Intro

Compare HMO vs PPO health insurance plans, understanding network differences, out-of-pocket costs, and flexibility to choose the best option for your needs, considering factors like deductibles, copays, and provider networks.

When it comes to choosing a health insurance plan, two of the most popular options are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). Both types of plans have their own set of benefits and drawbacks, and the right choice for you will depend on your individual needs and circumstances. In this article, we'll delve into the details of HMO and PPO plans, exploring their key features, advantages, and disadvantages, to help you make an informed decision.

The importance of choosing the right health insurance plan cannot be overstated. With the rising costs of healthcare, having a plan that meets your needs can help you avoid financial ruin in the event of a medical emergency. Moreover, a good plan can provide you with access to quality care, preventive services, and specialized treatments. However, with so many options available, it can be overwhelming to navigate the complex world of health insurance. That's why it's essential to understand the differences between HMO and PPO plans, as well as their respective benefits and drawbacks.

In recent years, the healthcare landscape has undergone significant changes, with the Affordable Care Act (ACA) introducing new regulations and requirements for health insurance plans. As a result, many people have found themselves re-evaluating their insurance options, seeking plans that balance affordability, coverage, and flexibility. HMO and PPO plans are two of the most common types of plans available, and each has its own strengths and weaknesses. By understanding the nuances of these plans, you can make a more informed decision about which one is right for you.

HMO Plans: An Overview

Benefits of HMO Plans

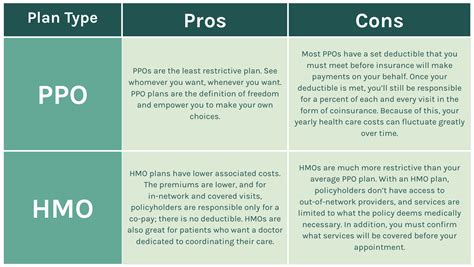

Some of the key benefits of HMO plans include: * Lower premiums and out-of-pocket costs * Emphasis on preventive care and wellness * Coordinated care through a primary care physician * Access to a network of participating providers * Often include additional benefits, such as dental and vision coverageDrawbacks of HMO Plans

However, HMO plans also have some drawbacks, including: * Limited flexibility, as you're required to choose a primary care physician and obtain referrals for specialist care * Out-of-network care is often not covered, or is covered at a higher cost * May have stricter requirements for pre-authorization and prior approvalPPO Plans: An Overview

Benefits of PPO Plans

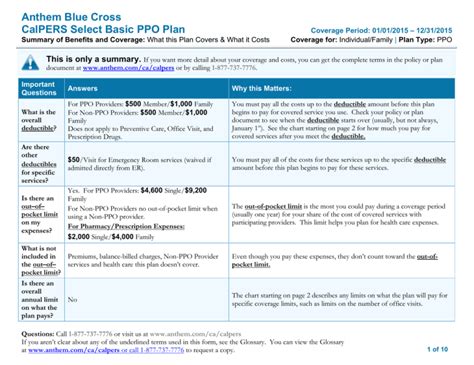

Some of the key benefits of PPO plans include: * Greater flexibility and freedom of choice when selecting healthcare providers * Coverage for out-of-network care, although at a higher cost * No requirement for a primary care physician or referrals for specialist care * Often include additional benefits, such as dental and vision coverage * May have more comprehensive coverage for specialized treatments and servicesDrawbacks of PPO Plans

However, PPO plans also have some drawbacks, including: * Higher premiums and out-of-pocket costs * More complex and confusing billing and payment processes * May have higher deductibles and copays for out-of-network care * Often require pre-authorization and prior approval for certain services and treatmentsKey Differences Between HMO and PPO Plans

Network and Provider Considerations

When choosing between HMO and PPO plans, it's essential to consider the network and provider options. HMO plans typically have a smaller network of participating providers, while PPO plans have a larger network and may include more specialized providers. You should also consider the quality of care and the reputation of the providers within the network. Additionally, you should think about your own healthcare needs and preferences, and choose a plan that meets your individual requirements.Choosing the Right Plan for You

Consider Your Healthcare Needs

When choosing between HMO and PPO plans, it's essential to consider your healthcare needs and preferences. Think about your medical history, your current health status, and any ongoing health conditions you may have. You should also consider your budget and your ability to pay for out-of-pocket costs, such as copays and deductibles. Additionally, you should think about your lifestyle and your preferences when it comes to healthcare providers and services.Final Thoughts

We invite you to share your thoughts and experiences with HMO and PPO plans in the comments section below. Have you had a positive or negative experience with one of these plans? Do you have any questions or concerns about choosing the right plan for you? Share your story and help others make informed decisions about their healthcare.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of flexibility and freedom of choice when selecting healthcare providers. HMO plans require you to choose a primary care physician and obtain referrals for specialist care, while PPO plans offer more flexibility and allow you to see any healthcare provider, both in-network and out-of-network.

Which type of plan is more cost-effective?

+HMO plans are often more cost-effective, with lower premiums and out-of-pocket costs. However, PPO plans may offer more comprehensive coverage and greater flexibility, which may be worth the additional cost for some individuals.

Can I see any healthcare provider with a PPO plan?

+Yes, with a PPO plan, you can see any healthcare provider, both in-network and out-of-network. However, out-of-network care may be covered at a higher cost, and you may be responsible for a larger portion of the bill.