Intro

Discover top 5 medical insurance plans, including health, dental, and vision coverage, with affordable premiums, flexible deductibles, and comprehensive benefits, to ensure optimal healthcare protection and financial security.

The importance of having a reliable medical insurance plan cannot be overstated. With the ever-increasing costs of healthcare, it has become essential for individuals and families to have a safety net that protects them from financial ruin in the event of a medical emergency. Medical insurance plans provide a sense of security, allowing people to seek medical attention without worrying about the financial implications. In this article, we will delve into the world of medical insurance, exploring the various types of plans available, their benefits, and what to consider when selecting a plan.

Having a medical insurance plan is crucial for maintaining good health and well-being. Without insurance, many people may avoid seeking medical attention, which can lead to more severe health problems down the line. Medical insurance plans help cover the costs of doctor visits, hospital stays, surgeries, and prescription medications, among other expenses. Additionally, many plans offer preventive care services, such as routine check-ups and screenings, which can help detect health issues early on. By investing in a medical insurance plan, individuals and families can ensure that they receive the medical care they need, when they need it.

The world of medical insurance can be complex and overwhelming, with numerous plans and options available. It is essential to understand the different types of plans, their benefits, and limitations to make an informed decision. Some plans may offer more comprehensive coverage, while others may be more budget-friendly. In this article, we will explore five medical insurance plans, discussing their features, advantages, and disadvantages. By the end of this article, readers will have a better understanding of the medical insurance landscape and be able to make informed decisions about their healthcare needs.

Introduction to Medical Insurance Plans

Medical insurance plans are designed to provide financial protection against medical expenses. These plans typically involve a premium, which is paid by the insured, and a deductible, which is the amount the insured must pay out-of-pocket before the insurance coverage kicks in. There are various types of medical insurance plans, including individual plans, family plans, group plans, and Medicare plans. Each type of plan has its unique features, benefits, and limitations.

Types of Medical Insurance Plans

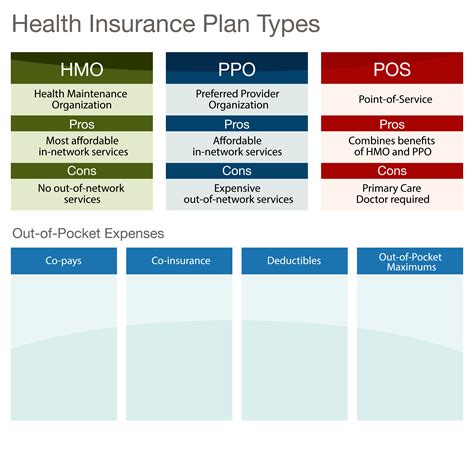

There are several types of medical insurance plans available, including: * Health Maintenance Organization (HMO) plans * Preferred Provider Organization (PPO) plans * Exclusive Provider Organization (EPO) plans * Point of Service (POS) plans * Indemnity plansPlan 1: Health Maintenance Organization (HMO) Plans

HMO plans are a type of medical insurance plan that provides coverage for a fixed monthly premium. These plans typically require the insured to receive medical care from a specific network of healthcare providers. HMO plans often have lower premiums than other types of plans but may have more restrictive coverage. One of the benefits of HMO plans is that they often provide preventive care services, such as routine check-ups and screenings, at no additional cost.

Benefits of HMO Plans

Some of the benefits of HMO plans include: * Lower premiums * Preventive care services * Coordination of care among healthcare providers * Reduced administrative costsPlan 2: Preferred Provider Organization (PPO) Plans

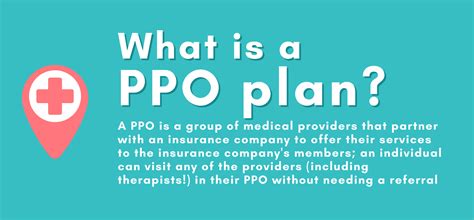

PPO plans are a type of medical insurance plan that provides coverage for a network of healthcare providers. These plans typically offer more flexibility than HMO plans, allowing the insured to receive care from both in-network and out-of-network providers. PPO plans often have higher premiums than HMO plans but may provide more comprehensive coverage.

Benefits of PPO Plans

Some of the benefits of PPO plans include: * More flexibility in choosing healthcare providers * Coverage for both in-network and out-of-network care * Higher annual limits on coverage * More comprehensive coverage for specialized carePlan 3: Exclusive Provider Organization (EPO) Plans

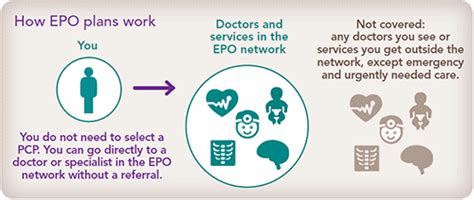

EPO plans are a type of medical insurance plan that provides coverage for a specific network of healthcare providers. These plans typically do not cover care received from out-of-network providers, except in emergency situations. EPO plans often have lower premiums than PPO plans but may have more restrictive coverage.

Benefits of EPO Plans

Some of the benefits of EPO plans include: * Lower premiums * Preventive care services * Coordination of care among healthcare providers * Reduced administrative costsPlan 4: Point of Service (POS) Plans

POS plans are a type of medical insurance plan that combines features of HMO and PPO plans. These plans typically require the insured to choose a primary care physician from a network of healthcare providers. POS plans often have higher premiums than HMO plans but may provide more comprehensive coverage.

Benefits of POS Plans

Some of the benefits of POS plans include: * More flexibility in choosing healthcare providers * Coverage for both in-network and out-of-network care * Higher annual limits on coverage * More comprehensive coverage for specialized carePlan 5: Indemnity Plans

Indemnity plans are a type of medical insurance plan that provides coverage for a percentage of medical expenses. These plans typically do not have a network of healthcare providers and may have higher premiums than other types of plans. Indemnity plans often provide more comprehensive coverage but may have higher out-of-pocket costs.

Benefits of Indemnity Plans

Some of the benefits of indemnity plans include: * More comprehensive coverage * Higher annual limits on coverage * More flexibility in choosing healthcare providers * Coverage for specialized careWhat is the difference between an HMO and a PPO plan?

+HMO plans typically require the insured to receive medical care from a specific network of healthcare providers, while PPO plans offer more flexibility in choosing healthcare providers.

How do I choose the right medical insurance plan for my needs?

+To choose the right medical insurance plan, consider your healthcare needs, budget, and preferences. Research different types of plans, and compare their benefits, limitations, and costs.

Can I change my medical insurance plan if I am not satisfied with my current coverage?

+Yes, you can change your medical insurance plan during the annual open enrollment period or if you experience a qualifying life event, such as a change in employment or marriage.

In conclusion, selecting the right medical insurance plan is a crucial decision that requires careful consideration of various factors. By understanding the different types of plans available, their benefits, and limitations, individuals and families can make informed decisions about their healthcare needs. We invite readers to share their thoughts and experiences with medical insurance plans in the comments section below. Additionally, we encourage readers to share this article with others who may be seeking information on medical insurance plans. By working together, we can promote a better understanding of medical insurance and improve healthcare outcomes for all.