Intro

Explore Kaiser Insurance Plans options, including health, dental, and vision coverage, with various plan types, such as HMO, PPO, and Medicare Advantage, to find the best fit for your needs and budget.

Kaiser Insurance Plans have become a staple in the healthcare industry, providing comprehensive coverage to individuals, families, and groups. With a wide range of options available, it's essential to understand the benefits, working mechanisms, and key information related to these plans. In this article, we'll delve into the world of Kaiser Insurance Plans, exploring their importance, benefits, and what makes them a popular choice among healthcare consumers.

The importance of having a reliable health insurance plan cannot be overstated. With the rising costs of medical care, having a safety net to fall back on can be a lifesaver. Kaiser Insurance Plans offer a unique approach to healthcare, combining high-quality medical services with affordable pricing. Their plans are designed to cater to diverse needs, from individual coverage to family and group plans. By choosing a Kaiser Insurance Plan, individuals can enjoy peace of mind, knowing they're protected against unexpected medical expenses.

Kaiser Insurance Plans have been a trusted name in the healthcare industry for decades. Their commitment to providing excellent care, combined with innovative approaches to healthcare management, has earned them a reputation as a leader in the field. With a focus on preventive care, Kaiser Insurance Plans encourage policyholders to take an active role in maintaining their health. This proactive approach not only improves overall well-being but also helps reduce healthcare costs in the long run. As we explore the world of Kaiser Insurance Plans, it's clear that their unique approach has resonated with healthcare consumers, making them a popular choice for those seeking comprehensive coverage.

Kaiser Insurance Plans Options

Kaiser Insurance Plans offer a variety of options to suit different needs and budgets. Their plans are designed to provide comprehensive coverage, including medical, dental, and vision care. Some of the key features of Kaiser Insurance Plans include:

- Comprehensive medical coverage, including doctor visits, hospital stays, and prescription medications

- Dental and vision care options, providing additional protection for overall health

- Preventive care services, such as routine check-ups and screenings, to encourage policyholders to take an active role in maintaining their health

- Access to a network of healthcare providers, including primary care physicians, specialists, and hospitals

- Affordable pricing, with options to suit different budgets and needs

Types of Kaiser Insurance Plans

Kaiser Insurance Plans offer a range of options, including: * Individual and family plans, providing coverage for single individuals or families * Group plans, designed for businesses and organizations looking to provide healthcare coverage for their employees * Medicare and Medicaid plans, offering coverage for seniors and low-income individuals * Supplemental plans, providing additional coverage for specific services, such as dental and vision careBenefits of Kaiser Insurance Plans

The benefits of Kaiser Insurance Plans are numerous. Some of the key advantages include:

- Comprehensive coverage, providing protection against unexpected medical expenses

- Access to a network of healthcare providers, including primary care physicians, specialists, and hospitals

- Preventive care services, encouraging policyholders to take an active role in maintaining their health

- Affordable pricing, with options to suit different budgets and needs

- Simplified billing and administration, reducing the administrative burden on policyholders

How Kaiser Insurance Plans Work

Kaiser Insurance Plans work by providing policyholders with access to a network of healthcare providers. Policyholders can choose from a range of plans, each with its own set of benefits and features. Once enrolled, policyholders can access medical care, dental and vision services, and other benefits, depending on their plan. Kaiser Insurance Plans use a combination of preventive care, education, and innovative approaches to healthcare management to reduce costs and improve outcomes.Kaiser Insurance Plans Enrollment

Enrolling in a Kaiser Insurance Plan is a straightforward process. Policyholders can choose from a range of plans, each with its own set of benefits and features. To enroll, individuals can:

- Visit the Kaiser Insurance Plans website, where they can browse plans, compare benefits, and apply online

- Contact a licensed insurance agent, who can provide guidance and support throughout the enrollment process

- Call the Kaiser Insurance Plans customer service number, where representatives can answer questions and help policyholders enroll over the phone

Eligibility and Enrollment Periods

Kaiser Insurance Plans have specific eligibility and enrollment periods. Policyholders can enroll during the annual open enrollment period, which typically takes place in the fall. Additionally, policyholders may be eligible for special enrollment periods, such as when they experience a qualifying life event, such as marriage, divorce, or the birth of a child.Kaiser Insurance Plans Costs

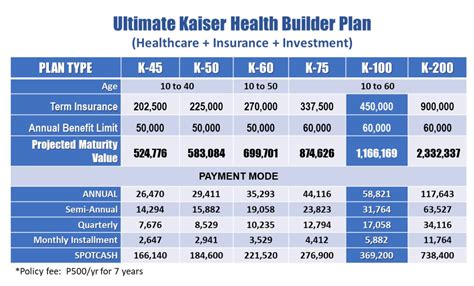

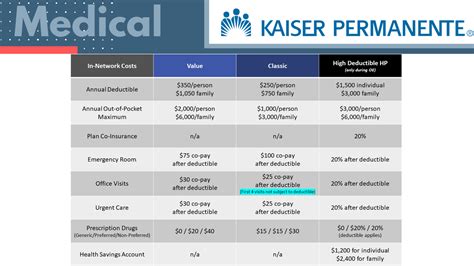

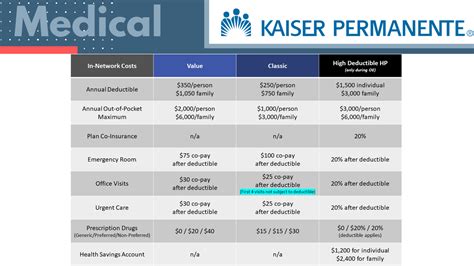

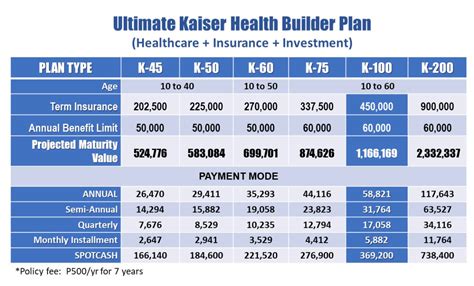

The cost of Kaiser Insurance Plans varies depending on the plan, policyholder age, and other factors. On average, policyholders can expect to pay between $300 and $1,000 per month for individual coverage, depending on the plan and benefits. Family plans typically cost more, ranging from $800 to $3,000 per month. However, these costs can be offset by the comprehensive coverage and preventive care services provided by Kaiser Insurance Plans.

Financial Assistance and Subsidies

Kaiser Insurance Plans offer financial assistance and subsidies to eligible policyholders. These programs can help reduce the cost of coverage, making it more affordable for individuals and families. Policyholders may be eligible for financial assistance, such as tax credits or cost-sharing reductions, depending on their income and family size.Kaiser Insurance Plans Network

The Kaiser Insurance Plans network is a key component of their healthcare system. The network includes a range of healthcare providers, including primary care physicians, specialists, and hospitals. Policyholders can access care from any provider within the network, which can help reduce costs and improve outcomes. The network is designed to provide comprehensive coverage, with a focus on preventive care and education.

Out-of-Network Care

Kaiser Insurance Plans also offer out-of-network care options, which allow policyholders to access care from providers outside the network. However, out-of-network care typically comes with higher costs and reduced benefits. Policyholders should carefully review their plan documents and understand the costs and benefits associated with out-of-network care before seeking treatment.Kaiser Insurance Plans Customer Service

Kaiser Insurance Plans customer service is designed to provide policyholders with support and guidance throughout their healthcare journey. Policyholders can contact customer service representatives via phone, email, or online chat. The customer service team can help policyholders with a range of issues, including:

- Billing and payment questions

- Plan benefits and features

- Provider network and out-of-network care

- Claims and appeals

Customer Service Ratings

Kaiser Insurance Plans have consistently received high customer service ratings. Policyholders praise the company's friendly and knowledgeable customer service representatives, who are available to help with any questions or concerns. The company's commitment to customer service has earned them a reputation as a leader in the healthcare industry.What is the difference between Kaiser Insurance Plans and other health insurance providers?

+Kaiser Insurance Plans offer a unique approach to healthcare, combining high-quality medical services with affordable pricing and a focus on preventive care. This approach sets them apart from other health insurance providers, who may not offer the same level of comprehensive coverage and support.

How do I enroll in a Kaiser Insurance Plan?

+To enroll in a Kaiser Insurance Plan, policyholders can visit the company's website, contact a licensed insurance agent, or call the customer service number. Policyholders can browse plans, compare benefits, and apply online or over the phone.

What is the cost of Kaiser Insurance Plans?

+The cost of Kaiser Insurance Plans varies depending on the plan, policyholder age, and other factors. On average, policyholders can expect to pay between $300 and $1,000 per month for individual coverage, depending on the plan and benefits.

Can I access care from providers outside the Kaiser Insurance Plans network?

+Yes, policyholders can access care from providers outside the Kaiser Insurance Plans network. However, out-of-network care typically comes with higher costs and reduced benefits. Policyholders should carefully review their plan documents and understand the costs and benefits associated with out-of-network care before seeking treatment.

How do I contact Kaiser Insurance Plans customer service?

+Policyholders can contact Kaiser Insurance Plans customer service via phone, email, or online chat. The customer service team can help policyholders with a range of issues, including billing and payment questions, plan benefits and features, and provider network and out-of-network care.

In conclusion, Kaiser Insurance Plans offer a unique approach to healthcare, combining high-quality medical services with affordable pricing and a focus on preventive care. With a range of options available, policyholders can choose the plan that best suits their needs and budget. By understanding the benefits, working mechanisms, and key information related to Kaiser Insurance Plans, individuals can make informed decisions about their healthcare coverage. We invite you to share your thoughts and experiences with Kaiser Insurance Plans in the comments below. If you found this article helpful, please consider sharing it with others who may be interested in learning more about Kaiser Insurance Plans.