Intro

Discover the meaning of PPO insurance, a popular health plan offering flexible network options, copays, and deductibles, explaining how Preferred Provider Organizations work.

The world of health insurance can be complex and overwhelming, with numerous options and terminology that can leave even the most informed individuals feeling confused. One such term that has gained significant attention in recent years is PPO insurance. But what does PPO insurance mean, and how does it work? In this article, we will delve into the world of PPO insurance, exploring its benefits, drawbacks, and everything in between. Whether you are an individual seeking to understand your health insurance options or an employer looking to provide comprehensive coverage to your employees, this article aims to provide a comprehensive guide to PPO insurance.

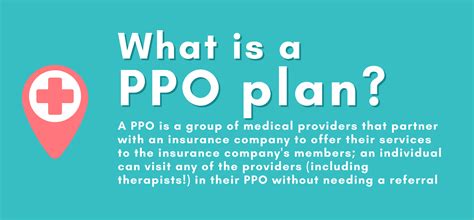

As we navigate the complexities of the healthcare system, it is essential to understand the various types of health insurance plans available. PPO insurance, which stands for Preferred Provider Organization, is a type of health insurance plan that offers a unique blend of flexibility and cost savings. With a PPO plan, individuals can choose to receive medical care from a network of preferred providers, who have agreed to provide discounted services to plan members. However, PPO plans also offer the freedom to seek care from out-of-network providers, albeit at a higher cost. This flexibility makes PPO plans a popular choice among individuals and families who value the ability to choose their healthcare providers.

The importance of understanding PPO insurance cannot be overstated, particularly in today's healthcare landscape. With the rising costs of medical care and the increasing complexity of health insurance plans, it is crucial to have a clear understanding of the options available. By grasping the fundamentals of PPO insurance, individuals can make informed decisions about their healthcare coverage, ensuring that they receive the best possible care while minimizing their out-of-pocket expenses. In the following sections, we will explore the inner workings of PPO insurance, including its benefits, drawbacks, and key considerations.

PPO Insurance Basics

To understand PPO insurance, it is essential to grasp the basic concepts that underlie this type of health insurance plan. At its core, a PPO plan is a type of managed care plan that combines elements of both HMO (Health Maintenance Organization) and indemnity plans. With a PPO plan, individuals can choose to receive medical care from a network of preferred providers, who have agreed to provide discounted services to plan members. This network of providers typically includes primary care physicians, specialists, hospitals, and other healthcare facilities. By receiving care from in-network providers, individuals can benefit from lower out-of-pocket costs, including copays, coinsurance, and deductibles.

Key Components of PPO Insurance

In addition to its network of preferred providers, PPO insurance plans typically include several key components, including: * Deductible: The amount that individuals must pay out-of-pocket before their insurance coverage kicks in. * Copay: A fixed amount that individuals must pay for specific medical services, such as doctor visits or prescription medications. * Coinsurance: A percentage of medical expenses that individuals must pay after meeting their deductible. * Out-of-pocket maximum: The maximum amount that individuals must pay for medical expenses within a given year.Benefits of PPO Insurance

PPO insurance plans offer several benefits that make them an attractive option for individuals and families. Some of the key advantages of PPO plans include:

- Flexibility: PPO plans allow individuals to choose their healthcare providers, both in-network and out-of-network.

- Comprehensive coverage: PPO plans typically cover a wide range of medical services, including preventive care, hospital stays, and prescription medications.

- Cost savings: By receiving care from in-network providers, individuals can benefit from lower out-of-pocket costs.

- No referrals required: Unlike HMO plans, PPO plans do not require individuals to obtain referrals from primary care physicians to see specialists.

Drawbacks of PPO Insurance

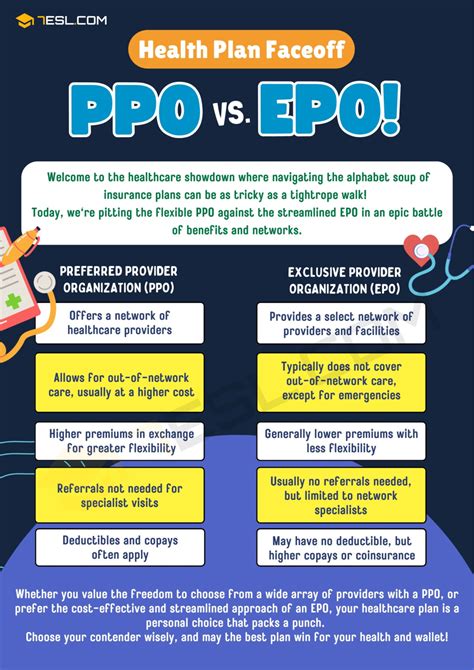

While PPO insurance plans offer several benefits, they also have some drawbacks. Some of the key disadvantages of PPO plans include: * Higher premiums: PPO plans tend to have higher premiums than other types of health insurance plans, such as HMOs. * Out-of-network costs: Receiving care from out-of-network providers can result in significantly higher out-of-pocket costs. * Complex administration: PPO plans can be complex to administer, particularly for individuals who are not familiar with the nuances of health insurance.How PPO Insurance Works

To understand how PPO insurance works, it is essential to grasp the flow of events that occurs when an individual receives medical care. Here is a step-by-step overview of the process:

- Choose a healthcare provider: Individuals can choose to receive medical care from either an in-network or out-of-network provider.

- Pay the deductible: If the individual has not yet met their deductible, they must pay the full amount of the medical bill.

- Pay the copay or coinsurance: After meeting the deductible, individuals must pay a copay or coinsurance for the medical services they receive.

- Receive reimbursement: If the individual receives care from an out-of-network provider, they may need to submit a claim to their insurance company to receive reimbursement.

Example of PPO Insurance in Action

To illustrate how PPO insurance works, let's consider an example. Suppose an individual has a PPO plan with a $1,000 deductible, 20% coinsurance, and a $30 copay for doctor visits. If the individual visits an in-network doctor, they will pay the $30 copay. If they receive care from an out-of-network doctor, they will pay the full amount of the bill and then submit a claim to their insurance company for reimbursement.PPO Insurance vs. Other Types of Health Insurance

PPO insurance plans are just one of several types of health insurance plans available. To make informed decisions about their healthcare coverage, individuals must understand the differences between PPO plans and other types of plans, such as HMOs, POS (Point of Service) plans, and indemnity plans. Here is a brief overview of each:

- HMO plans: HMO plans require individuals to receive medical care from a specific network of providers, with referrals required to see specialists.

- POS plans: POS plans combine elements of HMO and PPO plans, allowing individuals to choose between in-network and out-of-network care.

- Indemnity plans: Indemnity plans, also known as fee-for-service plans, allow individuals to choose their healthcare providers and pay a fixed percentage of the medical bill.

Comparison of PPO Insurance and Other Types of Health Insurance

The following table summarizes the key differences between PPO insurance and other types of health insurance: | Type of Plan | Network | Referrals | Out-of-Network Care | | --- | --- | --- | --- | | PPO | Preferred providers | Not required | Allowed, but at higher cost | | HMO | Specific network | Required | Not allowed | | POS | Combination of HMO and PPO | Required for out-of-network care | Allowed, but at higher cost | | Indemnity | No network | Not required | Allowed, but at higher cost |Conclusion and Next Steps

In conclusion, PPO insurance plans offer a unique blend of flexibility and cost savings, making them a popular choice among individuals and families. By understanding the basics of PPO insurance, including its benefits, drawbacks, and key components, individuals can make informed decisions about their healthcare coverage. Whether you are seeking to choose a new health insurance plan or optimize your existing coverage, it is essential to carefully consider your options and choose the plan that best meets your needs.

We invite you to share your thoughts and experiences with PPO insurance in the comments below. Have you had a positive or negative experience with a PPO plan? Do you have any questions or concerns about PPO insurance? By sharing your insights and engaging with others, we can create a community of informed individuals who are empowered to make the best decisions about their healthcare coverage.

What is the main difference between PPO and HMO insurance plans?

+The main difference between PPO and HMO insurance plans is the level of flexibility and freedom to choose healthcare providers. PPO plans allow individuals to receive care from both in-network and out-of-network providers, while HMO plans require individuals to receive care from a specific network of providers.

How do I choose the best PPO insurance plan for my needs?

+To choose the best PPO insurance plan for your needs, consider factors such as the size and quality of the provider network, the level of coverage for specific medical services, and the out-of-pocket costs, including deductibles, copays, and coinsurance.

Can I use my PPO insurance plan to receive care from out-of-network providers?

+Yes, with a PPO insurance plan, you can receive care from out-of-network providers, but you will typically pay a higher cost for these services. It is essential to understand the terms of your plan and the potential out-of-pocket costs before seeking care from an out-of-network provider.