Intro

Discover top-rated Medicare providers, compare plans, and find affordable coverage with our comprehensive list, featuring top Medicare Advantage, Supplement, and Part D providers, to make informed decisions about your healthcare.

The importance of selecting the right Medicare provider cannot be overstated, as it directly impacts the quality of healthcare services and financial security for millions of Americans. Medicare, a federal health insurance program primarily for individuals 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant), offers a wide range of plans and providers. With so many options available, navigating the landscape to find the top Medicare providers can be daunting. This article aims to guide readers through the process, highlighting key factors to consider and showcasing some of the top-rated Medicare providers.

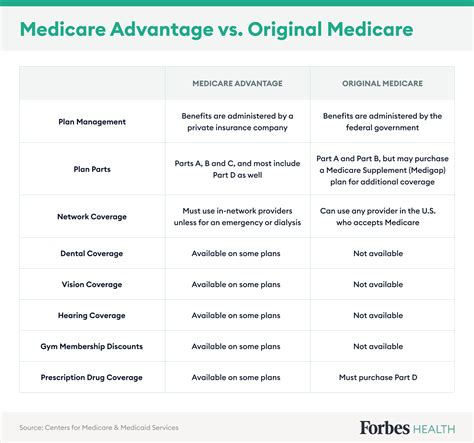

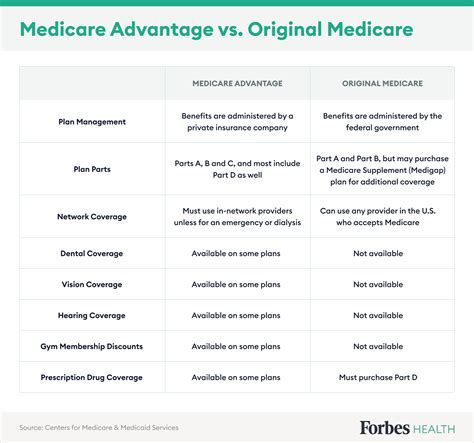

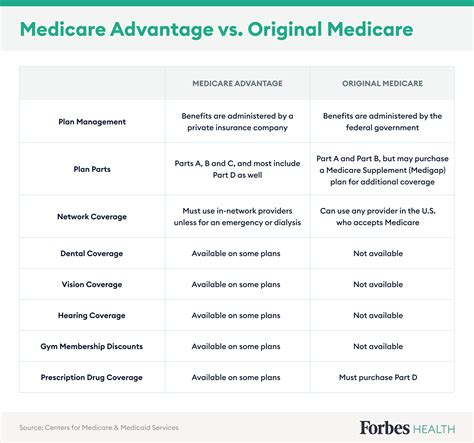

Understanding the different types of Medicare plans, including Original Medicare (Part A and Part B), Medicare Advantage (Part C), Medicare Prescription Drug Plans (Part D), and Medicare Supplement Insurance (Medigap), is crucial. Each type of plan has its benefits, drawbacks, and eligibility requirements. Moreover, the quality and reputation of the provider can significantly influence the patient's experience and health outcomes. Factors such as network coverage, out-of-pocket costs, prescription drug coverage, and customer service play a vital role in choosing the best provider.

The healthcare landscape is continuously evolving, with new technologies, treatments, and policies emerging regularly. Staying informed about these changes and how they affect Medicare and its providers is essential for making informed decisions. Furthermore, the needs and preferences of individuals can vary greatly, making personalized research and consideration necessary. Whether one prioritizes affordability, comprehensive coverage, flexibility in choosing healthcare providers, or something else, there's a Medicare provider that can meet those needs.

Introduction to Top Medicare Providers

The list of top Medicare providers includes well-known insurance companies and health organizations that have demonstrated excellence in terms of plan offerings, customer satisfaction, and network quality. Companies like UnitedHealthcare, Humana, Aetna, Cigna, and Kaiser Permanente are often recognized for their comprehensive Medicare plans and strong provider networks. These organizations not only offer a range of Medicare plans but also invest in innovative healthcare solutions, member engagement, and community outreach programs.

How to Choose the Best Medicare Provider

Choosing the best Medicare provider involves several steps and considerations:

- Assessing Health Needs: Understanding one's health requirements and the types of services needed is fundamental. This includes considering current health conditions, the necessity for prescription drug coverage, and the preference for specific healthcare providers or hospitals.

- Comparing Plans: Each Medicare provider offers various plans with different benefits, costs, and network coverage. Comparing these aspects across providers can help individuals find the plan that best matches their needs and budget.

- Evaluating Network Coverage: For those with preferred healthcare providers or a history with specific medical facilities, ensuring these are included in the provider's network is crucial.

- Reviewing Customer Service and Ratings: Looking into customer satisfaction ratings, reviews, and the provider's reputation can provide insights into the quality of service and support one can expect.

- Calculating Costs: Understanding all the costs associated with a plan, including premiums, deductibles, copays, and coinsurance, is vital for budgeting and financial planning.

Top Medicare Providers

Some of the top Medicare providers include:

- UnitedHealthcare: Known for its wide range of Medicare plans, including Advantage, Supplement, and Prescription Drug Plans, with a large network of healthcare providers.

- Humana: Offers a variety of Medicare plans, including Medicare Advantage plans with additional benefits like dental, vision, and hearing coverage, and a user-friendly website for plan management.

- Aetna: Provides Medicare Advantage and Prescription Drug Plans, with a focus on member wellness programs and a comprehensive network of healthcare professionals.

- Cigna: Offers Medicare Advantage and Supplement plans, emphasizing preventive care and healthy living initiatives, with a strong network of providers and facilities.

- Kaiser Permanente: A unique model that combines health insurance with its own medical facilities and staff, offering comprehensive and coordinated care to its members.

Benefits of Top Medicare Providers

The benefits of choosing a top Medicare provider are numerous:

- Comprehensive Coverage: Top providers offer a range of plans that can cover various healthcare needs, including medical, hospital, prescription drugs, and sometimes additional benefits like dental and vision care.

- Strong Network: A large and reliable network of healthcare providers ensures that individuals have access to quality care when needed.

- Customer Support: Top providers typically have well-regarded customer service, making it easier for members to navigate their plans, find providers, and resolve issues.

- Innovative Health Solutions: Many top providers invest in innovative healthcare solutions, including telehealth services, wellness programs, and disease management initiatives, to improve health outcomes and enhance the member experience.

- Financial Security: With transparent and competitive pricing, top Medicare providers can offer financial security and peace of mind, protecting individuals from unexpected healthcare costs.

Challenges and Considerations

Despite the benefits, there are challenges and considerations to keep in mind:

- Complexity: The Medicare system can be complex, with many plans and rules to understand, making it difficult for individuals to choose the right provider and plan.

- Cost: While Medicare provides essential health coverage, out-of-pocket costs, premiums, and potential gaps in coverage can be significant, requiring careful financial planning.

- Network Limitations: Depending on the plan, network limitations can restrict access to certain healthcare providers or facilities, potentially impacting the quality and convenience of care.

- Changing Healthcare Landscape: The healthcare industry is constantly evolving, with new technologies, treatments, and policies emerging. Staying informed and adapting to these changes can be challenging.

Future of Medicare and Its Providers

The future of Medicare and its providers is likely to be shaped by several factors, including technological advancements, policy changes, and shifting healthcare needs. Innovations in telehealth, personalized medicine, and health information technology are expected to play a significant role in enhancing the quality and accessibility of healthcare services. Additionally, efforts to improve healthcare affordability, expand coverage, and enhance the patient experience will continue to influence the Medicare landscape.

As the population ages and healthcare needs evolve, the demand for comprehensive, affordable, and high-quality Medicare plans will grow. Top Medicare providers will need to adapt, investing in innovative solutions, strengthening their networks, and prioritizing member satisfaction to remain competitive and meet the changing needs of beneficiaries.

Conclusion and Next Steps

In conclusion, selecting the right Medicare provider is a critical decision that can significantly impact one's health and financial well-being. By understanding the different types of Medicare plans, evaluating top providers, and considering individual needs and preferences, individuals can make informed choices. As the healthcare landscape continues to evolve, staying informed and engaged will be key to navigating the complexities of Medicare and finding the best provider for one's specific situation.

We invite readers to share their experiences with Medicare providers, ask questions, and seek advice from professionals in the comments below. For those considering a Medicare plan or looking to switch providers, we encourage you to explore the options outlined in this article, consult with a licensed insurance agent, and visit the official Medicare website for the most current information and resources.

What is the difference between Original Medicare and Medicare Advantage?

+Original Medicare is the traditional Medicare program run by the federal government, consisting of Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage, also known as Part C, is an alternative way to get Medicare benefits through private insurance companies approved by Medicare.

How do I choose the best Medicare provider for my needs?

+To choose the best Medicare provider, consider your health needs, budget, and preferences. Research different providers, compare their plans, network coverage, and customer service. It may also be helpful to consult with a licensed insurance agent or broker who specializes in Medicare.

Can I change my Medicare provider or plan after enrollment?

+Yes, you can change your Medicare provider or plan, but there are specific times when you can make changes. The Annual Election Period (AEP), also known as open enrollment, usually occurs from October 15 to December 7 each year, allowing you to change plans. Additionally, there are special enrollment periods for certain situations, such as moving to a new area or losing current coverage.