Intro

Discover if Kaiser is good insurance, exploring its health plans, coverage, and benefits, with insights on affordability, network, and customer reviews, to make informed decisions about your medical insurance needs.

Kaiser Permanente is a well-known health insurance provider in the United States, offering a range of plans to individuals, families, and groups. With a strong reputation for providing high-quality care, Kaiser has become a popular choice for many people seeking comprehensive health insurance coverage. But is Kaiser good insurance? Let's dive into the details to find out.

Kaiser Permanente has been in operation for over 70 years, with a mission to provide affordable, high-quality healthcare to its members. The organization has a unique approach to healthcare, emphasizing preventive care, wellness, and community involvement. Kaiser's integrated care model brings together physicians, hospitals, and health plans to provide coordinated care, which can lead to better health outcomes and lower costs.

One of the key benefits of Kaiser insurance is its extensive network of healthcare providers. With thousands of physicians and healthcare professionals across the country, Kaiser members have access to a wide range of specialists and primary care physicians. Kaiser's hospitals and medical facilities are also highly regarded, with many receiving top ratings for quality and patient satisfaction.

Benefits of Kaiser Insurance

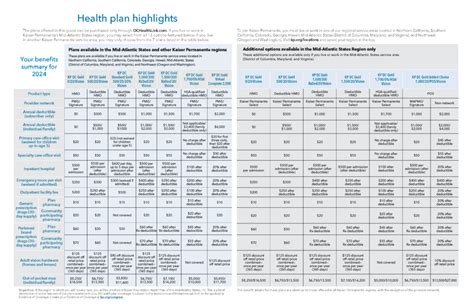

Types of Kaiser Insurance Plans

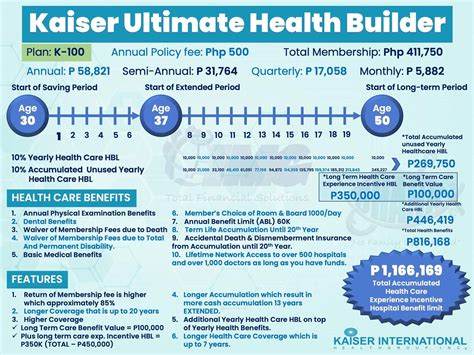

Some of the most popular Kaiser insurance plans include:

- Kaiser Permanente Individual and Family Plans: These plans offer comprehensive coverage for individuals and families, including preventive care, hospital stays, and prescription medications.

- Kaiser Permanente Group Plans: These plans are designed for employers, providing coverage for employees and their families.

- Kaiser Permanente Medicare Advantage Plans: These plans are designed for seniors, offering comprehensive coverage, including medical, hospital, and prescription drug coverage.

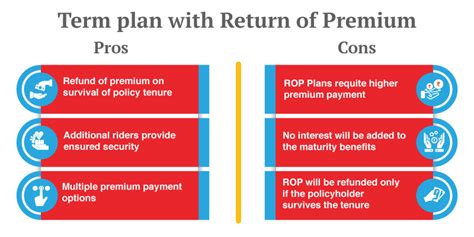

Pros and Cons of Kaiser Insurance

However, some of the disadvantages of Kaiser insurance include:

- Limited network: Kaiser's network of healthcare providers may be limited in certain areas, which can make it difficult for members to find in-network care.

- High deductibles: Some Kaiser insurance plans may have high deductibles, which can make it difficult for members to afford care, especially for those with chronic conditions.

- Limited flexibility: Kaiser's integrated care model can be inflexible, making it difficult for members to see out-of-network providers or access specialized care.

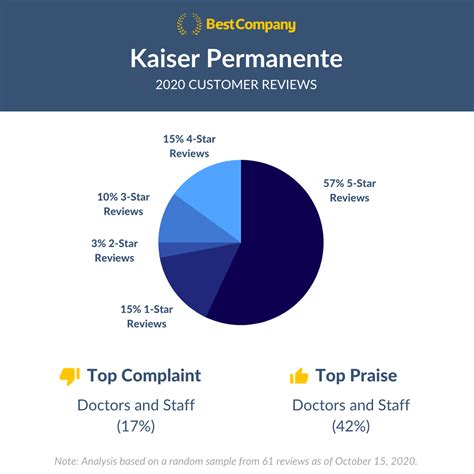

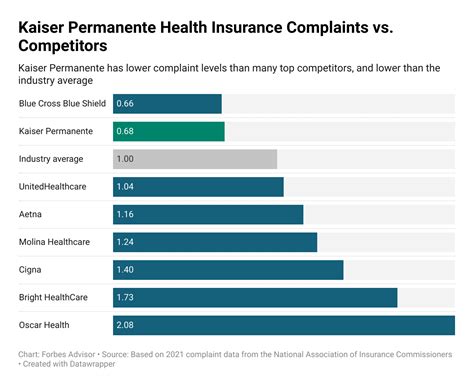

Kaiser Insurance Reviews and Ratings

Some of the key ratings and reviews for Kaiser insurance include:

- NCQA ratings: Kaiser Permanente has received high ratings from the NCQA, with many of its plans receiving 4.5 or 5 stars.

- CMS ratings: Kaiser Permanente has received high ratings from CMS, with many of its Medicare Advantage plans receiving 4.5 or 5 stars.

- Member satisfaction: Kaiser members have reported high satisfaction with their care and coverage, with many praising the organization's comprehensive benefits and high-quality care.

How to Choose the Right Kaiser Insurance Plan

Kaiser Insurance Costs and Premiums

Keep in mind that these are estimated costs and premiums, and actual costs may vary depending on your specific situation.

Kaiser Insurance Enrollment and Eligibility

To be eligible for Kaiser insurance, you must meet certain requirements, such as:

- Residing in a Kaiser service area

- Being a U.S. citizen or lawful resident

- Meeting income and eligibility requirements for subsidies or financial assistance

Kaiser Insurance Customer Service and Support

Kaiser also offers a range of online tools and resources, including secure messaging, appointment scheduling, and medication refills.

Conclusion and Final Thoughts

In conclusion, Kaiser insurance can be a good option for those seeking comprehensive health insurance coverage. With its unique approach to healthcare, extensive network of providers, and high-quality care, Kaiser has become a popular choice for many individuals and families. However, it's essential to consider the pros and cons, costs, and eligibility requirements before choosing a Kaiser insurance plan.We invite you to share your thoughts and experiences with Kaiser insurance in the comments below. Have you had a positive or negative experience with Kaiser? What do you think are the most important factors to consider when choosing a health insurance plan?

What is Kaiser Permanente?

+Kaiser Permanente is a health insurance provider that offers a range of plans to individuals, families, and groups.

What are the benefits of Kaiser insurance?

+Kaiser insurance offers comprehensive coverage, including preventive care, chronic disease management, and mental health services.

How do I choose the right Kaiser insurance plan?

+Consider your budget, healthcare needs, and network preferences when choosing a Kaiser insurance plan.