Signing up for Medicare can be a daunting task, especially for those who are new to the program. With various plans and options available, it's essential to understand the process and make informed decisions. In this article, we will delve into the world of Medicare, exploring its importance, benefits, and providing valuable tips for a seamless sign-up experience.

The Medicare program is a federal health insurance program primarily designed for individuals 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). It plays a vital role in ensuring that millions of Americans have access to quality healthcare. Understanding the intricacies of Medicare is crucial, as it can significantly impact one's health and financial well-being.

As people approach retirement age or become eligible for Medicare, they often find themselves overwhelmed by the numerous options and complexities of the program. The sign-up process can be particularly challenging, with many individuals unsure of where to start or how to navigate the system. However, with the right guidance and knowledge, signing up for Medicare can be a relatively straightforward process. In the following sections, we will explore the key aspects of Medicare and provide practical tips for a successful enrollment.

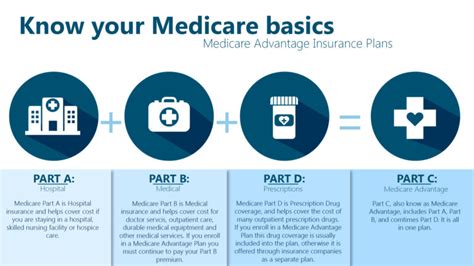

Understanding Medicare Basics

To make informed decisions about Medicare, it's essential to understand the different parts of the program. Medicare is divided into four main parts: Part A, Part B, Part C, and Part D. Each part covers specific healthcare services, and understanding these differences is crucial for choosing the right plan. Part A covers hospital stays, skilled nursing care, and hospice care, while Part B covers doctor visits, outpatient care, and medical equipment. Part C, also known as Medicare Advantage, combines the benefits of Part A and Part B, often with additional coverage for vision, dental, and hearing services. Part D, on the other hand, provides prescription drug coverage.

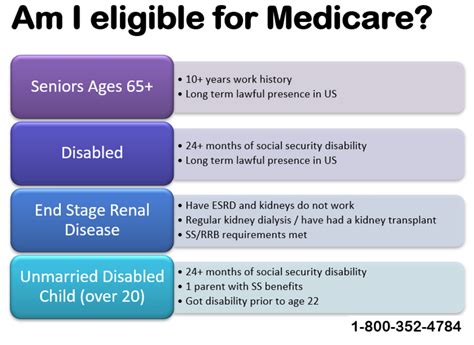

Medicare Eligibility and Enrollment

To be eligible for Medicare, individuals must meet specific requirements. Generally, people 65 or older are eligible, as well as certain younger individuals with disabilities or End-Stage Renal Disease. The enrollment process typically begins three months before one's 65th birthday and ends three months after. It's crucial to enroll during this initial enrollment period to avoid potential penalties or gaps in coverage. There are also special enrollment periods for individuals who miss the initial enrollment period or experience certain life events, such as losing employer coverage or moving to a new area.

Choosing the Right Medicare Plan

With numerous Medicare plans available, choosing the right one can be overwhelming. It's essential to consider individual healthcare needs, budget, and lifestyle when selecting a plan. Medicare Advantage plans, for example, may offer additional benefits like vision, dental, and hearing coverage, but may also have more restrictive provider networks. On the other hand, Original Medicare (Part A and Part B) provides more flexibility in terms of provider choice but may require additional supplemental coverage. Carefully evaluating the pros and cons of each plan and considering factors like out-of-pocket costs, copays, and deductibles can help individuals make informed decisions.

Medicare Sign-Up Tips

Here are five valuable tips for a successful Medicare sign-up experience:

* Start early: Begin researching and preparing for Medicare enrollment at least three months before turning 65 or becoming eligible.

* Understand the different parts of Medicare: Familiarize yourself with the various parts of Medicare, including Part A, Part B, Part C, and Part D, to make informed decisions about your coverage.

* Evaluate your healthcare needs: Consider your individual healthcare needs, including any pre-existing conditions or ongoing treatments, when choosing a Medicare plan.

* Compare plans and prices: Research and compare different Medicare plans, including their coverage, costs, and provider networks, to find the best fit for your needs and budget.

* Seek professional guidance: If needed, consult with a licensed insurance agent or Medicare counselor to help navigate the sign-up process and ensure you're making the most of your Medicare benefits.

Medicare Supplemental Insurance

For individuals who choose Original Medicare, supplemental insurance can help fill gaps in coverage. Medicare Supplement Insurance, also known as Medigap, can help cover out-of-pocket costs like copays, deductibles, and coinsurance. There are ten standardized Medigap plans available, each offering different levels of coverage. It's essential to carefully evaluate these plans and consider factors like premium costs, coverage, and provider networks when selecting a supplemental insurance plan.

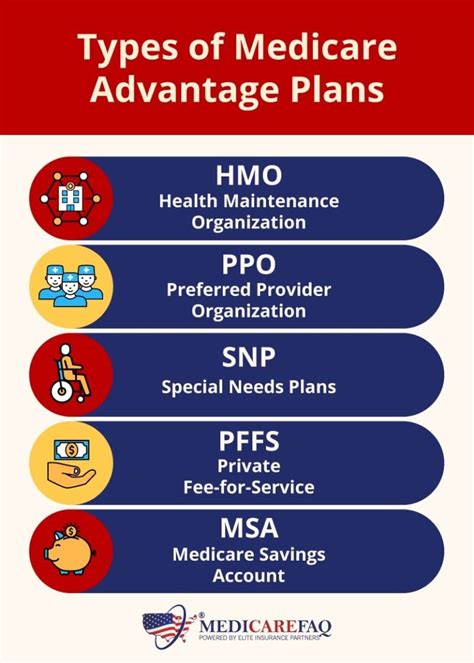

Medicare Advantage Plans

Medicare Advantage plans, also known as Part C, offer an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and often provide additional benefits like vision, dental, and hearing coverage. Medicare Advantage plans may have more restrictive provider networks, but they can also offer more comprehensive coverage and lower out-of-pocket costs. When evaluating Medicare Advantage plans, it's crucial to consider factors like network providers, coverage, and costs to ensure the plan meets your individual healthcare needs.

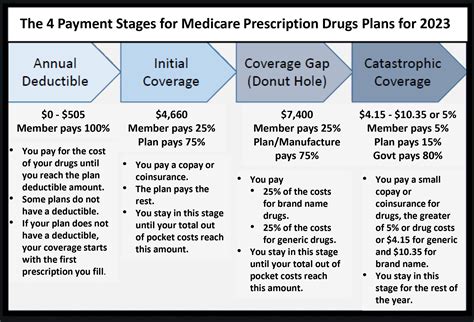

Medicare Prescription Drug Coverage

Medicare Part D provides prescription drug coverage for individuals with Medicare. There are two types of Part D plans: stand-alone prescription drug plans (PDPs) and Medicare Advantage prescription drug plans (MA-PDs). When choosing a Part D plan, it's essential to consider factors like the plan's formulary (list of covered medications), copays, and deductibles. Additionally, individuals should evaluate the plan's pharmacy network and mail-order prescription options to ensure convenient access to necessary medications.

Medicare and Employer Coverage

For individuals who are still working or have employer-sponsored health coverage, it's essential to understand how Medicare interacts with these plans. In general, Medicare is the primary payer for individuals 65 or older, while employer coverage is the secondary payer. However, this can vary depending on the size of the employer and the type of coverage. It's crucial to coordinate Medicare and employer coverage to avoid gaps in coverage and ensure seamless healthcare access.

Medicare Resources and Support

Navigating the Medicare system can be complex, but there are numerous resources available to provide support and guidance. The Medicare website (medicare.gov) offers a wealth of information on Medicare plans, coverage, and enrollment. Additionally, individuals can contact the Medicare hotline (1-800-MEDICARE) for personalized assistance. Local Area Agencies on Aging (AAAs) and State Health Insurance Assistance Programs (SHIPs) also provide free counseling and support to help individuals make informed decisions about their Medicare coverage.

What is the difference between Medicare Part A and Part B?

+

Medicare Part A covers hospital stays, skilled nursing care, and hospice care, while Part B covers doctor visits, outpatient care, and medical equipment.

Can I enroll in Medicare if I'm still working?

+

Yes, you can enroll in Medicare if you're still working, but you may need to coordinate your Medicare coverage with your employer-sponsored health plan.

What is Medicare Advantage, and how does it differ from Original Medicare?

+

Medicare Advantage, also known as Part C, is a type of Medicare plan offered by private insurance companies that combines the benefits of Part A and Part B, often with additional coverage for vision, dental, and hearing services.

In conclusion, signing up for Medicare requires careful consideration and planning. By understanding the different parts of Medicare, evaluating individual healthcare needs, and seeking professional guidance, individuals can navigate the sign-up process with confidence. Remember to start early, compare plans and prices, and take advantage of available resources and support to ensure a seamless transition into the Medicare program. We invite you to share your thoughts and experiences with Medicare in the comments below, and don't forget to share this article with friends and family who may be approaching Medicare eligibility.