Intro

Discover affordable Medical Insurance in MN, including individual and family plans, Medicare, and group health insurance options, to ensure comprehensive coverage and financial protection for Minnesota residents.

The importance of having medical insurance cannot be overstated, especially in a state like Minnesota where the cost of healthcare can be quite high. With the rising costs of medical care, it's essential for individuals and families to have a reliable safety net to fall back on in case of unexpected medical expenses. Medical insurance in MN provides financial protection against medical expenses, ensuring that individuals can receive the care they need without breaking the bank. In this article, we'll delve into the world of medical insurance in Minnesota, exploring the various options available, the benefits of having coverage, and what to expect when shopping for a plan.

Minnesota has a reputation for being a leader in healthcare, with some of the best hospitals and medical facilities in the country. However, this high level of care comes at a cost, and without medical insurance, individuals may find themselves struggling to pay for even routine medical expenses. That's why it's crucial for residents of Minnesota to understand their options when it comes to medical insurance, including the different types of plans available, the benefits of each, and how to choose the right plan for their needs. Whether you're an individual, family, or business owner, having medical insurance in MN can provide peace of mind and financial security in the face of unexpected medical expenses.

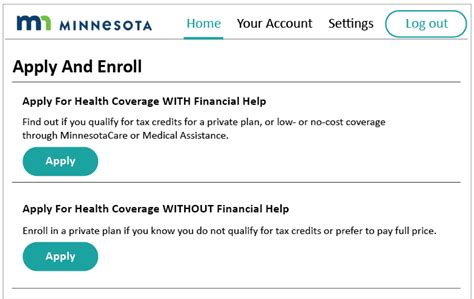

The state of Minnesota has implemented various initiatives to make medical insurance more accessible and affordable for its residents. For example, the Minnesota Health Insurance Marketplace, also known as MNsure, provides a platform for individuals and families to compare and purchase medical insurance plans from various providers. Additionally, the state has expanded Medicaid coverage to include more low-income individuals and families, ensuring that those who need it most have access to affordable healthcare. With so many options available, it's essential to understand the ins and outs of medical insurance in MN to make informed decisions about your healthcare.

Types of Medical Insurance in MN

When it comes to medical insurance in MN, there are several types of plans to choose from, each with its own unique benefits and drawbacks. Some of the most common types of medical insurance plans include:

- HMO (Health Maintenance Organization) plans: These plans require individuals to receive medical care from a specific network of providers, with the exception of emergency situations. HMO plans often have lower premiums but may have more restrictive provider networks.

- PPO (Preferred Provider Organization) plans: These plans offer more flexibility than HMO plans, allowing individuals to receive care from both in-network and out-of-network providers. PPO plans often have higher premiums but provide more freedom of choice.

- EPO (Exclusive Provider Organization) plans: These plans are similar to HMO plans but may offer more flexibility in terms of provider choice. EPO plans often have lower premiums than PPO plans but may have more restrictive provider networks.

- POS (Point of Service) plans: These plans combine elements of HMO and PPO plans, allowing individuals to choose between in-network and out-of-network care at the point of service.

Benefits of Medical Insurance in MN

Having medical insurance in MN provides numerous benefits, including:

- Financial protection: Medical insurance helps protect individuals and families from unexpected medical expenses, ensuring that they can receive the care they need without going into debt.

- Access to preventive care: Many medical insurance plans cover routine preventive care, such as check-ups, vaccinations, and screenings, helping to prevent illnesses and detect health problems early.

- Improved health outcomes: Studies have shown that individuals with medical insurance tend to have better health outcomes, as they are more likely to receive timely and effective treatment for medical conditions.

- Reduced stress and anxiety: Having medical insurance can provide peace of mind, reducing stress and anxiety related to unexpected medical expenses.

How to Choose the Right Medical Insurance Plan in MN

With so many medical insurance plans available in MN, it can be overwhelming to choose the right one. Here are some tips to help you make an informed decision:

- Assess your needs: Consider your age, health status, and medical needs when choosing a plan. If you have a pre-existing condition, you may want to choose a plan with more comprehensive coverage.

- Compare plans: Research and compare different medical insurance plans, considering factors such as premiums, deductibles, copays, and provider networks.

- Check provider networks: Make sure your primary care physician and any specialists you see are part of the plan's provider network.

- Consider additional benefits: Some plans may offer additional benefits, such as dental or vision coverage, that may be important to you.

Minnesota Health Insurance Marketplace (MNsure)

The Minnesota Health Insurance Marketplace, also known as MNsure, is a platform that allows individuals and families to compare and purchase medical insurance plans from various providers. MNsure offers a range of plans, including those from private insurers and public programs such as Medicaid and MinnesotaCare. To be eligible for MNsure, individuals must meet certain income requirements and be a resident of Minnesota.

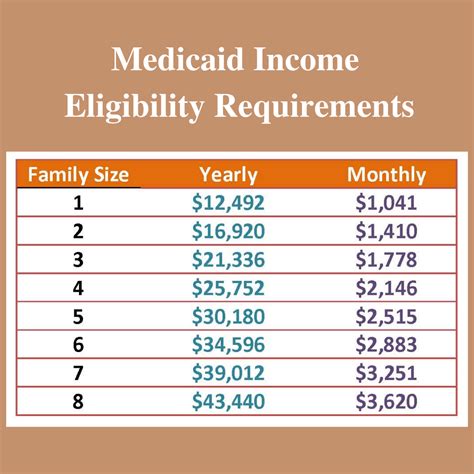

Medicaid and MinnesotaCare

Medicaid and MinnesotaCare are public health insurance programs that provide coverage to low-income individuals and families. Medicaid is a federal program that provides coverage to eligible individuals, while MinnesotaCare is a state-funded program that provides coverage to individuals who are not eligible for Medicaid but still need affordable healthcare. To be eligible for Medicaid or MinnesotaCare, individuals must meet certain income and eligibility requirements.

Small Business and Group Health Insurance

Small businesses and groups can also purchase medical insurance plans in MN, providing coverage to their employees and members. Group health insurance plans often have lower premiums than individual plans and may offer more comprehensive coverage. To be eligible for group health insurance, businesses must meet certain requirements, such as having a minimum number of employees.

Short-Term and Temporary Health Insurance

Short-term and temporary health insurance plans provide coverage for a limited period, often up to 12 months. These plans are designed for individuals who are between jobs, waiting for other coverage to start, or need temporary coverage. Short-term plans often have lower premiums than major medical plans but may have more limited coverage and higher deductibles.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged accounts that allow individuals to set aside money for medical expenses. To be eligible for an HSA, individuals must have a high-deductible health plan (HDHP) and meet certain income requirements. HSAs can be used to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays.

Conclusion and Next Steps

In conclusion, medical insurance in MN provides financial protection, access to preventive care, and improved health outcomes. With so many options available, it's essential to understand the different types of plans, benefits, and how to choose the right plan for your needs. Whether you're an individual, family, or business owner, having medical insurance in MN can provide peace of mind and financial security in the face of unexpected medical expenses. Take the next step and start exploring your options today!

We invite you to share your thoughts and experiences with medical insurance in MN. Have you had a positive or negative experience with a particular plan or provider? Do you have any questions or concerns about medical insurance? Share your comments and questions below, and we'll do our best to provide helpful and informative responses.

What is the difference between HMO and PPO plans?

+HMO plans require individuals to receive medical care from a specific network of providers, while PPO plans offer more flexibility and allow individuals to receive care from both in-network and out-of-network providers.

How do I choose the right medical insurance plan for my needs?

+Consider your age, health status, and medical needs when choosing a plan. Research and compare different plans, considering factors such as premiums, deductibles, copays, and provider networks.

What is MNsure, and how does it work?

+MNsure is the Minnesota Health Insurance Marketplace, which allows individuals and families to compare and purchase medical insurance plans from various providers. To be eligible for MNsure, individuals must meet certain income requirements and be a resident of Minnesota.