Intro

Get expert guidance on Kaiser Insurance Application with our comprehensive guide, covering enrollment, eligibility, and plan selection, to help you navigate the process smoothly and make informed decisions about your health coverage options.

Getting health insurance is a crucial step in ensuring that you and your loved ones are protected against unexpected medical expenses. With so many insurance providers out there, it can be overwhelming to choose the right one. Kaiser Permanente is a well-known and reputable health insurance provider that offers a range of plans to suit different needs and budgets. In this article, we will guide you through the Kaiser insurance application process, highlighting the key steps, benefits, and what to expect.

Applying for health insurance can seem like a daunting task, especially with all the paperwork and terminology involved. However, with the right guidance, you can navigate the process with ease. Kaiser Permanente is committed to making healthcare accessible and affordable for everyone. Their insurance plans are designed to provide comprehensive coverage, including preventive care, hospital stays, and prescription medications. By understanding the application process and what to expect, you can make informed decisions about your health insurance needs.

Kaiser Permanente has been a leader in the healthcare industry for over 70 years, with a reputation for providing high-quality care and excellent customer service. Their insurance plans are available in several states, including California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, and Washington. With a wide range of plans to choose from, you can select the one that best fits your needs and budget. Whether you are an individual, family, or business owner, Kaiser Permanente has a plan that can provide you with the coverage you need.

Kaiser Insurance Application Process

The Kaiser insurance application process is straightforward and can be completed online, by phone, or in person. To get started, you will need to provide some basic information, such as your name, date of birth, and contact details. You will also need to provide information about your household income and family size, as this will help determine your eligibility for certain plans and subsidies. Once you have submitted your application, you can expect to receive a response within a few days, outlining the plans that are available to you and the associated costs.

Step 1: Choose Your Plan

The first step in the application process is to choose the plan that best suits your needs. Kaiser Permanente offers a range of plans, including individual and family plans, Medicare plans, and group plans for businesses. Each plan has its own set of benefits and costs, so it's essential to carefully review the details before making a decision. You can compare plans online or speak with a Kaiser Permanente representative to get personalized advice.Step 2: Gather Required Documents

Once you have chosen your plan, you will need to gather the required documents to complete your application. These may include proof of income, identification, and citizenship or immigration status. You will also need to provide information about your medical history, including any pre-existing conditions. This information will help Kaiser Permanente determine your eligibility for coverage and the associated costs.Step 3: Submit Your Application

With all the necessary documents in hand, you can submit your application online, by phone, or in person. The application process typically takes around 30 minutes to complete, and you can expect to receive a response within a few days. If you have any questions or need help with the application process, you can contact Kaiser Permanente's customer service team for assistance.Benefits of Kaiser Insurance

Kaiser Permanente offers a range of benefits that make their insurance plans stand out from the competition. Some of the key benefits include:

- Comprehensive coverage: Kaiser Permanente's insurance plans provide comprehensive coverage, including preventive care, hospital stays, and prescription medications.

- Affordable costs: Kaiser Permanente offers competitive pricing and a range of plans to suit different budgets.

- High-quality care: Kaiser Permanente is committed to providing high-quality care, with a focus on preventive medicine and patient-centered care.

- Excellent customer service: Kaiser Permanente's customer service team is available to help with any questions or concerns you may have.

Preventive Care

Kaiser Permanente's insurance plans prioritize preventive care, with a focus on keeping you healthy and preventing illnesses. This includes regular check-ups, screenings, and vaccinations, as well as access to healthy lifestyle programs and resources. By prioritizing preventive care, you can reduce your risk of developing chronic diseases and improve your overall health and wellbeing.Prescription Medications

Kaiser Permanente's insurance plans also cover prescription medications, including generic and brand-name drugs. This can help you manage chronic conditions and improve your overall health and wellbeing. With a wide range of medications covered, you can rest assured that you will have access to the treatments you need.Eligibility and Enrollment

To be eligible for Kaiser Permanente's insurance plans, you must meet certain requirements. These may include:

- Age: You must be at least 18 years old to apply for an individual plan.

- Residency: You must be a resident of one of the states where Kaiser Permanente operates.

- Income: You must meet certain income requirements to be eligible for subsidies or discounts.

- Citizenship: You must be a U.S. citizen or have a valid immigration status.

Once you have determined your eligibility, you can enroll in a plan during the annual open enrollment period or during a special enrollment period if you experience a qualifying life event. This may include losing your job, getting married, or having a baby.

Special Enrollment Periods

If you experience a qualifying life event, you may be eligible for a special enrollment period. This allows you to enroll in a plan outside of the annual open enrollment period. Some common qualifying life events include:- Losing your job or income

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new state or area

- Becoming a U.S. citizen or gaining a valid immigration status

Cost and Pricing

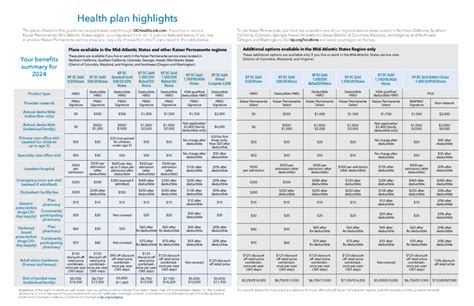

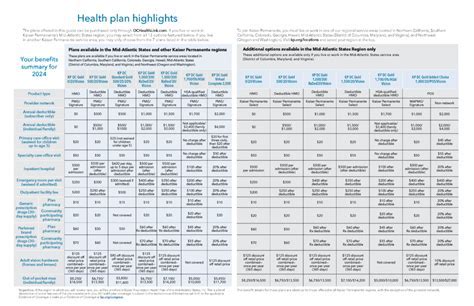

The cost of Kaiser Permanente's insurance plans varies depending on the plan you choose, your age, and your location. In general, the costs include:

- Premiums: This is the monthly cost of your plan, which can range from a few hundred to several thousand dollars per month.

- Deductibles: This is the amount you must pay out of pocket before your insurance coverage kicks in.

- Copays: This is the amount you must pay for each doctor visit or prescription medication.

- Coinsurance: This is the percentage of costs you must pay after meeting your deductible.

To give you a better idea of the costs, here are some examples of Kaiser Permanente's insurance plans:

- Individual plans: These plans can range from $300 to $1,000 per month, depending on the level of coverage and your age.

- Family plans: These plans can range from $800 to $3,000 per month, depending on the level of coverage and the number of family members.

- Medicare plans: These plans can range from $0 to $100 per month, depending on the level of coverage and your income.

Subsidies and Discounts

Kaiser Permanente offers subsidies and discounts to eligible individuals and families. These can help reduce the cost of your plan and make it more affordable. Some common subsidies and discounts include:- Premium tax credits: These are available to individuals and families who meet certain income requirements.

- Cost-sharing reductions: These are available to individuals and families who meet certain income requirements and are enrolled in a silver plan.

- Discounts for students: These are available to students who are enrolled in a qualified educational institution.

- Discounts for military personnel: These are available to military personnel and their families.

Customer Service and Support

Kaiser Permanente is committed to providing excellent customer service and support. Their customer service team is available to help with any questions or concerns you may have, including:

- Plan selection and enrollment

- Billing and payment

- Claims and reimbursement

- Medical questions and advice

You can contact Kaiser Permanente's customer service team by phone, email, or in person. They also offer a range of online resources and tools to help you manage your plan and get the most out of your coverage.

Online Resources

Kaiser Permanente offers a range of online resources and tools to help you manage your plan and get the most out of your coverage. These include:- Online portal: This allows you to view your plan details, pay your premium, and access your medical records.

- Mobile app: This allows you to access your plan details, schedule appointments, and communicate with your healthcare team on the go.

- Health and wellness resources: These include articles, videos, and other resources to help you stay healthy and manage chronic conditions.

Conclusion and Next Steps

In conclusion, applying for Kaiser insurance is a straightforward process that can be completed online, by phone, or in person. By understanding the application process, benefits, and costs, you can make informed decisions about your health insurance needs. Kaiser Permanente offers a range of plans to suit different needs and budgets, with a focus on preventive care, high-quality care, and excellent customer service.

If you are interested in learning more about Kaiser Permanente's insurance plans or would like to apply, we encourage you to visit their website or contact their customer service team. With the right plan and support, you can take control of your health and wellbeing and enjoy peace of mind knowing that you are protected against unexpected medical expenses.

We invite you to share your thoughts and experiences with Kaiser Permanente's insurance plans in the comments below. Your feedback and insights can help others make informed decisions about their health insurance needs.

What is the Kaiser insurance application process?

+The Kaiser insurance application process involves choosing a plan, gathering required documents, and submitting your application online, by phone, or in person.

What are the benefits of Kaiser insurance?

+The benefits of Kaiser insurance include comprehensive coverage, affordable costs, high-quality care, and excellent customer service.

How do I enroll in a Kaiser insurance plan?

+You can enroll in a Kaiser insurance plan during the annual open enrollment period or during a special enrollment period if you experience a qualifying life event.

What is the cost of Kaiser insurance?

+The cost of Kaiser insurance varies depending on the plan you choose, your age, and your location, but can range from a few hundred to several thousand dollars per month.

What kind of customer service and support does Kaiser Permanente offer?

+Kaiser Permanente offers excellent customer service and support, including online resources and tools, phone and email support, and in-person support at their facilities.