Intro

Discover the 5 Kaiser Plans, offering comprehensive health insurance coverage with flexible options, including Medicare, Medicaid, and group plans, providing medical, dental, and vision benefits with affordable premiums and extensive networks of healthcare providers.

The importance of healthcare plans cannot be overstated, and among the various options available, Kaiser Permanente stands out as a notable provider. With a history spanning over 70 years, Kaiser Permanente has established itself as a trusted name in the healthcare industry, offering a range of plans that cater to diverse needs and budgets. In this article, we will delve into the world of Kaiser plans, exploring their benefits, working mechanisms, and the steps involved in choosing the right plan for you.

As a pioneer in the healthcare sector, Kaiser Permanente has consistently demonstrated its commitment to providing high-quality, affordable care to its members. One of the key advantages of Kaiser plans is their emphasis on preventive care, which helps to detect and manage health issues before they become severe. This proactive approach not only improves health outcomes but also reduces healthcare costs in the long run. Moreover, Kaiser Permanente's integrated care model ensures that members receive seamless, coordinated care from a team of dedicated healthcare professionals.

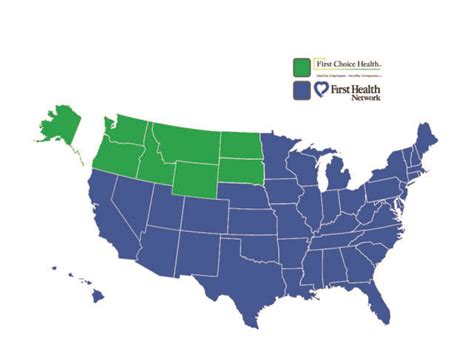

Kaiser Permanente's extensive network of hospitals, medical offices, and healthcare professionals is another significant advantage of their plans. With a vast array of services and specialists at their disposal, members can rest assured that they will receive the best possible care for their specific needs. Whether it's routine check-ups, chronic disease management, or specialized treatments, Kaiser Permanente's comprehensive range of services has got you covered. In the following sections, we will explore the different types of Kaiser plans, their benefits, and the factors to consider when selecting a plan that suits your needs.

Kaiser Permanente Plans Overview

Types of Kaiser Permanente Plans

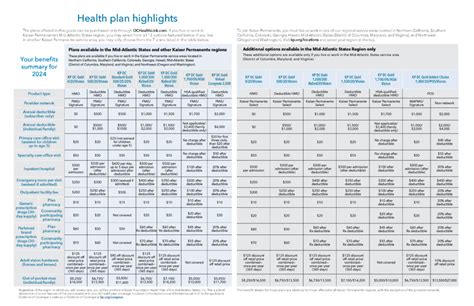

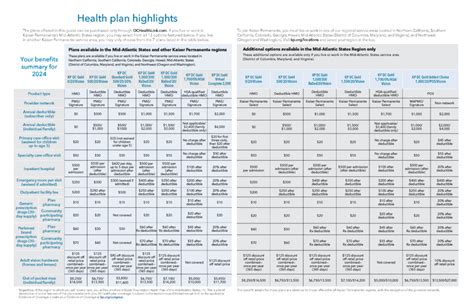

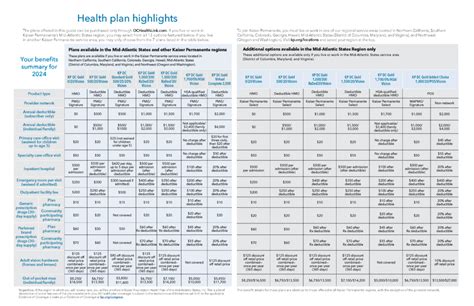

Kaiser Permanente's plan options include: * Individual and Family Plans * Group Plans * Medicare Plans * Medicaid Plans * CHIP (Children's Health Insurance Program) Plans Each of these plans has its unique features, benefits, and eligibility criteria. For example, the Kaiser Permanente Medicare Plans are designed for seniors and individuals with disabilities, offering a range of benefits, including medical, hospital, and prescription drug coverage.Benefits of Kaiser Permanente Plans

How to Choose the Right Kaiser Permanente Plan

Choosing the right Kaiser Permanente plan depends on several factors, including your budget, health needs, and personal preferences. Here are some steps to consider: 1. Assess your health needs: Consider your medical history, current health status, and any ongoing health issues. 2. Evaluate your budget: Determine how much you can afford to pay in premiums, deductibles, and out-of-pocket costs. 3. Research plan options: Explore the different types of Kaiser Permanente plans, including their benefits, features, and eligibility criteria. 4. Compare plans: Compare the different plans, considering factors such as premiums, deductibles, copays, and coinsurance. 5. Seek advice: Consult with a licensed insurance agent or broker to get personalized advice and guidance.Kaiser Permanente Plan Enrollment

Kaiser Permanente Plan Costs

The cost of Kaiser Permanente plans varies depending on several factors, including the type of plan, your age, health status, and location. Here are some estimated costs: * Individual plans: $300-$600 per month * Family plans: $800-$1,500 per month * Group plans: $500-$1,000 per month * Medicare plans: $0-$100 per month Keep in mind that these are estimated costs, and your actual premium may vary.Kaiser Permanente Plan Reviews

Kaiser Permanente Plan Ratings

Kaiser Permanente plans have received high ratings from various organizations, including: * NCQA (National Committee for Quality Assurance): 4.5/5 stars * CMS (Centers for Medicare and Medicaid Services): 4.5/5 stars * Consumer Reports: 4.5/5 stars These ratings reflect Kaiser Permanente's commitment to providing high-quality, affordable care to its members.Kaiser Permanente Plan FAQs

What is Kaiser Permanente?

+Kaiser Permanente is a healthcare organization that provides medical, dental, and vision coverage to its members.

What types of plans does Kaiser Permanente offer?

+Kaiser Permanente offers a range of plans, including individual, family, group, Medicare, and Medicaid plans.

How do I enroll in a Kaiser Permanente plan?

+You can enroll in a Kaiser Permanente plan online, by phone, or in person. Visit the Kaiser Permanente website or contact a licensed insurance agent for more information.

In