Intro

Learn about IRS Form 1095, health insurance verification, and tax compliance, including 1095-A, 1095-B, and 1095-C forms, to navigate Affordable Care Act requirements and avoid penalties.

The IRS Form 1095 is a crucial document for individuals and families who have obtained health insurance through the Health Insurance Marketplace, their employer, or other sources. This form plays a vital role in ensuring that taxpayers comply with the Affordable Care Act (ACA) and accurately report their health insurance coverage on their tax returns. In this article, we will delve into the importance of the IRS Form 1095, its different versions, and provide guidance on how to use it to complete your tax return.

The IRS Form 1095 is essential for taxpayers who have health insurance coverage, as it provides proof of insurance and helps to determine eligibility for the Premium Tax Credit (PTC). The PTC is a refundable tax credit that helps eligible individuals and families with low to moderate income afford health insurance purchased through the Health Insurance Marketplace. To qualify for the PTC, taxpayers must have a certain level of income and meet specific eligibility requirements.

Types of IRS Form 1095

There are three main types of IRS Form 1095, each with its own specific purpose and requirements. These forms are:

- Form 1095-A: This form is sent to individuals and families who have obtained health insurance through the Health Insurance Marketplace. It provides information about the insurance coverage, including the names of the individuals covered, the dates of coverage, and the amount of the monthly premium.

- Form 1095-B: This form is sent to individuals and families who have obtained health insurance through their employer or other sources, such as a private insurance company. It provides information about the insurance coverage, including the names of the individuals covered, the dates of coverage, and the type of coverage.

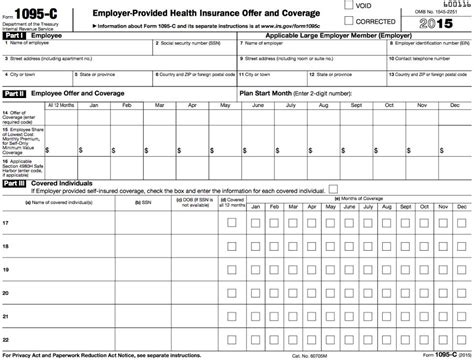

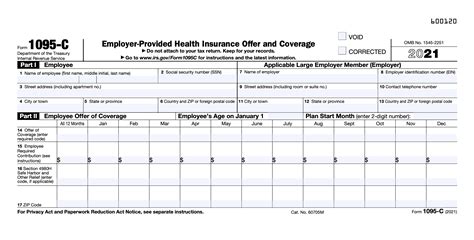

- Form 1095-C: This form is sent to employees who work for an Applicable Large Employer (ALE) that is required to offer health insurance coverage to its full-time employees. It provides information about the insurance coverage offered by the employer, including the names of the individuals covered, the dates of coverage, and the amount of the monthly premium.

What Information is Included on the IRS Form 1095?

The IRS Form 1095 includes important information about an individual's or family's health insurance coverage, such as:

- The names and Social Security numbers of the individuals covered

- The dates of coverage

- The type of coverage (e.g., individual, family, or employer-sponsored)

- The monthly premium amount

- The amount of any advance payments of the Premium Tax Credit (APTC)

This information is used to determine eligibility for the PTC and to reconcile any APTC payments made on behalf of the taxpayer.

How to Use the IRS Form 1095 to Complete Your Tax Return

To complete your tax return, you will need to use the information included on the IRS Form 1095 to determine your eligibility for the PTC and to reconcile any APTC payments. Here are the steps to follow:

- Review the information on the Form 1095 to ensure it is accurate and complete.

- Use the information on the Form 1095 to complete Form 8962, which is used to claim the PTC.

- If you received APTC, use the information on the Form 1095 to reconcile the payments on Form 8962.

- Attach the completed Form 8962 to your tax return (Form 1040) and submit it to the IRS.

Tips for Completing the IRS Form 1095

Here are some tips to keep in mind when completing the IRS Form 1095:

- Make sure to review the information on the Form 1095 carefully to ensure it is accurate and complete.

- Use the correct form (1095-A, 1095-B, or 1095-C) based on your specific situation.

- Keep a copy of the Form 1095 for your records, as you will need it to complete your tax return.

- If you have questions or concerns about the Form 1095, contact the IRS or a tax professional for assistance.

Common Mistakes to Avoid When Completing the IRS Form 1095

Here are some common mistakes to avoid when completing the IRS Form 1095:

- Failing to report all household members on the Form 1095

- Incorrectly reporting the dates of coverage

- Failing to reconcile APTC payments on Form 8962

- Not keeping a copy of the Form 1095 for your records

By avoiding these common mistakes, you can ensure that you accurately complete the IRS Form 1095 and avoid any potential issues with your tax return.

What to Do If You Don't Receive the IRS Form 1095

If you don't receive the IRS Form 1095, you should contact the issuer of the form (e.g., the Health Insurance Marketplace or your employer) to request a copy. You can also contact the IRS for assistance.

Here are the steps to follow:

- Contact the issuer of the form to request a copy.

- If you are unable to obtain a copy from the issuer, contact the IRS for assistance.

- Provide the IRS with your name, Social Security number, and any other relevant information to help them locate your Form 1095.

Conclusion and Next Steps

In conclusion, the IRS Form 1095 is an essential document for individuals and families who have obtained health insurance through the Health Insurance Marketplace, their employer, or other sources. By understanding the different types of Form 1095, what information is included, and how to use it to complete your tax return, you can ensure that you accurately report your health insurance coverage and claim any eligible tax credits.

If you have any questions or concerns about the IRS Form 1095, don't hesitate to reach out to the IRS or a tax professional for assistance. Additionally, you can visit the IRS website for more information and resources on the Form 1095 and other tax-related topics.

What is the purpose of the IRS Form 1095?

+The IRS Form 1095 is used to report health insurance coverage and determine eligibility for the Premium Tax Credit (PTC).

What types of IRS Form 1095 are there?

+There are three main types of IRS Form 1095: Form 1095-A, Form 1095-B, and Form 1095-C.

How do I use the IRS Form 1095 to complete my tax return?

+You will need to use the information on the Form 1095 to complete Form 8962, which is used to claim the PTC. Attach the completed Form 8962 to your tax return (Form 1040) and submit it to the IRS.

What if I don't receive the IRS Form 1095?

+If you don't receive the IRS Form 1095, contact the issuer of the form (e.g., the Health Insurance Marketplace or your employer) to request a copy. You can also contact the IRS for assistance.

Can I file my tax return without the IRS Form 1095?

+No, you will need to have the IRS Form 1095 to complete your tax return and claim any eligible tax credits. If you don't receive the form, contact the issuer or the IRS for assistance.

We hope this article has provided you with a comprehensive understanding of the IRS Form 1095 and its importance in reporting health insurance coverage and claiming tax credits. If you have any further questions or concerns, don't hesitate to reach out to the IRS or a tax professional for assistance. Additionally, you can share this article with others who may find it helpful, or leave a comment below with your thoughts and feedback.