Intro

Explore medical insurance options, including health plans, coverage types, and provider networks, to find affordable and comprehensive healthcare solutions, comparing benefits, deductibles, and premiums.

The world of medical insurance can be overwhelming, with numerous options available to individuals, families, and businesses. Having the right medical insurance coverage is crucial for protecting one's health and financial well-being. With the rising costs of healthcare, it's essential to understand the various medical insurance options and choose the one that best suits your needs. In this article, we will delve into the different types of medical insurance, their benefits, and how to select the most suitable option for yourself or your loved ones.

Medical insurance is a vital aspect of healthcare, providing financial protection against unexpected medical expenses. It helps individuals and families access quality healthcare services without breaking the bank. With so many medical insurance options available, it's crucial to educate oneself on the different types of plans, their coverage, and limitations. By doing so, you can make informed decisions and select the most suitable medical insurance option for your specific needs. Whether you're an individual, family, or business owner, having the right medical insurance coverage can provide peace of mind and financial security.

The importance of medical insurance cannot be overstated. It not only provides financial protection but also ensures that you receive timely and quality medical care. Without medical insurance, individuals may delay seeking medical attention, which can lead to more severe health complications and higher medical bills. Moreover, medical insurance can help prevent financial ruin due to unexpected medical expenses. According to a recent study, medical bills are a leading cause of bankruptcy in many countries. By having the right medical insurance coverage, you can avoid such financial pitfalls and focus on recovering from illnesses or injuries.

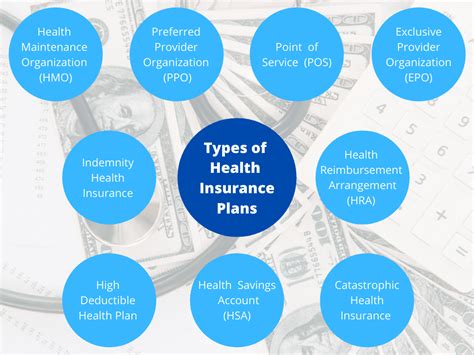

Types of Medical Insurance

There are several types of medical insurance options available, each with its unique features, benefits, and limitations. Some of the most common types of medical insurance include:

- Individual and Family Plans: These plans are designed for individuals and families who are not covered by their employers. They offer a range of coverage options, from basic to comprehensive, and can be customized to suit specific needs.

- Group Plans: These plans are designed for businesses and organizations, providing coverage for employees and their families. Group plans often offer more comprehensive coverage and lower premiums compared to individual plans.

- Medicare and Medicaid: These are government-sponsored programs that provide medical coverage for seniors, people with disabilities, and low-income individuals and families.

- Short-Term Plans: These plans provide temporary medical coverage for individuals and families, often used to bridge gaps between jobs or during times of transition.

Benefits of Medical Insurance

Medical insurance offers numerous benefits, including:- Financial Protection: Medical insurance provides financial protection against unexpected medical expenses, preventing financial ruin and bankruptcy.

- Access to Quality Care: Medical insurance enables individuals and families to access quality healthcare services, including specialist care, hospitalization, and prescription medications.

- Preventive Care: Many medical insurance plans cover preventive care services, such as routine check-ups, screenings, and vaccinations, promoting early detection and prevention of illnesses.

- Peace of Mind: Medical insurance provides peace of mind, knowing that you and your loved ones are protected against unexpected medical expenses and can access quality healthcare services when needed.

How to Choose the Right Medical Insurance Option

Choosing the right medical insurance option can be daunting, but by considering the following factors, you can make an informed decision:

- Assess Your Needs: Evaluate your health needs, including any pre-existing conditions, and consider the type of coverage you require.

- Compare Plans: Research and compare different medical insurance plans, considering factors such as premiums, deductibles, copays, and coverage limits.

- Check Network Providers: Ensure that your healthcare providers are part of the insurance network, as out-of-network care can be expensive.

- Read Reviews and Ratings: Research the insurance company's reputation, reading reviews and ratings from current and former policyholders.

Medical Insurance Costs and Affordability

Medical insurance costs can vary significantly, depending on factors such as age, health, and coverage options. To make medical insurance more affordable, consider the following:- Subsidies and Tax Credits: Eligible individuals and families may qualify for subsidies and tax credits, reducing premium costs.

- Cost-Sharing Reductions: Some plans offer cost-sharing reductions, lowering out-of-pocket expenses for deductibles, copays, and coinsurance.

- Catastrophic Plans: These plans offer lower premiums but higher deductibles, suitable for individuals and families who are healthy and unlikely to require extensive medical care.

Medical Insurance and Pre-Existing Conditions

Pre-existing conditions can impact medical insurance coverage and costs. Under the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. However, some plans may still impose limitations or exclusions on pre-existing conditions.

- Guaranteed Issue: The ACA requires insurance companies to offer guaranteed issue, ensuring that individuals with pre-existing conditions can purchase medical insurance.

- Pre-Existing Condition Exclusions: Some plans may impose pre-existing condition exclusions, limiting or excluding coverage for specific conditions.

- Rider or Exclusion: Insurance companies may offer a rider or exclusion for pre-existing conditions, providing limited coverage or higher premiums.

Medical Insurance and Mental Health

Medical insurance often covers mental health services, including:- Outpatient Services: Coverage for outpatient services, such as therapy sessions and counseling.

- Inpatient Services: Coverage for inpatient services, including hospitalization and residential treatment.

- Prescription Medications: Coverage for prescription medications, including antidepressants and antipsychotics.

Medical Insurance and Chronic Conditions

Medical insurance can help manage chronic conditions, such as diabetes, heart disease, and asthma. Many plans offer:

- Disease Management Programs: Programs that help individuals manage chronic conditions, including education, support, and monitoring.

- Prescription Medications: Coverage for prescription medications, including those used to manage chronic conditions.

- Preventive Care: Coverage for preventive care services, such as screenings and vaccinations, to prevent complications and exacerbations.

Medical Insurance and Alternative Therapies

Some medical insurance plans cover alternative therapies, including:- Acupuncture: Coverage for acupuncture services, often used to manage pain and other conditions.

- Chiropractic Care: Coverage for chiropractic care, including spinal manipulation and other services.

- Massage Therapy: Coverage for massage therapy, often used to manage pain, stress, and other conditions.

Medical Insurance and International Travel

When traveling internationally, it's essential to consider medical insurance coverage. Some plans offer:

- International Coverage: Coverage for medical expenses incurred while traveling abroad.

- Travel Insurance: Separate travel insurance policies that provide medical coverage, trip cancellations, and other benefits.

- Emergency Evacuation: Coverage for emergency evacuation services, including transportation to a hospital or medical facility.

What is the difference between individual and group medical insurance plans?

+Individual plans are designed for individuals and families, while group plans are designed for businesses and organizations. Group plans often offer more comprehensive coverage and lower premiums.

Can I purchase medical insurance if I have a pre-existing condition?

+Yes, under the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. However, some plans may still impose limitations or exclusions.

What is the difference between Medicare and Medicaid?

+Medicare is a federal program that provides medical coverage for seniors and people with disabilities, while Medicaid is a joint federal-state program that provides medical coverage for low-income individuals and families.

In conclusion, medical insurance is a vital aspect of healthcare, providing financial protection and access to quality care. With numerous options available, it's essential to understand the different types of medical insurance, their benefits, and limitations. By considering your needs, comparing plans, and reading reviews, you can make an informed decision and select the most suitable medical insurance option for yourself or your loved ones. Remember to review and update your medical insurance coverage regularly to ensure it continues to meet your changing needs. We invite you to share your thoughts and experiences with medical insurance in the comments below, and don't forget to share this article with others who may benefit from this information.