Intro

Explore Kaiser Permanente health insurance plans, offering affordable medical coverage, preventive care, and managed healthcare solutions with flexible options, network providers, and quality care services.

The healthcare landscape in the United States is complex and ever-evolving, with numerous options available for individuals and families seeking comprehensive health insurance coverage. Among the array of health insurance providers, Kaiser Permanente stands out as a prominent and integrated healthcare system, offering a wide range of health insurance plans designed to cater to diverse needs and budgets. Understanding the nuances of Kaiser Permanente health insurance plans is crucial for making informed decisions about healthcare coverage.

Navigating the world of health insurance can be daunting, given the myriad of options, terms, and conditions associated with each plan. However, for those seeking high-quality, integrated care that combines health insurance with medical care and health education, Kaiser Permanente is a name that resonates with excellence and reliability. With a history spanning over seven decades, Kaiser Permanente has established itself as a leader in healthcare, emphasizing preventive care, cutting-edge medical technology, and patient-centered service.

The significance of choosing the right health insurance plan cannot be overstated. A plan that aligns with an individual's or family's health needs, financial situation, and lifestyle can provide peace of mind, protect against financial ruin in the event of medical emergencies, and ensure access to necessary healthcare services. Kaiser Permanente's approach to healthcare, which integrates insurance, medical care, and health education, positions it uniquely to offer comprehensive and coordinated care that addresses the whole person - body, mind, and spirit.

Kaiser Permanente Overview

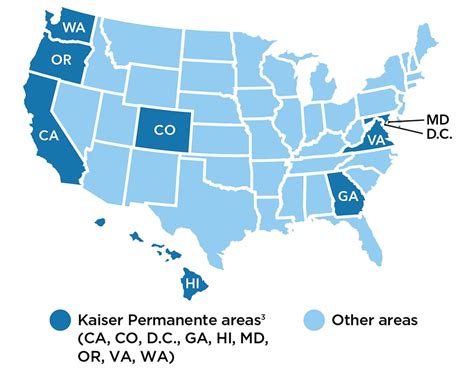

Kaiser Permanente's history dates back to the 1930s, when Henry J. Kaiser and Dr. Sidney Garfield pioneered a new approach to healthcare during the construction of the Grand Coulee Dam. This innovative approach focused on preventive care and wellness, aiming to keep workers healthy and productive. Today, Kaiser Permanente is one of the largest nonprofit healthcare plans in the United States, serving over 12 million members across eight states and the District of Columbia.

Key Features of Kaiser Permanente Health Insurance Plans

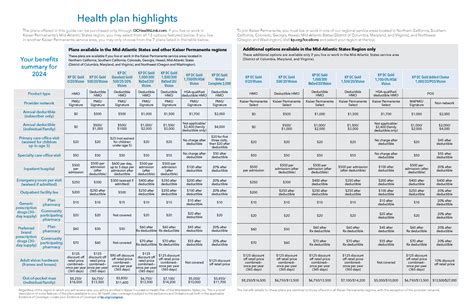

Kaiser Permanente offers a variety of health insurance plans tailored to meet the diverse needs of its members. These plans are designed to provide comprehensive coverage, including preventive care, hospital stays, prescriptions, and more. A key feature of Kaiser Permanente's approach is its emphasis on integrated care, where insurance, medical care, and health education are coordinated to provide seamless and high-quality service.Types of Health Insurance Plans Offered by Kaiser Permanente

Kaiser Permanente offers a range of health insurance plans, including but not limited to:

- Individual and Family Plans: Designed for individuals and families who are not covered by employer-sponsored health insurance.

- Group Plans: Suitable for businesses of all sizes, offering comprehensive coverage to employees.

- Medicare Plans: For seniors and individuals with disabilities, providing coverage that complements Medicare benefits.

- Medicaid Plans: For low-income individuals and families, offering essential health benefits.

Benefits of Choosing Kaiser Permanente Health Insurance Plans

The benefits of selecting Kaiser Permanente for health insurance are multifaceted. Members enjoy access to a large network of healthcare providers, state-of-the-art medical facilities, and a wide range of health and wellness programs. Additionally, Kaiser Permanente's focus on preventive care and early intervention can lead to better health outcomes and lower healthcare costs over time.How to Choose the Right Kaiser Permanente Health Insurance Plan

Selecting the right health insurance plan involves careful consideration of several factors, including:

- Health Needs: Assessing the health needs of yourself and your family, including any chronic conditions or anticipated medical expenses.

- Budget: Evaluating the premium costs, deductibles, copays, and coinsurance associated with each plan.

- Network: Considering the network of healthcare providers and medical facilities included in the plan.

- Additional Benefits: Looking into any additional benefits or services offered, such as dental, vision, or wellness programs.

Steps to Enroll in a Kaiser Permanente Health Insurance Plan

Enrolling in a Kaiser Permanente health insurance plan can be straightforward, especially with the guidance of a licensed agent or through the online marketplace. The process typically involves: 1. **Researching Plans:** Comparing the different plans offered by Kaiser Permanente to find the one that best fits your needs and budget. 2. **Checking Eligibility:** Ensuring you are eligible for the plan you are interested in, considering factors like age, income, and residency. 3. **Applying:** Submitting an application, which can often be done online or by phone, and providing required documentation. 4. **Payment:** Setting up payment for your premiums, which can usually be done through various payment methods.Kaiser Permanente's Approach to Healthcare

Kaiser Permanente is renowned for its patient-centered approach to healthcare, emphasizing preventive care, early intervention, and the use of advanced technology to improve health outcomes. This approach is built on a foundation of:

- Preventive Care: Encouraging regular check-ups, screenings, and vaccinations to prevent illnesses.

- Coordinated Care: Ensuring that all aspects of a patient's care are well-coordinated, from primary care to specialty services.

- Health Education: Providing patients with the information and tools they need to manage their health effectively.

Technology and Innovation in Kaiser Permanente

Kaiser Permanente has been at the forefront of leveraging technology and innovation to enhance patient care and experience. This includes: - **Telehealth Services:** Offering virtual visits and consultations to expand access to care. - **Personalized Medicine:** Using genetic information and other data to tailor treatments to individual needs. - **Electronic Health Records:** Utilizing digital records to streamline care coordination and improve patient safety.Kaiser Permanente's Community Involvement

Beyond providing healthcare services, Kaiser Permanente is committed to improving the health and well-being of the communities it serves. This commitment is reflected in its:

- Community Benefit Programs: Investing in programs that address social determinants of health, such as housing, education, and economic opportunity.

- Charitable Giving: Supporting local charities and organizations that share its mission of improving health outcomes.

- Health Education and Outreach: Offering health education programs and outreach services to promote healthy lifestyles and disease prevention.

Addressing Healthcare Disparities

Kaiser Permanente recognizes the importance of addressing healthcare disparities and ensuring that all individuals, regardless of their background or socioeconomic status, have access to high-quality healthcare. Efforts to address disparities include: - **Culturally Competent Care:** Providing care that respects and responds to the cultural and linguistic needs of diverse patient populations. - **Language Access Services:** Offering interpretation and translation services to ensure that language barriers do not impede access to care. - **Community Partnerships:** Collaborating with community organizations to develop targeted interventions and programs that address specific health disparities.Conclusion and Next Steps

In conclusion, Kaiser Permanente health insurance plans offer a comprehensive and integrated approach to healthcare, emphasizing preventive care, coordinated service, and patient-centeredness. Whether you are an individual, family, or business, selecting the right health insurance plan is a critical decision that can significantly impact your health and financial well-being. By understanding the benefits, features, and enrollment process of Kaiser Permanente's plans, you can make an informed choice that aligns with your needs and priorities.

We invite you to share your thoughts and experiences with Kaiser Permanente health insurance plans in the comments below. Your insights can help others navigate the complex world of health insurance and make informed decisions about their healthcare coverage. Additionally, if you found this article informative and helpful, please consider sharing it with your network to spread awareness about the importance of choosing the right health insurance plan.

What is Kaiser Permanente, and how does it differ from other health insurance providers?

+Kaiser Permanente is a nonprofit healthcare organization that offers integrated health insurance plans, medical care, and health education. It differs from other providers by its emphasis on preventive care, coordinated service, and patient-centered approach.

How do I choose the right Kaiser Permanente health insurance plan for my needs?

+To choose the right plan, consider your health needs, budget, and lifestyle. Research the different plans offered by Kaiser Permanente, compare their benefits and costs, and seek advice from a licensed agent if needed.

Can I enroll in a Kaiser Permanente health insurance plan at any time, or are there specific enrollment periods?

+Enrollment in Kaiser Permanente health insurance plans is typically available during the annual open enrollment period, though special enrollment periods may be available for individuals experiencing qualifying life events, such as marriage, divorce, or the birth of a child.