Intro

Discover Kaiser Medical Insurance Plans, offering comprehensive health coverage with affordable premiums, flexible networks, and preventive care services, including medical, dental, and vision insurance options for individuals and families.

Kaiser Permanente is one of the largest and most well-known healthcare organizations in the United States, providing a wide range of medical insurance plans to individuals, families, and groups. With a strong focus on preventive care, Kaiser Permanente has been a leader in the healthcare industry for over 70 years, offering high-quality, affordable health insurance plans to its members. In this article, we will delve into the world of Kaiser medical insurance plans, exploring their benefits, working mechanisms, and key features.

Kaiser Permanente's medical insurance plans are designed to provide comprehensive coverage to its members, including doctor visits, hospital stays, prescriptions, and other medical services. The organization's integrated care model allows members to receive seamless, coordinated care from a team of healthcare professionals, including primary care physicians, specialists, and other healthcare experts. This approach has been shown to improve health outcomes, reduce medical errors, and enhance the overall quality of care.

The importance of having a reliable medical insurance plan cannot be overstated. With the rising costs of healthcare, having a comprehensive insurance plan can provide financial protection and peace of mind, allowing individuals and families to focus on their health and well-being without worrying about the financial burden of medical expenses. Kaiser Permanente's medical insurance plans are designed to provide this protection, offering a range of plan options to suit different needs and budgets.

Kaiser Medical Insurance Plan Options

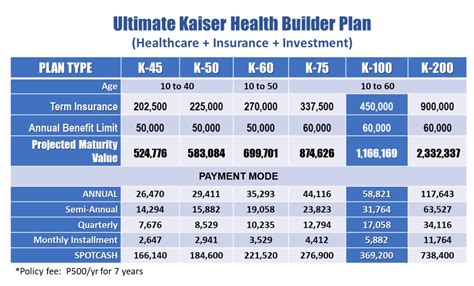

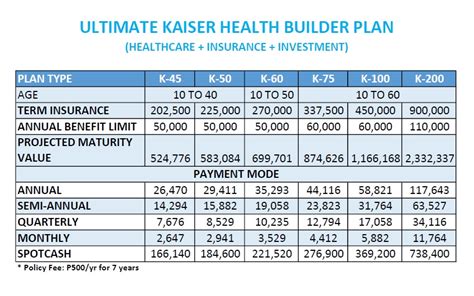

Kaiser Permanente offers a variety of medical insurance plans, including individual and family plans, group plans, and Medicare plans. These plans are designed to provide comprehensive coverage, including preventive care, diagnostic testing, treatment, and follow-up care. Kaiser Permanente's plan options include:

- Individual and family plans: These plans are designed for individuals and families who are not eligible for group coverage or prefer to purchase their own insurance.

- Group plans: These plans are designed for employers who want to provide health insurance coverage to their employees.

- Medicare plans: These plans are designed for individuals who are eligible for Medicare, including Medicare Advantage plans and Medicare Supplement plans.

Key Features of Kaiser Medical Insurance Plans

Kaiser Permanente's medical insurance plans offer a range of key features, including:- Comprehensive coverage: Kaiser Permanente's plans provide comprehensive coverage, including doctor visits, hospital stays, prescriptions, and other medical services.

- Preventive care: Kaiser Permanente's plans emphasize preventive care, including routine check-ups, screenings, and vaccinations.

- Integrated care: Kaiser Permanente's integrated care model allows members to receive seamless, coordinated care from a team of healthcare professionals.

- Affordable premiums: Kaiser Permanente's plans are designed to be affordable, with premiums that are competitive with other insurance providers.

Benefits of Kaiser Medical Insurance Plans

Kaiser Permanente's medical insurance plans offer a range of benefits, including:

- Financial protection: Kaiser Permanente's plans provide financial protection against unexpected medical expenses.

- Access to quality care: Kaiser Permanente's plans provide access to high-quality care from a team of experienced healthcare professionals.

- Preventive care: Kaiser Permanente's plans emphasize preventive care, which can help prevent illnesses and reduce the risk of chronic diseases.

- Convenience: Kaiser Permanente's plans offer convenient online tools and mobile apps, allowing members to manage their care and communicate with their healthcare team.

How Kaiser Medical Insurance Plans Work

Kaiser Permanente's medical insurance plans work by providing members with access to a network of healthcare providers, including primary care physicians, specialists, and hospitals. Members can choose from a range of plan options, including individual and family plans, group plans, and Medicare plans. Once enrolled, members can receive care from any Kaiser Permanente provider, without the need for referrals or prior authorization.Kaiser Permanente's plans also offer a range of online tools and mobile apps, allowing members to manage their care, communicate with their healthcare team, and access their medical records. These tools include:

- Online appointment scheduling: Members can schedule appointments online, 24/7.

- Secure messaging: Members can communicate with their healthcare team via secure messaging.

- Medical records: Members can access their medical records online, including test results, medications, and medical history.

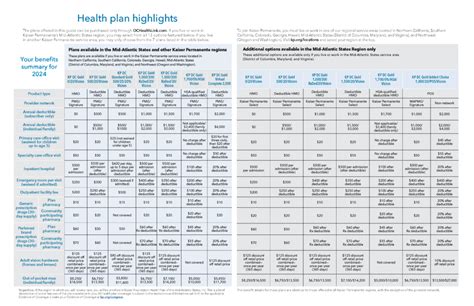

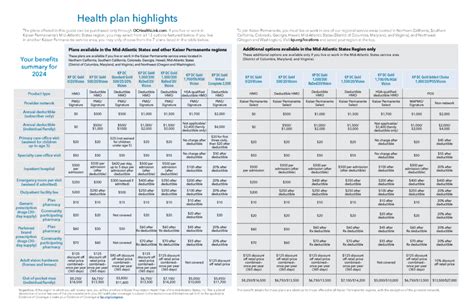

Kaiser Medical Insurance Plan Costs

The cost of Kaiser Permanente's medical insurance plans varies depending on the plan option, age, and location. Generally, Kaiser Permanente's plans are competitive with other insurance providers, with premiums that range from a few hundred to several thousand dollars per month.

To give you a better idea of the costs, here are some examples of Kaiser Permanente's plan premiums:

- Individual plans: $300-$1,000 per month

- Family plans: $800-$3,000 per month

- Group plans: $500-$2,000 per month

- Medicare plans: $0-$100 per month

It's worth noting that these are just examples, and the actual cost of Kaiser Permanente's plans may vary depending on your specific situation.

Kaiser Medical Insurance Plan Discounts

Kaiser Permanente offers a range of discounts and incentives to help make its plans more affordable. These discounts include:- Discounted premiums for individuals and families who are eligible for financial assistance.

- Discounts for groups who enroll in Kaiser Permanente's plans.

- Discounts for Medicare-eligible individuals who enroll in Kaiser Permanente's Medicare plans.

Kaiser Medical Insurance Plan Enrollment

Enrolling in Kaiser Permanente's medical insurance plans is easy and convenient. Members can enroll online, by phone, or in person at a Kaiser Permanente facility. To enroll, members will need to provide some basic information, including:

- Name and date of birth

- Social Security number

- Income information

- Family size

Once enrolled, members can begin receiving care from Kaiser Permanente's network of healthcare providers.

Kaiser Medical Insurance Plan Customer Service

Kaiser Permanente's customer service team is available to help members with any questions or concerns they may have. Members can contact customer service by phone, email, or online chat. Kaiser Permanente's customer service team can help with:- Plan questions and enrollment

- Billing and payment

- Claims and appeals

- Medical records and test results

Kaiser Medical Insurance Plan Reviews

Kaiser Permanente's medical insurance plans have received positive reviews from members and healthcare experts alike. Members praise Kaiser Permanente's plans for their comprehensive coverage, affordable premiums, and excellent customer service.

Some of the benefits of Kaiser Permanente's plans include:

- High-quality care: Kaiser Permanente's plans provide access to high-quality care from a team of experienced healthcare professionals.

- Comprehensive coverage: Kaiser Permanente's plans offer comprehensive coverage, including preventive care, diagnostic testing, treatment, and follow-up care.

- Affordable premiums: Kaiser Permanente's plans are designed to be affordable, with premiums that are competitive with other insurance providers.

However, some members have reported issues with:

- Network limitations: Kaiser Permanente's plans have a limited network of healthcare providers, which may not include all specialists or hospitals.

- Prior authorization: Kaiser Permanente's plans may require prior authorization for certain treatments or services, which can delay care.

- Customer service: Some members have reported issues with Kaiser Permanente's customer service, including long wait times and unhelpful representatives.

Kaiser Medical Insurance Plan Ratings

Kaiser Permanente's medical insurance plans have received high ratings from healthcare experts and members alike. Some of the ratings include:- 4.5 out of 5 stars from the National Committee for Quality Assurance (NCQA)

- 4.5 out of 5 stars from the Centers for Medicare and Medicaid Services (CMS)

- 4.5 out of 5 stars from the California Department of Insurance

These ratings are based on a range of factors, including:

- Quality of care: Kaiser Permanente's plans provide high-quality care from a team of experienced healthcare professionals.

- Customer service: Kaiser Permanente's customer service team is available to help members with any questions or concerns they may have.

- Affordability: Kaiser Permanente's plans are designed to be affordable, with premiums that are competitive with other insurance providers.

What is Kaiser Permanente's medical insurance plan?

+Kaiser Permanente's medical insurance plan is a comprehensive health insurance plan that provides access to a network of healthcare providers, including primary care physicians, specialists, and hospitals.

How do I enroll in Kaiser Permanente's medical insurance plan?

+To enroll in Kaiser Permanente's medical insurance plan, you can visit their website, call their customer service number, or visit a Kaiser Permanente facility in person.

What are the benefits of Kaiser Permanente's medical insurance plan?

+The benefits of Kaiser Permanente's medical insurance plan include comprehensive coverage, affordable premiums, and access to high-quality care from a team of experienced healthcare professionals.

In conclusion, Kaiser Permanente's medical insurance plans are a great option for individuals and families who are looking for comprehensive coverage, affordable premiums, and excellent customer service. With a range of plan options to choose from, including individual and family plans, group plans, and Medicare plans, Kaiser Permanente has something for everyone. Whether you're looking for preventive care, diagnostic testing, treatment, or follow-up care, Kaiser Permanente's plans have got you covered. So why not consider Kaiser Permanente for your medical insurance needs? With their high-quality care, affordable premiums, and excellent customer service, you can trust that you're in good hands.

We hope this article has provided you with a comprehensive overview of Kaiser Permanente's medical insurance plans. If you have any further questions or would like to learn more, please don't hesitate to reach out. You can also share this article with your friends and family on social media, or leave a comment below to let us know what you think. Thank you for reading!