Intro

Discover expert 5 Washington Insurance Tips, including liability coverage, premium rates, and policy comparisons, to make informed decisions about auto, health, and home insurance in Washington state.

In the state of Washington, having the right insurance coverage is crucial for protecting your assets, health, and well-being. With so many insurance options available, it can be overwhelming to navigate the complex world of insurance policies. However, by understanding the key aspects of insurance and following expert tips, you can make informed decisions that benefit you and your loved ones. Whether you're a resident of Seattle, Spokane, or any other city in Washington, it's essential to stay informed about the latest insurance trends and regulations. By doing so, you can ensure that you're adequately protected against unforeseen events and financial losses.

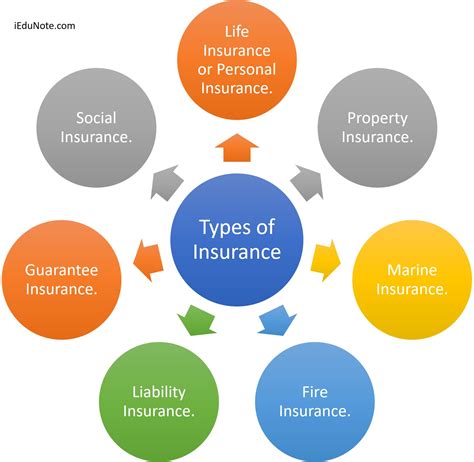

The importance of insurance cannot be overstated, as it provides a safety net for individuals and families during difficult times. From health insurance to auto insurance, each type of policy serves a unique purpose and offers distinct benefits. In Washington, insurance companies offer a wide range of policies, each with its own set of features, premiums, and deductibles. To make the most of your insurance coverage, it's crucial to understand the intricacies of each policy and choose the one that best suits your needs. By doing so, you can enjoy peace of mind, knowing that you're protected against life's uncertainties.

In recent years, the insurance landscape in Washington has undergone significant changes, with new regulations and policies emerging to address the evolving needs of residents. As a result, it's more important than ever to stay up-to-date with the latest developments and trends in the insurance industry. By doing so, you can ensure that you're taking advantage of the best insurance options available and avoiding potential pitfalls. Whether you're a seasoned insurance expert or just starting to explore your options, it's essential to approach the topic with a clear understanding of the key concepts and principles involved.

Understanding Washington Insurance Laws

Key Aspects of Washington Insurance Laws

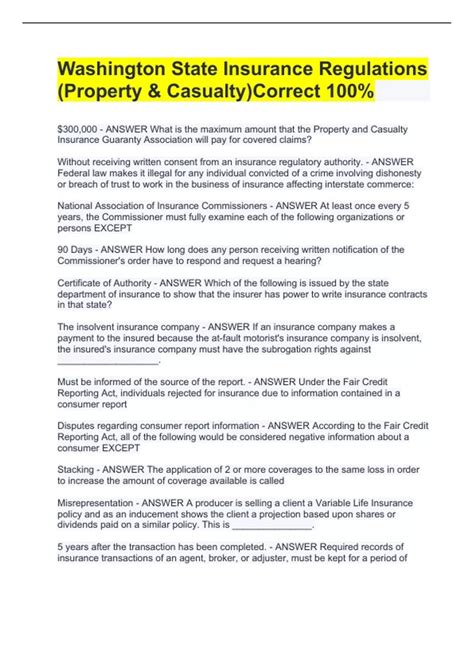

Some of the key aspects of Washington insurance laws include: * Policy cancellations: Insurance companies must provide written notice to policyholders before cancelling a policy. * Claims settlements: Insurance companies must settle claims fairly and promptly, and provide clear explanations for any denials or delays. * Policy language: Insurance companies must use clear and concise language in their policies, avoiding ambiguity and confusion. * Consumer protection: Washington law provides strong consumer protection provisions, including regulations against unfair claims settlement practices and policy cancellations.Types of Insurance in Washington

Benefits of Each Type of Insurance

Each type of insurance offers unique benefits and advantages, including: * Health insurance: Provides access to essential medical care and services, helping to prevent and treat illnesses. * Auto insurance: Offers financial protection against car accidents and other events, helping to repair or replace your vehicle. * Homeowners insurance: Protects your home and personal property against damages and losses, providing peace of mind and financial security. * Life insurance: Provides a death benefit to your loved ones, helping to ensure their financial well-being and security. * Disability insurance: Offers income replacement benefits, helping to maintain your standard of living if you become unable to work.Washington Insurance Tips

Additional Tips for Washington Residents

Some additional tips for Washington residents include: * Take advantage of Washington's insurance regulations: The state's laws and regulations are designed to protect consumers, so be sure to take advantage of them. * Consider working with an independent insurance agent: Independent agents can help you compare policies and find the best coverage for your needs. * Don't be afraid to file a complaint: If you have a dispute with your insurance company, don't be afraid to file a complaint with the Washington State Office of the Insurance Commissioner.Washington Insurance Companies

How to Choose the Right Insurance Company

When choosing an insurance company in Washington, consider the following factors: * Financial stability: Look for companies with strong financial ratings and a history of stability. * Customer service: Choose a company with a reputation for excellent customer service and support. * Policy options: Consider the range of policies and coverage options available, and choose a company that meets your needs. * Price: Compare prices and premiums from multiple companies to find the best rates.Washington Insurance FAQs

What is the minimum auto insurance coverage required in Washington?

+In Washington, the minimum auto insurance coverage required is $25,000 for bodily injury or death of one person, $50,000 for bodily injury or death of two or more people, and $10,000 for property damage.

Can I purchase health insurance through the Washington Healthplanfinder?

+Yes, you can purchase health insurance through the Washington Healthplanfinder, which is the state's health insurance marketplace.

How do I file a complaint against an insurance company in Washington?

+You can file a complaint against an insurance company in Washington by contacting the Washington State Office of the Insurance Commissioner.

In conclusion, navigating the world of insurance in Washington can be complex and overwhelming, but by following expert tips and advice, you can make informed decisions about your coverage. Remember to shop around, read policy language carefully, and ask questions to ensure that you're getting the best possible rates and coverage. By staying informed and taking advantage of Washington's insurance regulations, you can enjoy peace of mind and financial security, knowing that you're protected against life's uncertainties. We invite you to share your thoughts and experiences with insurance in Washington, and to ask any questions you may have about this topic. Your feedback and engagement are invaluable in helping us provide the best possible information and resources for Washington residents.