Intro

Explore NY health insurance marketplace options, including Affordable Care Act plans, Medicaid, and private insurance, to find the best coverage for individuals and families, with information on enrollment, subsidies, and healthcare providers.

The New York Health Insurance Marketplace, also known as NY State of Health, is a platform where individuals, families, and small businesses can purchase health insurance. With numerous options available, it's essential to understand the different types of plans, their benefits, and how to choose the best one for your needs. In this article, we'll delve into the world of NY health insurance marketplace options, exploring the various plans, their advantages, and what you need to know to make an informed decision.

The importance of having health insurance cannot be overstated. It provides financial protection against unexpected medical expenses, allowing you to receive necessary care without breaking the bank. The NY Health Insurance Marketplace offers a range of plans from various insurance providers, catering to different budgets, health needs, and preferences. Whether you're an individual, family, or small business owner, you'll find a plan that suits your requirements.

The NY Health Insurance Marketplace is designed to be user-friendly, with a website and customer service team available to guide you through the enrollment process. You can browse plans, compare prices, and apply for coverage online, by phone, or in-person with a certified enrollment counselor. The marketplace also offers a range of resources and tools to help you understand the different plans, including a plan comparison tool and a glossary of health insurance terms.

New York Health Insurance Marketplace Plans

The NY Health Insurance Marketplace offers several types of plans, including Individual and Family Plans, Small Business Plans, and Medicaid. Individual and Family Plans are designed for people who don't have access to employer-sponsored coverage or are self-employed. These plans are available through the marketplace and can be purchased during the annual open enrollment period or during a special enrollment period if you experience a qualifying life event, such as losing job-based coverage or getting married.

Small Business Plans, on the other hand, are designed for businesses with 1-100 employees. These plans offer a range of benefits, including access to a network of doctors and hospitals, preventive care, and coverage for pre-existing conditions. Small businesses can purchase plans through the marketplace or work with a licensed insurance broker to find a plan that meets their needs.

Types of Plans

The NY Health Insurance Marketplace offers several types of plans, including: * Catastrophic Plans: These plans have lower premiums but higher deductibles and out-of-pocket costs. They're designed for young adults or people who don't expect to need much medical care. * Bronze Plans: These plans have moderate premiums and deductibles. They're a good option for people who want some level of coverage but don't expect to need extensive medical care. * Silver Plans: These plans have moderate premiums and lower deductibles. They're a popular choice for people who want a balance between premium costs and out-of-pocket expenses. * Gold Plans: These plans have higher premiums but lower deductibles and out-of-pocket costs. They're designed for people who expect to need more medical care or want more comprehensive coverage. * Platinum Plans: These plans have the highest premiums but the lowest deductibles and out-of-pocket costs. They're designed for people who want the most comprehensive coverage available.Benefits of NY Health Insurance Marketplace Plans

The NY Health Insurance Marketplace plans offer several benefits, including:

- Access to a network of doctors and hospitals

- Preventive care, including routine check-ups and screenings

- Coverage for pre-existing conditions

- Prescription drug coverage

- Mental health and substance abuse treatment

- Dental and vision coverage for children

Additionally, many plans offer extra benefits, such as:

- Telehealth services

- Fitness discounts

- Health coaching

- Discount programs for healthy behaviors

How to Choose a Plan

Choosing a plan through the NY Health Insurance Marketplace can be overwhelming, but there are several steps you can take to make the process easier: 1. Determine your budget: Calculate how much you can afford to pay each month for premiums, deductibles, and out-of-pocket costs. 2. Assess your health needs: Consider your medical history, current health status, and any ongoing health needs. 3. Compare plans: Use the marketplace's plan comparison tool to compare prices, benefits, and provider networks. 4. Check provider networks: Make sure your doctors and hospitals are part of the plan's network. 5. Read reviews: Check online reviews and ratings from other customers to get a sense of the plan's quality and customer service.Special Enrollment Periods

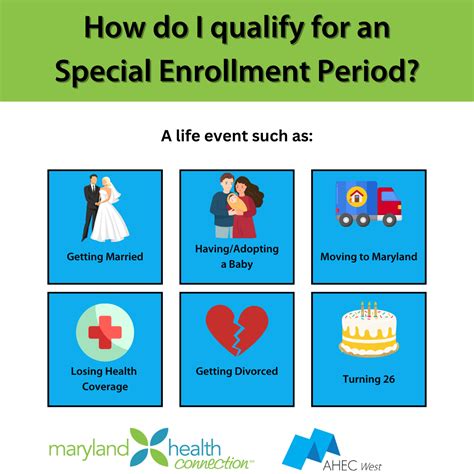

In addition to the annual open enrollment period, you may be eligible for a special enrollment period if you experience a qualifying life event, such as:

- Losing job-based coverage

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new area

- Becoming a U.S. citizen

During a special enrollment period, you can enroll in a plan or change your existing plan. You'll need to provide documentation to prove your qualifying life event, such as a letter from your employer or a marriage certificate.

Medicaid and the NY Health Insurance Marketplace

Medicaid is a government-funded health insurance program for low-income individuals and families. If you're eligible for Medicaid, you can enroll at any time, and you won't need to worry about premiums or out-of-pocket costs. The NY Health Insurance Marketplace can help you determine if you're eligible for Medicaid and guide you through the enrollment process.NY Health Insurance Marketplace Enrollment

Enrolling in a plan through the NY Health Insurance Marketplace is relatively straightforward. You can apply online, by phone, or in-person with a certified enrollment counselor. You'll need to provide some basic information, such as:

- Your name and date of birth

- Your income and family size

- Your Social Security number or immigration documents

- Information about your current health insurance coverage, if applicable

Once you've submitted your application, you'll receive a determination of eligibility and a list of available plans. You can then choose a plan and enroll online or by phone.

NY Health Insurance Marketplace Customer Service

The NY Health Insurance Marketplace offers a range of customer service options, including: * Phone support: You can call the marketplace's customer service number to get help with enrollment, billing, or other issues. * Online chat: You can chat with a customer service representative online to get answers to your questions. * In-person support: You can visit a marketplace office or meet with a certified enrollment counselor to get in-person support.NY Health Insurance Marketplace FAQs

Here are some frequently asked questions about the NY Health Insurance Marketplace:

- Q: What is the NY Health Insurance Marketplace? A: The NY Health Insurance Marketplace is a platform where individuals, families, and small businesses can purchase health insurance.

- Q: How do I enroll in a plan? A: You can enroll online, by phone, or in-person with a certified enrollment counselor.

- Q: What types of plans are available? A: The marketplace offers a range of plans, including Individual and Family Plans, Small Business Plans, and Medicaid.

- Q: Can I get help with enrollment? A: Yes, the marketplace offers customer service support, including phone, online chat, and in-person support.

What is the difference between a Bronze and Silver plan?

+Bronze plans have lower premiums but higher deductibles and out-of-pocket costs. Silver plans have moderate premiums and lower deductibles.

Can I enroll in a plan if I have a pre-existing condition?

+Yes, the NY Health Insurance Marketplace plans cover pre-existing conditions. You cannot be denied coverage or charged more because of a pre-existing condition.

How do I know if I'm eligible for Medicaid?

+You can check your eligibility for Medicaid through the NY Health Insurance Marketplace. You'll need to provide information about your income and family size.

In conclusion, the NY Health Insurance Marketplace offers a range of options for individuals, families, and small businesses. By understanding the different types of plans, their benefits, and how to choose the best one for your needs, you can make an informed decision and get the coverage you need. Don't hesitate to reach out to the marketplace's customer service team or a certified enrollment counselor for help with enrollment or questions about the plans. Share this article with your friends and family to help them navigate the NY Health Insurance Marketplace and find the perfect plan for their needs.