Intro

Boost your Kaiser Permanente paycheck with 5 expert pay tips, including salary negotiation, benefits maximization, and tax optimization strategies for medical professionals, healthcare workers, and employees.

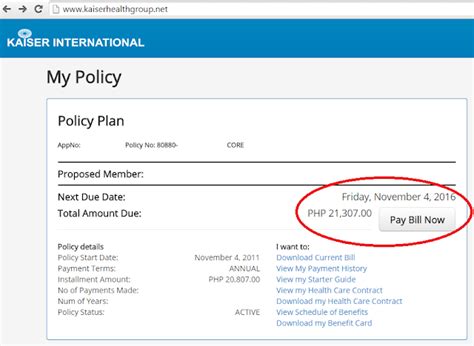

Kaiser Pay, also known as Kaiser Permanente's payroll system, is a vital part of the organization's human resources infrastructure. It is designed to manage the compensation and benefits of Kaiser Permanente's employees, ensuring that they are paid accurately and on time. With the ever-changing landscape of healthcare and employment laws, understanding the intricacies of Kaiser Pay is essential for both employees and management. In this article, we will delve into the world of Kaiser Pay, exploring its benefits, working mechanisms, and providing valuable tips for navigating the system.

The importance of understanding Kaiser Pay cannot be overstated. As a comprehensive payroll system, it encompasses a wide range of functions, from salary and benefits management to tax compliance and reporting. Employees who grasp the fundamentals of Kaiser Pay are better equipped to manage their compensation, plan their finances, and make informed decisions about their benefits. On the other hand, management and human resources personnel who are well-versed in Kaiser Pay can ensure that the organization remains compliant with relevant laws and regulations, minimizing the risk of errors and disputes.

In today's fast-paced and increasingly complex work environment, staying on top of payroll matters is crucial. Kaiser Pay is designed to streamline payroll processes, reduce administrative burdens, and enhance the overall employee experience. By leveraging the capabilities of Kaiser Pay, Kaiser Permanente aims to foster a positive and supportive work environment, where employees can focus on delivering high-quality patient care without worrying about their compensation. As we explore the features and benefits of Kaiser Pay, we will also provide actionable tips and insights to help employees and management get the most out of the system.

Kaiser Pay Overview

Key Features of Kaiser Pay

Some of the key features of Kaiser Pay include: * Automated payroll processing * Electronic pay stubs and W-2 forms * Online benefits enrollment and management * Time-off tracking and leave management * Performance monitoring and evaluation tools * Integration with other Kaiser Permanente systems, such as HR and benefits platformsKaiser Pay Tips for Employees

Benefits of Using Kaiser Pay

The benefits of using Kaiser Pay are numerous. Some of the most significant advantages include: * Convenience: Kaiser Pay provides 24/7 access to payroll information and benefits management * Accuracy: The system automates many payroll processes, reducing the risk of errors and discrepancies * Efficiency: Kaiser Pay streamlines payroll administration, freeing up HR and management staff to focus on other tasks * Transparency: The system provides employees with clear and timely information about their compensation and benefitsKaiser Pay Best Practices for Management

Common Challenges and Solutions

Some common challenges faced by employees and management when using Kaiser Pay include: * Technical issues and system downtime * Errors and discrepancies in payroll data * Difficulty navigating the system's interface and features * Insufficient training and support * Solutions to these challenges include: * Regular system maintenance and updates * Comprehensive training and support programs * Clear communication and feedback channels * Ongoing monitoring and evaluation of system performanceKaiser Pay Security and Compliance

Importance of Security and Compliance

The importance of security and compliance in payroll systems cannot be overstated. Failure to protect employee data and comply with relevant laws and regulations can result in serious consequences, including: * Financial penalties and fines * Damage to reputation and brand * Loss of employee trust and confidence * Increased risk of data breaches and cyber attacksKaiser Pay Support and Resources

Accessing Support and Resources

Accessing support and resources for Kaiser Pay is easy. Employees and management can: * Visit the Kaiser Permanente website for online tutorials and training programs * Contact the HR or payroll department for phone and email support * Refer to the user guide and documentation for comprehensive information on system features and functionality * Participate in regular training and support sessionsKaiser Pay Future Developments

Preparing for Future Developments

To prepare for future developments and enhancements, employees and management should: * Stay up-to-date with the latest Kaiser Pay updates and announcements * Participate in training and support sessions * Provide feedback and suggestions for system improvements * Stay flexible and adaptable in the face of changeKaiser Pay Conclusion and Next Steps

To take the next steps, employees and management should:

- Review the information and insights provided in this article

- Explore the Kaiser Pay portal and its various features

- Participate in training and support sessions

- Stay engaged and informed about the latest Kaiser Pay updates and announcements

We invite you to share your thoughts and experiences with Kaiser Pay in the comments section below. Your feedback and insights are invaluable in helping us improve the system and provide better support and resources. Additionally, we encourage you to share this article with your colleagues and peers, helping to spread the word about the benefits and capabilities of Kaiser Pay.

What is Kaiser Pay?

+Kaiser Pay is a comprehensive payroll system designed to manage employee compensation, benefits, and time-off tracking.

How do I access Kaiser Pay?

+You can access Kaiser Pay through the Kaiser Permanente website or by contacting the HR or payroll department for assistance.

What are the benefits of using Kaiser Pay?

+The benefits of using Kaiser Pay include convenience, accuracy, efficiency, and transparency, as well as access to comprehensive training and support resources.