Intro

Pay bills online securely with ease, using digital payment methods, online billing, and e-pay services, saving time and reducing paperwork with convenient bill pay options.

Paying bills online has become an essential part of our daily lives, offering a convenient and efficient way to manage our financial responsibilities. With the rise of digital banking and online payment systems, individuals can now pay their bills from the comfort of their own homes, 24/7. This shift towards online bill payments has not only saved time but also reduced the risk of late payments, lost checks, and fraudulent activities. As we delve into the world of online bill payments, it's essential to understand the benefits, working mechanisms, and best practices to ensure a seamless and secure experience.

The importance of paying bills online cannot be overstated, as it has revolutionized the way we manage our finances. Gone are the days of waiting in line, writing checks, and worrying about missed payments. With online bill payments, individuals can schedule payments in advance, receive reminders, and track their payment history. This level of convenience and control has made it easier for people to stay on top of their financial obligations, reducing stress and anxiety. Moreover, online bill payments have also helped to reduce paper waste, minimize the risk of identity theft, and provide a clear audit trail of all transactions.

As we explore the world of online bill payments, it's crucial to understand the different types of payment methods available. From credit cards and debit cards to online banking and digital wallets, individuals have a wide range of options to choose from. Each payment method has its own set of benefits and drawbacks, and it's essential to choose the one that best suits your needs. For instance, credit cards offer rewards and cashback incentives, while online banking provides a secure and convenient way to manage your accounts. Digital wallets, on the other hand, offer a seamless and contactless payment experience.

Benefits of Paying Bills Online

Some of the key benefits of paying bills online include:

- Convenience: Pay bills from anywhere, at any time

- Security: Reduce the risk of lost checks, stolen payments, and identity theft

- Cost savings: Avoid late fees, penalties, and interest charges

- Transparency: Track payment history and detect suspicious activity

- Environmentally friendly: Reduce paper waste and minimize carbon footprint

How Online Bill Payments Work

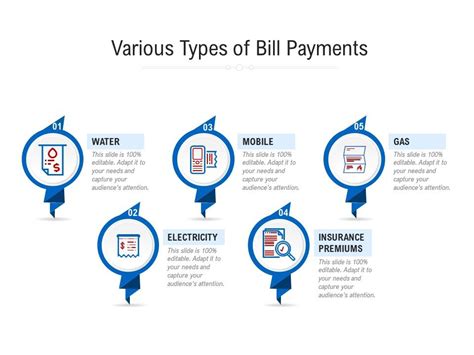

Online bill payments work by leveraging digital banking and online payment systems. When you pay a bill online, you're essentially transferring funds from your account to the biller's account. This process involves several steps, including: 1. Setting up an online account: Create an account with your biller or bank to access online payment services. 2. Adding a payment method: Link a payment method, such as a credit card or debit card, to your online account. 3. Scheduling a payment: Choose the payment date, amount, and frequency (one-time or recurring). 4. Confirming the payment: Review and confirm the payment details to ensure accuracy. 5. Receiving confirmation: Get a confirmation of the payment, either via email or text message.Types of Online Bill Payments

Security Measures for Online Bill Payments

Security is a top priority when it comes to online bill payments. To ensure a secure payment experience, it's essential to: * Use strong passwords and keep them confidential * Enable two-factor authentication (2FA) whenever possible * Monitor account activity regularly * Avoid using public computers or public Wi-Fi for online payments * Keep software and browsers up-to-dateBest Practices for Online Bill Payments

Common Mistakes to Avoid

When paying bills online, it's essential to avoid common mistakes, such as: * Missing payment deadlines * Entering incorrect payment information * Using an incorrect payment method * Failing to confirm payment details * Not monitoring account activity regularlyFuture of Online Bill Payments

Conclusion and Next Steps

In conclusion, paying bills online has become an essential part of our daily lives, offering a convenient, secure, and efficient way to manage our financial responsibilities. By understanding the benefits, working mechanisms, and best practices of online bill payments, individuals can ensure a seamless and secure payment experience. As we look to the future, it's essential to stay informed about emerging trends and technologies shaping the world of online bill payments.To take the next step, we invite you to share your thoughts and experiences with online bill payments. Have you had a positive or negative experience with online bill payments? What features or functionalities would you like to see in future online bill payment systems? Share your comments below, and let's start a conversation about the future of online bill payments.

What are the benefits of paying bills online?

+Paying bills online offers a multitude of benefits, including convenience, security, and cost savings. With online bill payments, individuals can avoid late fees, penalties, and interest charges associated with missed payments.

How do I set up an online bill payment account?

+To set up an online bill payment account, simply visit your biller's website or online banking platform and follow the registration process. You'll typically need to provide personal and payment information to complete the setup.

Is it safe to pay bills online?

+Yes, paying bills online is generally safe, as long as you take necessary precautions to secure your account and payment information. Use strong passwords, enable two-factor authentication, and monitor account activity regularly to ensure a secure payment experience.