexities of family health insurance, it is essential to understand the different types of plans available, including individual, group, and government-sponsored plans.

Family health insurance plans are designed to provide coverage for spouses, children, and sometimes even extended family members. These plans can be purchased through employers, private insurance companies, or government marketplaces. When selecting a family health insurance plan, it is crucial to consider factors such as premium costs, deductibles, copays, and coinsurance. Additionally, understanding the network of healthcare providers, prescription drug coverage, and any additional benefits, such as dental or vision care, is vital.

Types of Family Health Insurance Plans

There are several types of family health insurance plans to choose from, each with its unique features and benefits. The most common types of plans include Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Exclusive Provider Organization (EPO) plans, and Point of Service (POS) plans. HMO plans, for example, require policyholders to receive care from a specific network of providers, while PPO plans offer more flexibility in choosing healthcare providers. EPO plans, on the other hand, combine elements of HMO and PPO plans, providing a balance between network restrictions and flexibility.

Health Maintenance Organization (HMO) Plans

HMO plans are a popular choice for family health insurance, offering a range of benefits, including preventive care, routine check-ups, and access to a network of healthcare providers. These plans typically require policyholders to choose a primary care physician (PCP) from the network, who will coordinate care and refer patients to specialists as needed. HMO plans often have lower premiums compared to other types of plans, but may have more restrictive network requirements.Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility than HMO plans, allowing policyholders to receive care from both in-network and out-of-network providers. While in-network care is typically less expensive, PPO plans provide the freedom to choose healthcare providers without the need for a referral from a PCP. PPO plans often have higher premiums compared to HMO plans, but may be a better option for families who value flexibility and choice.Benefits of Family Health Insurance

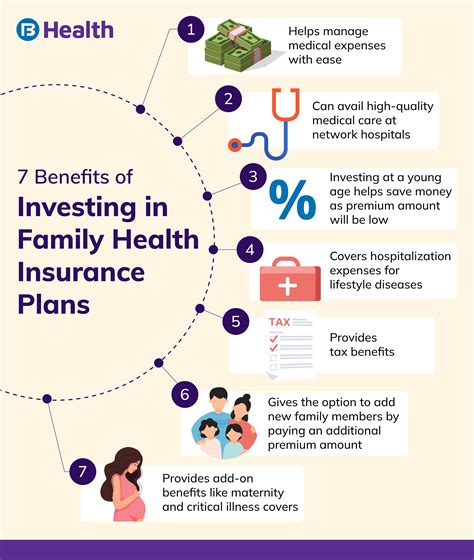

Family health insurance plans offer numerous benefits, including financial protection, access to preventive care, and improved health outcomes. With a family health insurance plan, policyholders can enjoy:

- Financial protection against unexpected medical expenses

- Access to routine check-ups, screenings, and preventive care

- Improved health outcomes through early detection and treatment of medical conditions

- Reduced out-of-pocket costs for healthcare services

- Increased peace of mind and reduced stress related to healthcare expenses

Financial Protection

Family health insurance plans provide financial protection against unexpected medical expenses, which can be devastating for families without proper coverage. With a comprehensive plan in place, policyholders can avoid financial ruin and focus on recovering from illness or injury.Access to Preventive Care

Family health insurance plans often cover preventive care services, such as routine check-ups, screenings, and vaccinations. These services are essential for maintaining good health and preventing the onset of chronic diseases.How to Choose the Right Family Health Insurance Plan

Choosing the right family health insurance plan can be a daunting task, but by considering the following factors, policyholders can make an informed decision:

- Premium costs: Compare premiums among different plans to find the most affordable option.

- Deductibles: Consider the deductible amount and how it will impact out-of-pocket costs.

- Copays and coinsurance: Understand the copay and coinsurance structure and how it will affect healthcare expenses.

- Network of healthcare providers: Ensure the plan's network includes preferred healthcare providers.

- Additional benefits: Consider additional benefits, such as dental or vision care, and whether they are essential for your family's needs.

Premium Costs

Premium costs are a critical factor to consider when choosing a family health insurance plan. Policyholders should compare premiums among different plans to find the most affordable option. However, it is essential to remember that lower premiums may mean higher out-of-pocket costs or more restrictive network requirements.Deductibles

Deductibles are the amount policyholders must pay out-of-pocket before insurance coverage kicks in. When choosing a family health insurance plan, consider the deductible amount and how it will impact healthcare expenses. Higher deductibles may mean lower premiums, but may also result in higher out-of-pocket costs.Common Mistakes to Avoid When Choosing Family Health Insurance

When choosing a family health insurance plan, there are several common mistakes to avoid:

- Not researching the plan's network of healthcare providers

- Not understanding the plan's deductible and copay structure

- Not considering additional benefits, such as dental or vision care

- Not comparing premiums among different plans

- Not reading reviews and checking the plan's reputation

Not Researching the Plan's Network

Failing to research the plan's network of healthcare providers can result in unexpected out-of-pocket costs or limited access to care. Policyholders should ensure the plan's network includes preferred healthcare providers and understand the consequences of seeking care from out-of-network providers.Not Understanding the Plan's Deductible and Copay Structure

Not understanding the plan's deductible and copay structure can lead to unexpected healthcare expenses. Policyholders should carefully review the plan's deductible and copay requirements to avoid surprises.Conclusion and Next Steps

In conclusion, family health insurance is a vital aspect of securing the well-being and financial stability of loved ones. By understanding the different types of plans, their benefits, and what to consider when selecting the right coverage, policyholders can make informed decisions and enjoy peace of mind. When choosing a family health insurance plan, it is essential to avoid common mistakes, such as not researching the plan's network or not understanding the deductible and copay structure. By taking the time to carefully review and compare plans, policyholders can find the right coverage for their family's unique needs.

We invite you to share your thoughts and experiences with family health insurance in the comments below. Have you had success with a particular plan or provider? Do you have questions about the process of selecting a plan? Share your insights and help others make informed decisions about their family's health insurance needs.

What is the difference between an HMO and PPO plan?

+HMO plans require policyholders to receive care from a specific network of providers, while PPO plans offer more flexibility in choosing healthcare providers.

How do I choose the right family health insurance plan for my family?

+Consider factors such as premium costs, deductibles, copays, and coinsurance, as well as the network of healthcare providers and additional benefits, such as dental or vision care.

What are the benefits of having family health insurance?

+Family health insurance plans offer financial protection, access to preventive care, and improved health outcomes, as well as reduced out-of-pocket costs and increased peace of mind.