Intro

Get informed with 5 US health insurance tips, covering affordable care, medical coverage, and policy benefits, to make informed decisions on healthcare plans and insurance options.

The US health insurance landscape can be complex and overwhelming, with numerous options and factors to consider. Understanding the intricacies of health insurance is crucial for individuals and families to make informed decisions about their healthcare coverage. In this article, we will delve into the world of US health insurance, exploring key aspects, benefits, and tips to help navigate this intricate system.

Health insurance is a vital component of overall well-being, providing financial protection against medical expenses that can arise from unexpected illnesses, injuries, or routine care. The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted the health insurance market, expanding coverage to millions of Americans. However, with the numerous plans and providers available, selecting the right health insurance can be daunting. It is essential to approach this decision with a clear understanding of the options, benefits, and potential drawbacks.

The importance of health insurance cannot be overstated. It not only ensures access to necessary medical care but also protects individuals and families from financial ruin due to medical bills. The US health insurance system is multifaceted, with various types of plans, including employer-sponsored insurance, individual and family plans, Medicare, Medicaid, and the Children's Health Insurance Program (CHIP). Each of these options has its eligibility criteria, coverage levels, and costs, making it critical for consumers to research and compare plans carefully.

Understanding Health Insurance Plans

Key Components of Health Insurance Plans

When evaluating health insurance plans, several key components must be considered, including premiums, deductibles, copays, coinsurance, and out-of-pocket maximums. Premiums are the monthly payments made to maintain coverage. Deductibles are the amounts policyholders must pay out of pocket before the insurance plan begins to cover medical expenses. Copays are fixed amounts paid for specific healthcare services, such as doctor visits or prescription medications. Coinsurance refers to the percentage of medical expenses paid by the policyholder after meeting the deductible. Finally, the out-of-pocket maximum is the highest amount an individual or family must pay for healthcare expenses within a calendar year, excluding premiums.Choosing the Right Health Insurance Plan

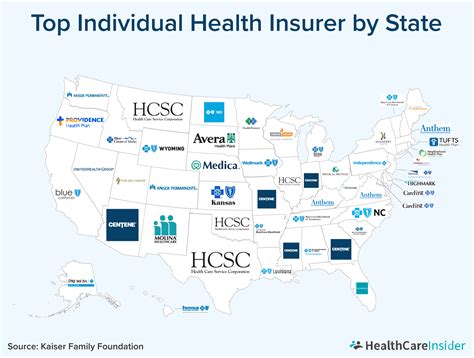

Evaluating Health Insurance Providers

Evaluating health insurance providers is another critical step in the selection process. This involves researching the provider's reputation, customer service, claim processing efficiency, and network of healthcare professionals. Policyholders should also review the plan's coverage of essential health benefits, including emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, laboratory services, preventive and wellness services, and pediatric services.5 US Health Insurance Tips

-

Understand Your Health Needs: Before selecting a health insurance plan, it is essential to have a clear understanding of your health needs and those of your family. This includes considering any chronic conditions, anticipated medical expenses, and the importance of having access to specific healthcare providers or services.

-

Compare Plans Carefully: With numerous health insurance plans available, comparing them based on coverage, costs, and provider networks is crucial. Utilizing online marketplaces or consulting with a licensed insurance agent can facilitate this process and help identify the most suitable plan.

-

Consider Preventive Care: Many health insurance plans cover preventive care services without additional cost to the policyholder. Understanding what preventive services are covered can help individuals stay healthy and avoid more severe health issues down the line.

-

Review Plan Documents: Once enrolled in a health insurance plan, it is vital to review the plan documents carefully. This includes understanding the plan's benefits, limitations, and exclusions, as well as the process for filing claims and appealing denied services.

-

Seek Professional Advice: For those overwhelmed by the health insurance selection process, seeking advice from a licensed insurance professional can be highly beneficial. These experts can provide personalized guidance based on individual circumstances and help navigate the complexities of the health insurance market.

Health Insurance and Financial Planning

Managing Healthcare Costs

Managing healthcare costs is a challenge many individuals and families face. This can involve negotiating medical bills, seeking financial assistance programs offered by healthcare providers or pharmaceutical companies, and utilizing tax-advantaged health savings accounts (HSAs) or flexible spending accounts (FSAs) to pay for medical expenses with pre-tax dollars. Staying informed about healthcare costs, preventive care options, and available financial resources can help mitigate the financial impact of medical care.Future of US Health Insurance

Emerging Trends in Health Insurance

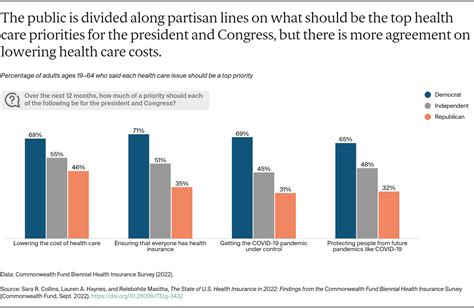

Several emerging trends are expected to influence the health insurance market, including the growth of telehealth services, increased focus on preventive and personalized medicine, and the integration of artificial intelligence and data analytics to improve healthcare outcomes and efficiency. Additionally, there may be continued discussions about policy reforms aimed at expanding coverage, reducing costs, and improving the overall quality of healthcare services.What is the main purpose of health insurance?

+The main purpose of health insurance is to provide financial protection against medical expenses, ensuring access to necessary healthcare services without causing financial hardship.

How do I choose the right health insurance plan?

+Choosing the right health insurance plan involves considering your health needs, budget, and preferences regarding healthcare providers and services. It is also essential to compare different plans based on coverage, costs, and network of providers.

What are the benefits of preventive care in health insurance plans?

+The benefits of preventive care in health insurance plans include early detection and treatment of health issues, reduction in the risk of chronic diseases, and overall improvement in health and well-being, often at no additional cost to the policyholder.

In conclusion, navigating the US health insurance system requires a thorough understanding of available options, careful consideration of personal health needs, and a strategic approach to selecting and utilizing health insurance plans. By staying informed, evaluating plans meticulously, and seeking professional advice when needed, individuals and families can make the most of their health insurance coverage, ensuring they receive the medical care they need while protecting their financial well-being. We invite readers to share their experiences and insights about health insurance, and we look forward to continuing the conversation on this critical aspect of healthcare.