Intro

Discover 5 ways to navigate Medicare, including enrollment, supplemental insurance, and cost-saving strategies, to maximize benefits and minimize expenses, ensuring a secure healthcare future with Medicare advantage plans and prescription coverage.

The importance of understanding Medicare cannot be overstated, especially for individuals approaching retirement age or those already enrolled in the program. Medicare is a federal health insurance program that provides coverage for people 65 and older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). With its complex structure and numerous options, navigating the world of Medicare can be daunting. However, grasping the basics and exploring the various pathways to Medicare enrollment can empower individuals to make informed decisions about their healthcare.

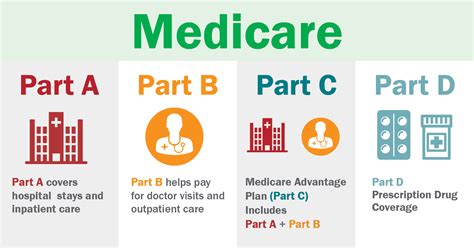

Medicare's significance extends beyond mere health insurance; it represents a vital component of retirement planning and financial security. The program's evolution over the years has introduced various plans and options, aiming to cater to the diverse needs of its beneficiaries. From traditional Medicare (Parts A and B) to Medicare Advantage (Part C) and prescription drug coverage (Part D), the array of choices can seem overwhelming. Nonetheless, each part of Medicare serves a unique purpose, and understanding these differences is crucial for maximizing benefits and minimizing out-of-pocket costs.

As the healthcare landscape continues to evolve, the role of Medicare in providing comprehensive and affordable coverage becomes increasingly critical. With the baby boomer generation aging and more individuals becoming eligible for Medicare, the demand for clear, concise information about the program has never been higher. Whether you're a retiree, a caregiver, or simply planning for the future, delving into the world of Medicare can seem like a monumental task. However, by breaking down the process into manageable steps and exploring the various pathways to enrollment, individuals can better navigate this complex system and ensure they receive the care they need.

Introduction to Medicare

Medicare is divided into several parts, each covering different aspects of healthcare. Part A, also known as hospital insurance, covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Most people don't pay a premium for Part A because they or their spouse paid Medicare taxes for at least 10 years while working. Part B, medical insurance, covers certain doctors' services, outpatient care, medical supplies, and preventive services. There's usually a monthly premium for Part B. Medicare Advantage, or Part C, combines the coverage of Part A and Part B and often includes additional benefits like vision, hearing, and dental coverage, as well as fitness programs. Prescription drug coverage, Part D, helps cover the cost of prescription drugs.

Eligibility and Enrollment

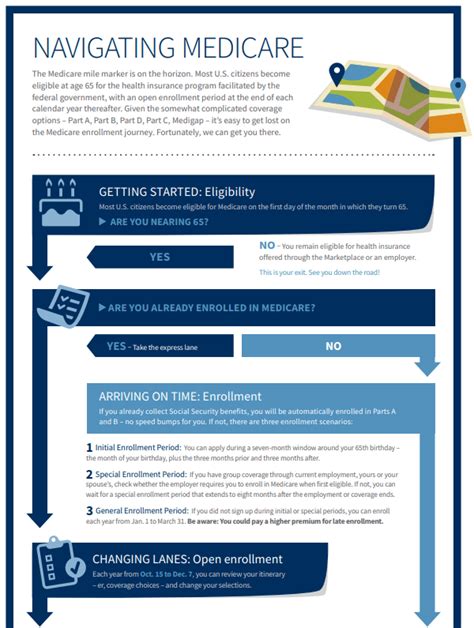

To be eligible for Medicare, individuals must be 65 or older, a U.S. citizen or permanent resident, and eligible for Social Security benefits. Younger people with disabilities who receive Social Security Disability Insurance (SSDI) for 24 months are also eligible. The enrollment process typically begins three months before an individual's 65th birthday and ends three months after, providing a seven-month window for initial enrollment. It's crucial to enroll during this period to avoid late penalties and ensure continuous coverage. The process can be completed online, by phone, or in person at a local Social Security office.

Medicare Parts and Plans

Understanding the different parts of Medicare and the plans available is essential for making informed decisions. Here are the key components:

- Part A (Hospital Insurance): Covers hospital stays, skilled nursing care, and some home health care.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, medical supplies, and preventive services.

- Part C (Medicare Advantage): Combines Parts A and B, often with additional benefits like dental, vision, and hearing coverage.

- Part D (Prescription Drug Coverage): Helps cover the cost of prescription drugs.

Medicare Advantage Plans

Medicare Advantage plans are offered by private companies approved by Medicare. These plans must cover all Medicare Part A and Part B benefits, and many include additional coverage for expenses that original Medicare doesn't cover, such as vision, hearing, and dental services. Some Medicare Advantage plans also offer coverage for services like transportation to medical appointments and healthy food delivery, aiming to address social determinants of health.Costs and Financial Assistance

While Medicare provides comprehensive coverage, there are costs associated with the program, including premiums, deductibles, copayments, and coinsurance. The cost of Medicare varies depending on the part and the type of coverage chosen. For example, most people don't pay a premium for Part A, but there is a monthly premium for Part B, which can vary based on income level. Financial assistance is available for those who qualify, such as the Medicare Savings Programs, which help pay for Part B premiums, deductibles, and coinsurance.

Navigating Medicare

Navigating the Medicare system can be complex, but there are resources available to help. The official Medicare website (medicare.gov) offers a wealth of information, including tools to compare plans, find healthcare providers, and estimate costs. Additionally, licensed insurance agents specializing in Medicare can provide personalized guidance, helping individuals choose the plan that best fits their needs and budget.

Conclusion and Next Steps

In conclusion, Medicare is a vital program that offers healthcare coverage to millions of Americans. By understanding the different parts of Medicare, the enrollment process, and the various plans available, individuals can make informed decisions about their healthcare. Whether you're approaching eligibility or already enrolled, it's essential to review and adjust your coverage annually to ensure it continues to meet your needs. For those looking to delve deeper, there are numerous resources available, from official government websites to professional advisors who can guide you through the process.

As you consider your Medicare options, remember that knowledge is power. Empowering yourself with a thorough understanding of Medicare can lead to better healthcare outcomes, reduced costs, and peace of mind. So, take the first step today by exploring the resources available to you, and don't hesitate to reach out for guidance when needed. Your health and financial security are worth the investment.

What is Medicare, and how does it work?

+Medicare is a federal health insurance program for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. It's divided into parts that cover different healthcare services, including hospital stays, doctor visits, and prescription drugs.

How do I enroll in Medicare?

+You can enroll in Medicare during the Initial Enrollment Period, which starts three months before your 65th birthday and ends three months after. You can enroll online, by phone, or in person at a local Social Security office.

What's the difference between Medicare Advantage and Original Medicare?

+Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage, or Part C, combines Parts A and B and often includes additional benefits like dental, vision, and hearing coverage, offered by private companies approved by Medicare.

We hope this comprehensive guide to Medicare has provided you with valuable insights and a clearer understanding of the program. Whether you're just starting to explore your options or are looking to make changes to your existing coverage, remember that you're not alone. Share your thoughts, ask questions, and seek advice from professionals to ensure you're making the most of your Medicare benefits. Together, let's navigate the world of Medicare and work towards a healthier, more secure future for all.