Intro

Discover the factors affecting Medical Insurance Cost, including premiums, deductibles, and copays, to make informed decisions about your healthcare coverage and reduce out-of-pocket expenses.

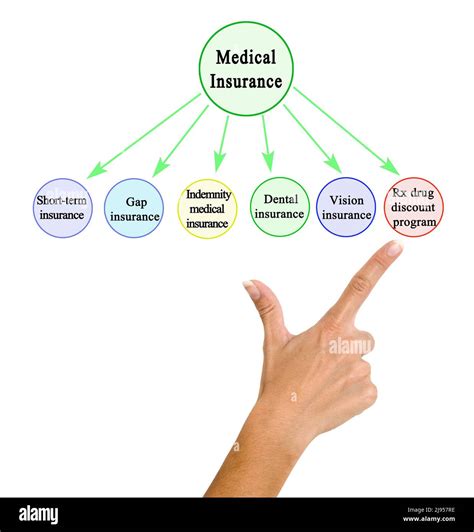

The cost of medical insurance is a significant concern for individuals and families around the world. With the rising costs of healthcare, having adequate medical insurance coverage is essential to protect against financial ruin in the event of a medical emergency. However, the cost of medical insurance premiums can be prohibitively expensive, making it difficult for many people to afford. In this article, we will explore the factors that affect medical insurance costs, the different types of medical insurance available, and strategies for reducing medical insurance costs.

The cost of medical insurance is influenced by a variety of factors, including age, health status, lifestyle, and location. For example, older adults and those with pre-existing medical conditions tend to pay higher premiums due to their increased risk of requiring medical care. Additionally, people who engage in high-risk behaviors, such as smoking or extreme sports, may also face higher premiums. The cost of medical insurance also varies by location, with premiums tend to be higher in areas with higher costs of living and higher healthcare costs.

The importance of having medical insurance cannot be overstated. Without adequate coverage, individuals and families may be forced to pay out-of-pocket for medical expenses, which can quickly become overwhelming. In fact, medical debt is a leading cause of bankruptcy in many countries. Furthermore, having medical insurance can provide peace of mind and financial security, allowing individuals to focus on their health and well-being rather than worrying about the cost of medical care.

Understanding Medical Insurance Costs

Factors Affecting Medical Insurance Costs

There are several factors that can affect the cost of medical insurance, including: * Age: Older adults tend to pay higher premiums due to their increased risk of requiring medical care. * Health status: Individuals with pre-existing medical conditions or chronic illnesses may face higher premiums. * Lifestyle: People who engage in high-risk behaviors, such as smoking or extreme sports, may face higher premiums. * Location: The cost of medical insurance varies by location, with premiums tend to be higher in areas with higher costs of living and higher healthcare costs. * Employer-sponsored coverage: Individuals who receive medical insurance through their employer may pay lower premiums due to the group rate.Types of Medical Insurance

Benefits of Medical Insurance

Medical insurance provides several benefits, including: * Financial protection: Medical insurance can help protect against financial ruin in the event of a medical emergency. * Access to care: Medical insurance can provide access to necessary medical care, including doctor visits, hospital stays, and prescription medications. * Preventive care: Many medical insurance plans cover preventive care services, such as routine check-ups and screenings. * Peace of mind: Having medical insurance can provide peace of mind and financial security, allowing individuals to focus on their health and well-being.Strategies for Reducing Medical Insurance Costs

HSAs and Medical Insurance

An HSA is a type of savings account that allows individuals to set aside pre-tax dollars for medical expenses. To be eligible for an HSA, an individual must have a high-deductible health plan (HDHP). The funds in an HSA can be used to pay for qualified medical expenses, including doctor visits, hospital stays, and prescription medications. HSAs offer several benefits, including: * Tax advantages: Contributions to an HSA are tax-deductible, and the funds grow tax-free. * Portability: HSAs are portable, meaning that the funds can be taken with the individual if they change jobs or retire. * Flexibility: HSAs can be used to pay for a wide range of medical expenses, including preventive care services.Medical Insurance and Healthcare Reform

Impact of Healthcare Reform on Medical Insurance Costs

The ACA has had a significant impact on medical insurance costs, including: * Increased access to care: The ACA has increased access to medical insurance for millions of Americans, including low-income individuals and families. * Reduced costs: The ACA has reduced healthcare costs for many individuals and families, including those with pre-existing medical conditions. * Improved quality of care: The ACA has introduced several provisions to improve the quality of care, including incentives for preventive care and patient-centered care.Conclusion and Next Steps

We invite you to share your thoughts and experiences with medical insurance costs in the comments below. Have you found ways to reduce your medical insurance costs? What challenges have you faced in accessing affordable healthcare? Your feedback and insights can help others navigate the complex world of medical insurance.

What is the average cost of medical insurance in the US?

+The average cost of medical insurance in the US varies depending on several factors, including age, health status, and location. However, according to recent data, the average monthly premium for an individual health insurance plan is around $400.

How can I reduce my medical insurance costs?

+There are several ways to reduce medical insurance costs, including shopping around, choosing a higher deductible, and taking advantage of discounts or incentives for healthy behaviors. Additionally, considering a health savings account (HSA) can provide a tax-advantaged way to save for medical expenses.

What is the difference between a high-deductible health plan (HDHP) and a traditional health insurance plan?

+A high-deductible health plan (HDHP) has a higher deductible than a traditional health insurance plan, but often offers lower premiums. HDHPs are designed to be paired with a health savings account (HSA), which allows individuals to set aside pre-tax dollars for medical expenses.