Intro

Discover key differences between HMO and PPO health plans, including network flexibility, out-of-pocket costs, and provider choice, to make informed decisions about your healthcare coverage and insurance needs.

Health insurance plans are designed to provide financial protection against medical expenses, and there are various types of plans available in the market. Two of the most popular types of health insurance plans are Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO). Understanding the differences between HMO and PPO plans is crucial to make an informed decision when selecting a health insurance plan. In this article, we will delve into the details of HMO and PPO plans, highlighting their key features, benefits, and drawbacks.

The importance of choosing the right health insurance plan cannot be overstated. A good health insurance plan can provide peace of mind, financial security, and access to quality healthcare services. On the other hand, a poorly chosen plan can lead to unexpected medical bills, limited access to healthcare services, and financial hardship. With the rising cost of healthcare, it is essential to carefully evaluate the features and benefits of different health insurance plans before making a decision.

When it comes to HMO and PPO plans, there are significant differences that can impact the quality and cost of healthcare services. HMO plans are known for their affordability and simplicity, while PPO plans offer more flexibility and freedom to choose healthcare providers. In the following sections, we will explore the key differences between HMO and PPO plans, including their network structures, coverage options, out-of-pocket costs, and provider selection.

HMO Plan Overview

HMO Plan Benefits

The benefits of HMO plans include lower premiums, comprehensive coverage, and a focus on preventive care. HMO plans are often less expensive than PPO plans, making them an attractive option for individuals and families on a budget. Additionally, HMO plans provide comprehensive coverage for medical services, including doctor visits, hospital stays, and prescription medications.PPO Plan Overview

PPO Plan Benefits

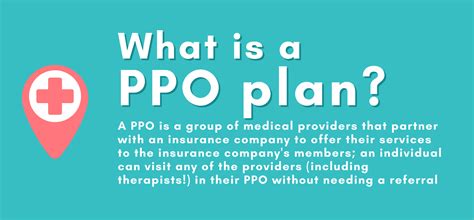

The benefits of PPO plans include more flexibility, out-of-network coverage, and higher quality care. PPO plans allow plan members to see any healthcare provider, both in-network and out-of-network, without a referral from a PCP. Additionally, PPO plans provide coverage for out-of-network services, although at a higher cost.Key Differences Between HMO and PPO Plans

Network Structure

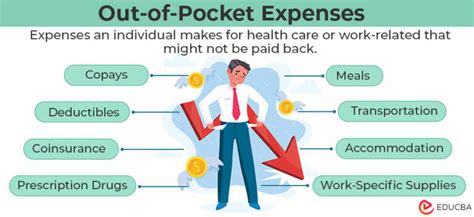

HMO plans have a more restrictive network structure, requiring plan members to receive medical care from participating providers. In contrast, PPO plans have a more flexible network structure, allowing plan members to see any healthcare provider. The network structure of HMO plans can limit access to specialized care, while PPO plans provide more freedom to choose healthcare providers.Out-of-Pocket Costs

Provider Selection

Provider selection is another key difference between HMO and PPO plans. HMO plans require plan members to choose a PCP who coordinates medical care, while PPO plans allow plan members to see any healthcare provider without a referral. The provider selection process can impact the quality of care, with HMO plans focusing on preventive care and PPO plans providing more flexibility to choose specialized care.Choosing Between HMO and PPO Plans

Considerations for Choosing a Health Insurance Plan

When choosing a health insurance plan, it is essential to consider several factors, including network structure, coverage options, out-of-pocket costs, and provider selection. Additionally, plan members should evaluate their health status, budget, and personal preferences to determine the best plan for their needs.Conclusion and Next Steps

We invite you to share your thoughts and experiences with HMO and PPO plans in the comments section below. If you found this article helpful, please share it with your friends and family who may be evaluating health insurance plans. Additionally, if you have any questions or concerns about HMO and PPO plans, please do not hesitate to ask.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the network structure. HMO plans have a more restrictive network structure, requiring plan members to receive medical care from participating providers, while PPO plans have a more flexible network structure, allowing plan members to see any healthcare provider.

Which plan is more suitable for individuals with chronic health conditions?

+PPO plans may be more suitable for individuals with chronic health conditions, as they provide more flexibility to choose healthcare providers and offer out-of-network coverage. However, HMO plans can also provide comprehensive coverage for chronic health conditions, and the choice ultimately depends on individual circumstances and preferences.

Can I change from an HMO plan to a PPO plan?

+Yes, you can change from an HMO plan to a PPO plan, but the process and availability may vary depending on your location, employer, and individual circumstances. It is essential to evaluate your options carefully and consider factors such as network structure, coverage options, and out-of-pocket costs before making a decision.