Intro

Discover the ultimate Medicare PPO plans guide, covering benefits, costs, and enrollment. Learn about Medicare Advantage, network providers, and out-of-pocket expenses to make informed decisions about your healthcare coverage.

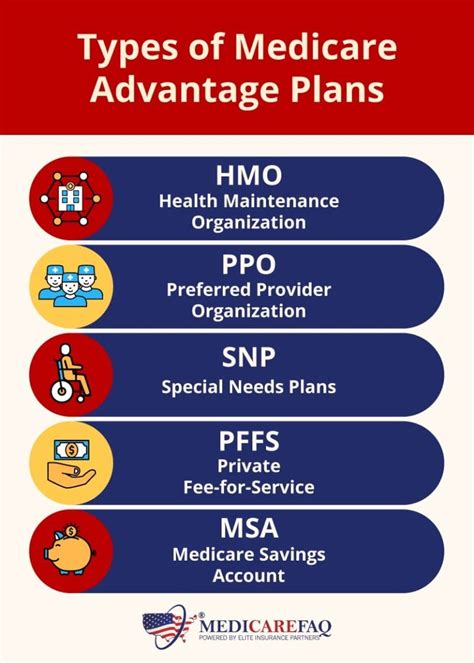

The world of health insurance can be complex and overwhelming, especially for those nearing retirement or already enrolled in Medicare. With various options available, it's essential to understand the different types of plans and their benefits. One popular choice among Medicare beneficiaries is the Medicare PPO (Preferred Provider Organization) plan. In this article, we'll delve into the details of Medicare PPO plans, exploring their advantages, disadvantages, and what to expect when enrolling in one of these plans.

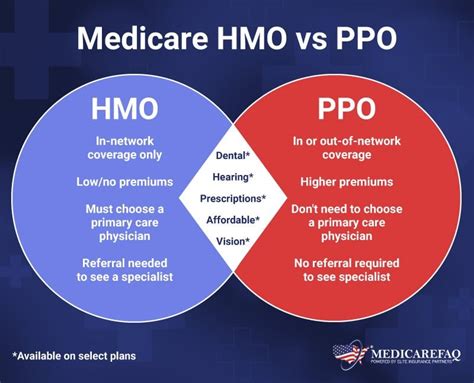

Medicare PPO plans are a type of Medicare Advantage plan, which means they're offered by private insurance companies approved by Medicare. These plans combine the benefits of Original Medicare (Part A and Part B) with additional coverage, such as prescription drugs, dental, and vision care. PPO plans are known for their flexibility, allowing beneficiaries to see any healthcare provider they choose, both in-network and out-of-network. This flexibility is a significant advantage, especially for those who travel frequently or have healthcare providers outside of their network.

The importance of understanding Medicare PPO plans cannot be overstated. With the rising costs of healthcare, it's crucial to have a plan that meets your needs and budget. Medicare PPO plans offer a range of benefits, including lower out-of-pocket costs, additional coverage, and the freedom to choose your healthcare providers. However, it's essential to weigh the pros and cons of these plans, considering factors such as network restrictions, copays, and coinsurance. By doing so, you'll be better equipped to make an informed decision about your healthcare coverage.

What are Medicare PPO Plans?

One of the primary benefits of Medicare PPO plans is the ability to see any healthcare provider, without the need for a referral. This is particularly useful for those who have established relationships with their healthcare providers or require specialized care. Additionally, PPO plans often include additional benefits, such as dental, vision, and hearing coverage, which can help reduce out-of-pocket expenses.

How Do Medicare PPO Plans Work?

Medicare PPO plans work by combining the benefits of Original Medicare with additional coverage, such as prescription drugs and extra benefits like dental and vision care. When you enroll in a PPO plan, you'll typically pay a monthly premium, which may vary depending on the plan and insurance company. You'll also be responsible for copays, coinsurance, and deductibles, which can vary depending on the service and provider.For example, if you see an in-network primary care physician, you may pay a $20 copay. However, if you see an out-of-network specialist, you may pay a higher copay or coinsurance rate. It's essential to review the plan's summary of benefits and coverage to understand the costs associated with each service.

Benefits of Medicare PPO Plans

However, it's essential to weigh these benefits against the potential drawbacks, such as higher premiums, network restrictions, and higher out-of-pocket costs for out-of-network care.

Disadvantages of Medicare PPO Plans

While Medicare PPO plans offer several advantages, there are also some disadvantages to consider: * Higher premiums: PPO plans may have higher premiums than other types of Medicare Advantage plans. * Network restrictions: While PPO plans offer flexibility, seeing an out-of-network provider can result in higher out-of-pocket costs. * Higher out-of-pocket costs: PPO plans may have higher copays, coinsurance, and deductibles, especially for out-of-network care.To minimize these disadvantages, it's crucial to carefully review the plan's summary of benefits and coverage, ask questions, and consider your individual needs and budget.

How to Choose a Medicare PPO Plan

By taking the time to research and compare different plans, you can find a Medicare PPO plan that meets your needs and budget.

Medicare PPO Plan Enrollment

Enrolling in a Medicare PPO plan is relatively straightforward. You can enroll during the following periods: * Initial Enrollment Period (IEP): This is the 7-month period around your 65th birthday, including the 3 months before, the month of, and the 3 months after. * Annual Enrollment Period (AEP): This occurs every year from October 15 to December 7, allowing you to change or enroll in a new plan. * Special Enrollment Period (SEP): This is a special period that allows you to enroll in a plan outside of the regular enrollment periods, typically due to a qualifying event, such as moving or losing coverage.It's essential to understand the enrollment periods and deadlines to avoid missing your opportunity to enroll in a Medicare PPO plan.

Medicare PPO Plan Costs

It's essential to review the plan's summary of benefits and coverage to understand the costs associated with each service.

Medicare PPO Plan Coverage

Medicare PPO plans typically include coverage for: * Doctor visits * Hospital stays * Prescription drugs * Dental care * Vision care * Hearing careHowever, the specific coverage and benefits may vary depending on the plan and insurance company. It's crucial to review the plan's summary of benefits and coverage to understand what's included and what's not.

Medicare PPO Plan Providers

When choosing a provider, consider factors such as network, coverage, and customer service. It's essential to research and compare different providers to find the one that best meets your needs.

Medicare PPO Plan Network

The network of healthcare providers is a critical aspect of Medicare PPO plans. When choosing a plan, consider the following: * In-network providers: These are providers who have contracted with the insurance company to offer discounted services to plan members. * Out-of-network providers: These are providers who have not contracted with the insurance company, resulting in higher out-of-pocket costs.It's essential to check the plan's network to ensure it includes your healthcare providers.

Medicare PPO Plan Ratings

When choosing a plan, consider the ratings to get a sense of the plan's quality and performance.

Medicare PPO Plan Reviews

Reviews from other beneficiaries can provide valuable insights into the plan's quality and customer service. Consider the following: * Read reviews from multiple sources, such as Medicare.gov, Consumer Reports, and online forums. * Look for reviews that mention specific aspects of the plan, such as coverage, network, and customer service. * Take reviews with a grain of salt, as individual experiences may vary.By considering reviews and ratings, you can make a more informed decision about your Medicare PPO plan.

Medicare PPO Plan FAQs

By understanding the answers to these questions, you can make a more informed decision about your Medicare PPO plan.

What is a Medicare PPO plan?

+A Medicare PPO plan is a type of Medicare Advantage plan that offers a network of healthcare providers who have agreed to participate in the plan.

How do Medicare PPO plans work?

+Medicare PPO plans work by combining the benefits of Original Medicare with additional coverage, such as prescription drugs and extra benefits like dental and vision care.

What are the benefits of Medicare PPO plans?

+Medicare PPO plans offer several benefits, including flexibility, additional coverage, and lower out-of-pocket costs.

In conclusion, Medicare PPO plans offer a range of benefits, including flexibility, additional coverage, and lower out-of-pocket costs. However, it's essential to weigh the pros and cons, considering factors such as network restrictions, copays, and coinsurance. By taking the time to research and compare different plans, you can find a Medicare PPO plan that meets your needs and budget. We hope this guide has provided you with a comprehensive understanding of Medicare PPO plans and has helped you make a more informed decision about your healthcare coverage. If you have any further questions or would like to share your experiences with Medicare PPO plans, please comment below.