Intro

Discover 5 key facts about FSA accounts, including flexible spending, medical expenses, and tax benefits, to maximize your healthcare savings and minimize costs with these specialized savings accounts.

The world of health savings is complex, and one of the most effective ways to manage medical expenses is through a Flexible Spending Account (FSA). An FSA is an employer-sponsored savings account that allows employees to set aside a portion of their income on a pre-tax basis to pay for qualified medical expenses. This innovative financial tool has been a cornerstone of employee benefits packages for decades, providing a tax-advantaged way to save for healthcare costs. Understanding the intricacies of an FSA can help individuals make the most out of this valuable benefit, ensuring they are well-equipped to handle unexpected medical bills and routine healthcare expenses alike.

FSAs are particularly appealing due to their potential to reduce taxable income, thereby lowering the amount of income taxes owed. By contributing to an FSA, individuals can allocate a portion of their salary to a dedicated account before taxes are applied, which can lead to significant savings over the course of a year. Moreover, the funds in an FSA can be used to cover a wide range of healthcare expenses, from doctor visits and prescriptions to glasses and dental care, making it a versatile tool for managing health-related costs.

The flexibility and benefits of FSAs have made them a popular choice among employees looking to optimize their healthcare spending. However, navigating the rules and regulations surrounding these accounts can be daunting. From understanding the annual contribution limits to grasping the nuances of eligible expenses, there is a lot to consider when utilizing an FSA. Furthermore, the implementation of the Affordable Care Act and other healthcare reforms has introduced new considerations for individuals and employers alike, highlighting the need for clear guidance on how to leverage FSAs effectively in the modern healthcare landscape.

Introduction to FSAs

An FSA is essentially a tax-advantaged financial account that can be used to pay for certain out-of-pocket healthcare expenses. The funds contributed to an FSA are deducted from an employee's paycheck before income taxes are applied, reducing taxable income and, by extension, lowering the amount of taxes owed. This pre-tax treatment of contributions makes FSAs an attractive option for individuals looking to minimize their tax liability while also setting aside money for medical expenses.

Key Benefits of FSAs

The primary benefits of FSAs include tax savings, flexibility in covering a wide range of healthcare expenses, and the ability to reduce out-of-pocket medical costs. By contributing pre-tax dollars to an FSA, individuals can lower their taxable income, which may result in a lower tax bracket and overall tax savings. Additionally, FSAs can be used to pay for expenses that are not covered by health insurance, such as copays, deductibles, and certain medical equipment, providing a financial cushion against unexpected healthcare costs.How FSAs Work

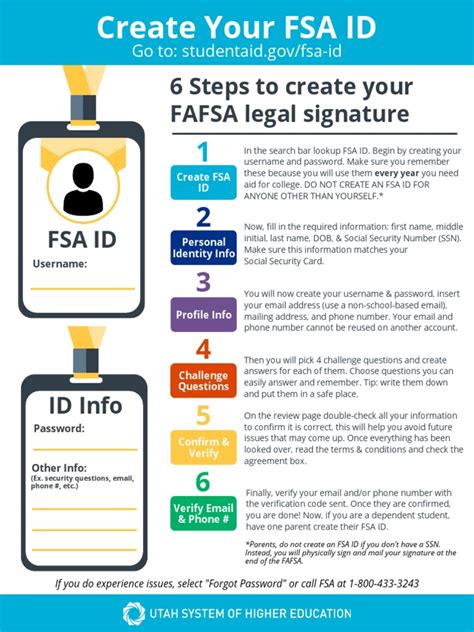

The process of enrolling in and using an FSA is relatively straightforward. Typically, employers offer FSAs as part of their benefits package, and employees can elect to participate during open enrollment periods. Once enrolled, employees decide how much of their salary they wish to contribute to their FSA for the year, up to the annual limit set by the IRS. These contributions are then deducted from their paychecks in equal amounts throughout the year.

Eligible Expenses

FSAs can be used to cover a variety of healthcare expenses, including but not limited to: - Doctor visits and copays - Prescription medications - Dental care, including routine cleanings and orthodontia - Vision care, including glasses, contacts, and eye exams - Medical equipment and supplies Understanding what expenses are eligible for reimbursement through an FSA is crucial for maximizing the benefits of this account. It's also important to note that the IRS sets guidelines for eligible expenses, and not all healthcare-related costs qualify.FSA Contribution Limits

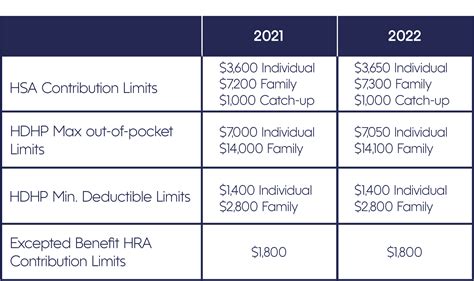

Each year, the IRS announces the annual contribution limits for FSAs. These limits are subject to change and are typically adjusted for inflation. For the current year, individuals can contribute up to a certain amount to their healthcare FSA. It's essential for participants to review and understand these limits to plan their contributions effectively and avoid any potential penalties associated with exceeding the limits.

Use-It-or-Lose-It Rule

One of the critical aspects of FSAs is the use-it-or-lose-it rule, which states that any unused funds in an FSA at the end of the plan year are forfeited. However, some employers offer a grace period or the option to carry over a limited amount to the next plan year, providing some flexibility. Understanding these rules is vital to ensure that contributions are utilized effectively and to minimize the risk of losing funds.Managing FSA Funds

Effective management of FSA funds involves careful planning and tracking of expenses throughout the year. Participants should keep receipts and records of all eligible expenses, as these will be required to substantiate claims for reimbursement. Additionally, understanding the process for submitting claims and the timeframe for doing so is crucial to ensure timely reimbursement and to avoid any issues with the use-it-or-lose-it rule.

Best Practices for FSA Participants

To get the most out of an FSA, participants should: - Plan contributions carefully based on anticipated healthcare expenses. - Keep detailed records of all medical expenses. - Submit claims promptly to avoid missing deadlines. - Consider the carryover or grace period options, if available, to minimize the risk of losing funds.Evolution of FSAs

Over the years, FSAs have evolved to better meet the needs of employees and employers. Changes in healthcare legislation, such as the Affordable Care Act, have introduced new considerations for FSA design and administration. Additionally, advancements in technology have streamlined the process of managing FSA accounts, making it easier for participants to track expenses, submit claims, and access their account information online.

Future of FSAs

As the healthcare landscape continues to evolve, the role of FSAs in employee benefits packages is likely to remain significant. Employers and employees alike value the tax advantages and flexibility that FSAs provide. Looking ahead, there may be further changes to FSA rules and regulations, potentially expanding the types of expenses that can be covered or adjusting contribution limits in response to economic conditions.Conclusion and Next Steps

In conclusion, FSAs offer a valuable tool for managing healthcare expenses, providing tax savings and flexibility in covering a wide range of medical costs. By understanding the benefits, rules, and best practices associated with FSAs, individuals can make informed decisions about their healthcare spending and maximize the advantages of these accounts. Whether you're considering enrolling in an FSA for the first time or looking to optimize your current account, taking the time to learn about these accounts can lead to significant financial benefits.

We invite you to share your experiences and questions about FSAs in the comments below. How have you utilized your FSA to manage healthcare expenses? What challenges have you faced, and how have you overcome them? Your insights can help others navigate the complexities of FSAs and make the most of this valuable employee benefit.

What is the main advantage of using an FSA?

+The main advantage of using an FSA is the ability to set aside pre-tax dollars for healthcare expenses, reducing taxable income and lowering the amount of taxes owed.

Can FSA funds be used for any healthcare expense?

+No, FSA funds can only be used for eligible healthcare expenses as defined by the IRS. This includes expenses such as doctor visits, prescriptions, glasses, and dental care, but excludes expenses like gym memberships and cosmetic procedures.

What happens to unused FSA funds at the end of the plan year?

+Unused FSA funds are typically subject to the use-it-or-lose-it rule, meaning they are forfeited at the end of the plan year. However, some employers offer a grace period or the option to carry over a limited amount to the next plan year.