Intro

Compare HMO vs PPO health insurance plans with 5 expert tips, exploring network coverage, out-of-pocket costs, and provider flexibility to make informed decisions about managed care, copays, and deductibles.

When it comes to choosing a health insurance plan, two of the most popular options are Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. Both types of plans have their advantages and disadvantages, and understanding the key differences between them is crucial to making an informed decision. In this article, we will delve into the world of HMO and PPO plans, exploring their benefits, drawbacks, and everything in between.

The importance of selecting the right health insurance plan cannot be overstated. With the rising costs of healthcare, having a plan that meets your needs and budget is essential. HMO and PPO plans are two of the most common types of plans offered by employers and insurance companies, and each has its unique features and limitations. By understanding the pros and cons of each plan, you can make a decision that works best for you and your family.

The world of health insurance can be complex and overwhelming, especially for those who are new to it. With so many options available, it's easy to get confused and end up with a plan that doesn't meet your needs. That's why it's essential to take the time to research and understand the different types of plans available, including HMO and PPO plans. By doing so, you can ensure that you have the right coverage and avoid costly surprises down the line.

HMO Plans: What You Need to Know

One of the benefits of HMO plans is that they often have lower deductibles and copays compared to PPO plans. This means that you'll pay less out-of-pocket for medical care, which can be a significant advantage for those who require frequent medical attention. Additionally, HMO plans often have a stronger focus on preventive care, which can help you stay healthy and avoid costly medical bills down the line.

Benefits of HMO Plans

Some of the benefits of HMO plans include: * Lower premiums and out-of-pocket costs * Stronger focus on preventive care * Lower deductibles and copays * Simplified billing and administrationHowever, HMO plans also have some drawbacks. For example, you may be required to choose a PCP from the plan's network, and you may need a referral from your PCP to see a specialist. Additionally, HMO plans often have limited coverage for out-of-network care, which can be a disadvantage if you need to see a specialist who is not part of the plan's network.

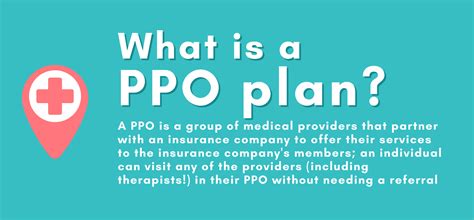

PPO Plans: What You Need to Know

One of the benefits of PPO plans is that they often have a larger network of providers, which can be a significant advantage if you need to see a specialist who is not part of an HMO plan's network. Additionally, PPO plans often have more comprehensive coverage for out-of-network care, which can be a lifesaver if you need to see a doctor who is not part of the plan's network.

Benefits of PPO Plans

Some of the benefits of PPO plans include: * Greater flexibility and choice * Larger network of providers * More comprehensive coverage for out-of-network care * No requirement for a PCP referral to see a specialistHowever, PPO plans also have some drawbacks. For example, they often have higher premiums and out-of-pocket costs compared to HMO plans. Additionally, PPO plans may have higher deductibles and copays, which can be a disadvantage for those who require frequent medical attention.

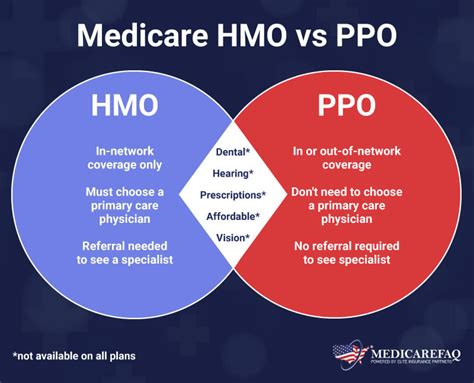

Key Differences Between HMO and PPO Plans

Another key difference is the level of coverage for out-of-network care. HMO plans often have limited coverage for out-of-network care, while PPO plans often have more comprehensive coverage. This can be a significant advantage if you need to see a specialist who is not part of an HMO plan's network.

Comparison of HMO and PPO Plans

Here is a comparison of HMO and PPO plans: * HMO plans: Lower premiums, lower out-of-pocket costs, stronger focus on preventive care, limited coverage for out-of-network care * PPO plans: Higher premiums, higher out-of-pocket costs, greater flexibility and choice, more comprehensive coverage for out-of-network careTips for Choosing Between HMO and PPO Plans

Second, consider the level of coverage for out-of-network care. If you need to see a specialist who is not part of an HMO plan's network, a PPO plan may be the better choice.

Third, consider the level of preventive care. If you are interested in staying healthy and avoiding costly medical bills, an HMO plan may be the better choice.

Final Tips

Here are some final tips for choosing between HMO and PPO plans: * Consider your budget and healthcare needs * Consider the level of coverage for out-of-network care * Consider the level of preventive care * Read the fine print and ask questions before making a decisionCommon Mistakes to Avoid

Another common mistake is not considering the level of coverage for out-of-network care. This can be a significant disadvantage if you need to see a specialist who is not part of an HMO plan's network.

Avoiding Mistakes

Here are some tips for avoiding common mistakes: * Read the fine print and understand the terms of the plan * Consider the level of coverage for out-of-network care * Ask questions and seek advice from a healthcare professionalConclusion and Next Steps

If you're still unsure about which plan to choose, consider seeking advice from a healthcare professional or insurance expert. They can help you navigate the complex world of health insurance and ensure that you have the right coverage for your needs.

We hope this article has provided you with valuable insights and tips for choosing between HMO and PPO plans. Remember to always read the fine print, consider your budget and healthcare needs, and ask questions before making a decision.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of flexibility and choice. HMO plans require you to receive medical care from a specific network of providers, while PPO plans allow you to choose any healthcare provider you want, both in-network and out-of-network.

Which plan is better for someone on a tight budget?

+HMO plans are often better for someone on a tight budget, as they tend to have lower premiums and out-of-pocket costs. However, it's essential to consider your healthcare needs and the level of coverage for out-of-network care before making a decision.

Can I see a specialist with an HMO plan?

+Yes, you can see a specialist with an HMO plan, but you may need a referral from your primary care physician (PCP). Additionally, HMO plans often have limited coverage for out-of-network care, so it's essential to check with your plan before seeing a specialist who is not part of the network.