Intro

Discover Kaiser Permanente Medicare Plans, including Advantage, Supplement, and Part D options, offering comprehensive coverage, affordable premiums, and quality healthcare services for seniors and retirees, with flexible benefits and network providers.

As the US population ages, the demand for comprehensive and affordable healthcare plans continues to rise. Medicare, a federal health insurance program, has been a cornerstone of healthcare for seniors and individuals with disabilities. However, navigating the complexities of Medicare can be daunting, and many individuals seek additional coverage to supplement their benefits. This is where Kaiser Permanente Medicare plans come into play, offering a range of options to enhance healthcare coverage. In this article, we will delve into the world of Kaiser Permanente Medicare plans, exploring their benefits, working mechanisms, and key information to help readers make informed decisions about their healthcare.

The importance of Medicare plans cannot be overstated, as they provide essential healthcare coverage for millions of Americans. Kaiser Permanente, a renowned healthcare organization, has been a trusted partner in providing high-quality care to its members. By combining the strengths of Medicare with the expertise of Kaiser Permanente, individuals can enjoy comprehensive coverage, improved health outcomes, and enhanced overall well-being. As we explore the intricacies of Kaiser Permanente Medicare plans, readers will gain a deeper understanding of the options available and how to choose the best plan for their unique needs.

Kaiser Permanente has a long history of providing innovative and patient-centered care, and their Medicare plans are no exception. With a focus on preventive care, disease management, and coordinated treatment, Kaiser Permanente Medicare plans aim to improve health outcomes, reduce healthcare costs, and enhance the overall quality of life for its members. By leveraging the organization's extensive network of healthcare professionals, state-of-the-art facilities, and cutting-edge technology, individuals can enjoy seamless care, personalized attention, and unparalleled support. As we navigate the complexities of Kaiser Permanente Medicare plans, readers will discover the numerous benefits, advantages, and features that set these plans apart from others in the market.

Kaiser Permanente Medicare Plan Options

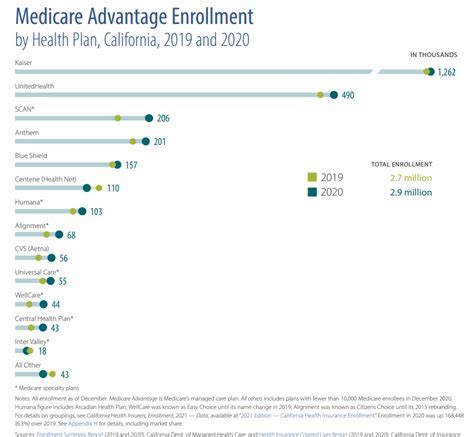

Kaiser Permanente offers a range of Medicare plan options, each designed to cater to the unique needs and preferences of its members. These plans include Medicare Advantage plans, Medicare Supplement Insurance plans, and stand-alone prescription drug plans. Medicare Advantage plans, also known as Part C, combine the benefits of Medicare Parts A and B, often with additional coverage for dental, vision, and hearing services. Medicare Supplement Insurance plans, also known as Medigap, help fill the gaps in Original Medicare coverage, reducing out-of-pocket expenses for copayments, coinsurance, and deductibles. Stand-alone prescription drug plans, also known as Part D, provide coverage for prescription medications, helping individuals manage their medication costs and improve their overall health.

Medicare Advantage Plans

Medicare Advantage plans offered by Kaiser Permanente provide comprehensive coverage, including hospital stays, doctor visits, and preventive care services. These plans often include additional benefits, such as fitness programs, health education classes, and disease management services. With a focus on coordinated care, Kaiser Permanente's Medicare Advantage plans aim to improve health outcomes, reduce healthcare costs, and enhance the overall quality of life for its members. Some of the key features of Kaiser Permanente's Medicare Advantage plans include: * Comprehensive coverage for hospital stays, doctor visits, and preventive care services * Additional benefits, such as fitness programs, health education classes, and disease management services * Coordinated care through a network of healthcare professionals and facilities * Personalized attention and support from dedicated healthcare teamsKaiser Permanente Medicare Plan Benefits

Kaiser Permanente Medicare plans offer a range of benefits, including comprehensive coverage, coordinated care, and personalized attention. Some of the key benefits of these plans include:

- Comprehensive coverage for hospital stays, doctor visits, and preventive care services

- Coordinated care through a network of healthcare professionals and facilities

- Personalized attention and support from dedicated healthcare teams

- Additional benefits, such as fitness programs, health education classes, and disease management services

- Access to state-of-the-art facilities and cutting-edge technology

- Improved health outcomes and reduced healthcare costs

Coordinated Care

Coordinated care is a hallmark of Kaiser Permanente's Medicare plans, with a focus on seamless communication, collaboration, and care coordination among healthcare professionals. This approach helps to ensure that individuals receive the right care, at the right time, and in the right setting. With a team of dedicated healthcare professionals, including primary care physicians, specialists, and care coordinators, Kaiser Permanente's Medicare plans provide personalized attention and support to its members. Some of the key features of coordinated care include: * Seamless communication and collaboration among healthcare professionals * Care coordination to ensure that individuals receive the right care, at the right time, and in the right setting * Personalized attention and support from dedicated healthcare teams * Access to a network of healthcare professionals and facilitiesKaiser Permanente Medicare Plan Enrollment

Enrolling in a Kaiser Permanente Medicare plan is a straightforward process, with several options available to individuals. These options include:

- Online enrollment through the Kaiser Permanente website

- Phone enrollment by calling the Kaiser Permanente customer service department

- In-person enrollment at a Kaiser Permanente facility or office

- Mail-in enrollment by completing and submitting a paper application To enroll in a Kaiser Permanente Medicare plan, individuals must meet certain eligibility requirements, including:

- Being 65 or older

- Being a US citizen or permanent resident

- Living in the Kaiser Permanente service area

- Having Medicare Part A and Part B coverage

Eligibility Requirements

Eligibility requirements for Kaiser Permanente Medicare plans vary depending on the specific plan and the individual's circumstances. However, in general, individuals must meet the following requirements: * Be 65 or older * Be a US citizen or permanent resident * Live in the Kaiser Permanente service area * Have Medicare Part A and Part B coverage * Not have End-Stage Renal Disease (ESRD), unless they are eligible for a Special Needs Plan (SNP)Kaiser Permanente Medicare Plan Costs

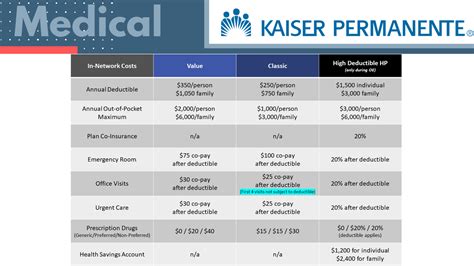

The costs associated with Kaiser Permanente Medicare plans vary depending on the specific plan, the individual's circumstances, and the level of coverage chosen. These costs may include:

- Monthly premiums

- Copayments and coinsurance for doctor visits, hospital stays, and prescription medications

- Deductibles for medical services and prescription medications

- Out-of-pocket expenses for non-covered services and supplies To help individuals manage their healthcare costs, Kaiser Permanente offers a range of tools and resources, including:

- Online cost estimators and calculators

- Personalized cost assessments and counseling

- Financial assistance programs and discounts

- Medicare Savings Programs (MSPs) and Low-Income Subsidies (LIS)

Financial Assistance Programs

Kaiser Permanente offers a range of financial assistance programs to help individuals manage their healthcare costs. These programs include: * Medicare Savings Programs (MSPs) * Low-Income Subsidies (LIS) * Financial assistance programs and discounts * Sliding fee scale programs These programs can help individuals reduce their out-of-pocket expenses, improve their access to healthcare services, and enhance their overall quality of life.Kaiser Permanente Medicare Plan Reviews

Kaiser Permanente Medicare plans have received high ratings and reviews from satisfied members. These reviews highlight the plans' comprehensive coverage, coordinated care, and personalized attention. Some of the key benefits and features mentioned in these reviews include:

- Comprehensive coverage for hospital stays, doctor visits, and preventive care services

- Coordinated care through a network of healthcare professionals and facilities

- Personalized attention and support from dedicated healthcare teams

- Additional benefits, such as fitness programs, health education classes, and disease management services

- Access to state-of-the-art facilities and cutting-edge technology

Member Testimonials

Kaiser Permanente Medicare plan members have shared their positive experiences and testimonials, highlighting the plans' benefits and features. Some of these testimonials include: * "I have been a Kaiser Permanente member for over 10 years, and I have always been satisfied with the care and attention I receive." * "The coordinated care and personalized attention I receive from my healthcare team have been invaluable in managing my chronic conditions." * "I appreciate the additional benefits, such as fitness programs and health education classes, which have helped me improve my overall health and well-being."Kaiser Permanente Medicare Plan FAQs

Here are some frequently asked questions and answers about Kaiser Permanente Medicare plans:

What are the eligibility requirements for Kaiser Permanente Medicare plans?

+To be eligible for a Kaiser Permanente Medicare plan, you must be 65 or older, a US citizen or permanent resident, live in the Kaiser Permanente service area, and have Medicare Part A and Part B coverage.

What are the costs associated with Kaiser Permanente Medicare plans?

+The costs associated with Kaiser Permanente Medicare plans vary depending on the specific plan, the individual's circumstances, and the level of coverage chosen. These costs may include monthly premiums, copayments and coinsurance, deductibles, and out-of-pocket expenses.

What are the benefits of coordinated care in Kaiser Permanente Medicare plans?

+Coordinated care in Kaiser Permanente Medicare plans provides seamless communication, collaboration, and care coordination among healthcare professionals, ensuring that individuals receive the right care, at the right time, and in the right setting.

In conclusion, Kaiser Permanente Medicare plans offer a range of benefits, advantages, and features that set them apart from other Medicare plans. With comprehensive coverage, coordinated care, and personalized attention, these plans can help individuals improve their health outcomes, reduce healthcare costs, and enhance their overall quality of life. We invite readers to share their thoughts, ask questions, and explore the various options available to them. By working together, we can help ensure that everyone has access to high-quality, affordable healthcare, and can live their lives to the fullest.