Intro

Maximize efficiency with 5 Kaiser Payroll Tips, streamlining payroll management, tax compliance, and employee benefits, while minimizing errors and optimizing payroll processing, payroll reporting, and payroll services.

Managing payroll effectively is crucial for any business, as it directly impacts employee satisfaction, legal compliance, and overall financial health. Kaiser Payroll, a system designed to streamline payroll processes, offers a range of tools and features to help businesses manage their payroll efficiently. Understanding how to utilize these tools to their fullest potential can significantly benefit organizations, from reducing administrative burdens to ensuring accurate and timely payments. In this article, we will delve into five key tips for maximizing the benefits of Kaiser Payroll, exploring its capabilities, and discussing best practices for implementation.

The importance of efficient payroll management cannot be overstated. It is not only a matter of ensuring that employees are paid correctly and on time but also involves navigating complex legal and regulatory requirements. Non-compliance with these regulations can lead to severe penalties, making it essential for businesses to adopt a robust and reliable payroll system. Kaiser Payroll, with its advanced features and user-friendly interface, stands out as a valuable resource for businesses seeking to enhance their payroll management.

For businesses considering the implementation of Kaiser Payroll, or for those already utilizing the system, understanding its full range of capabilities is key to maximizing its benefits. From automated payment processing to detailed reporting and analytics, Kaiser Payroll is designed to simplify payroll management, reduce errors, and increase productivity. By leveraging these features effectively, businesses can not only improve their payroll processes but also gain valuable insights into their financial operations, enabling more informed decision-making.

Understanding Kaiser Payroll Basics

Key Features of Kaiser Payroll

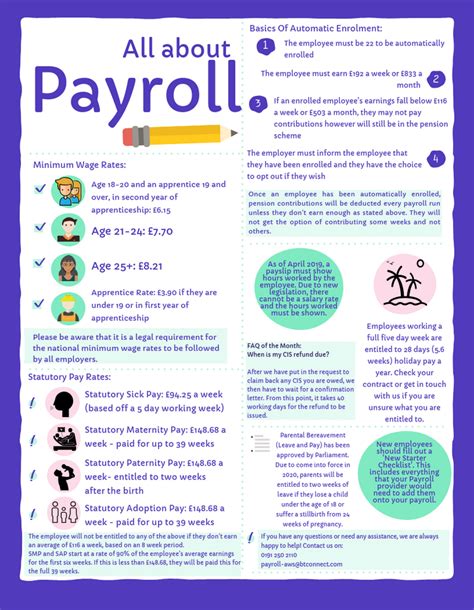

Kaiser Payroll is equipped with a variety of features designed to make payroll management more streamlined and efficient. Some of the key features include: - Automated payroll processing: This feature allows for the automatic calculation and payment of salaries, benefits, and taxes, significantly reducing the administrative burden on HR and finance teams. - Customizable reporting: The system provides the ability to generate detailed reports on payroll expenses, employee compensation, and tax compliance, offering valuable insights for financial planning and decision-making. - Integration with accounting systems: Kaiser Payroll can be integrated with existing accounting software, ensuring seamless data transfer and reducing the need for manual data entry.Implementing Kaiser Payroll Effectively

Best Practices for Kaiser Payroll Management

Adopting best practices in managing Kaiser Payroll can significantly enhance its benefits. Some key practices include: - Regularly reviewing and updating employee data to ensure accuracy and compliance. - Utilizing automated features to minimize manual intervention and reduce errors. - Leveraging reporting tools for financial analysis and planning. - Implementing robust security measures to protect sensitive payroll data.Maximizing Efficiency with Kaiser Payroll

Strategies for Streamlining Payroll Processes

Strategies for streamlining payroll processes with Kaiser Payroll include: - Automating payroll runs to ensure timely and accurate payments. - Implementing a direct deposit system to reduce check processing and enhance security. - Utilizing the system's reporting features to identify inefficiencies and areas for improvement.Troubleshooting Common Issues in Kaiser Payroll

Common Issues and Solutions

Common issues in Kaiser Payroll and potential solutions include: - Data entry errors: Regularly review and update employee data to ensure accuracy. - System downtime: Contact Kaiser Payroll support for assistance in resolving technical issues. - Compliance errors: Utilize the system's reporting features to monitor compliance and address any discrepancies promptly.Future Developments in Kaiser Payroll

Emerging Trends in Payroll Management

Emerging trends in payroll management that may influence the future of Kaiser Payroll include: - Increased use of artificial intelligence for predictive analytics and automated decision-making. - Enhanced mobile accessibility to facilitate remote payroll management. - Greater emphasis on data security and privacy compliance.Conclusion and Next Steps

For those looking to implement Kaiser Payroll or enhance their current usage, the next steps involve exploring the system's features in more detail, consulting with payroll professionals, and planning for effective integration with existing business systems. By taking these steps, businesses can position themselves for success, navigating the complexities of payroll management with confidence and precision.

What are the primary benefits of using Kaiser Payroll?

+The primary benefits include automated payroll processing, customizable reporting, and integration with accounting systems, which together enhance efficiency, accuracy, and compliance.

How can I ensure accurate and timely payments with Kaiser Payroll?

+Ensure accurate and timely payments by regularly updating employee data, leveraging automated payment features, and monitoring payroll runs through the system's reporting tools.

What kind of support does Kaiser Payroll offer for troubleshooting issues?

+Kaiser Payroll offers customer support for troubleshooting issues, including technical assistance and guidance on resolving data inaccuracies and compliance errors.

We invite you to share your experiences with Kaiser Payroll, ask questions, or suggest topics for future articles in the comments below. Your engagement is valuable to us, and we look forward to continuing the conversation on optimizing payroll management strategies.