Intro

Discover the ins and outs of High Deductible Health Plans, including benefits, drawbacks, and eligibility for Health Savings Accounts, to make informed decisions about your healthcare coverage and medical expenses.

The world of health insurance can be complex and overwhelming, with numerous options and plans available to consumers. One type of plan that has gained popularity in recent years is the High Deductible Health Plan (HDHP). But what exactly is an HDHP, and how does it work? In this article, we will delve into the details of HDHPs, exploring their benefits, drawbacks, and everything in between. Whether you're a seasoned insurance expert or a newcomer to the world of health coverage, this article aims to provide a comprehensive understanding of HDHPs and their role in the modern healthcare landscape.

As healthcare costs continue to rise, consumers are looking for ways to reduce their expenses while still maintaining adequate coverage. HDHPs have emerged as a popular solution, offering lower premiums in exchange for higher deductibles. But what does this mean for individuals and families, and how can they make the most of these plans? To answer these questions, we'll need to take a closer look at the inner workings of HDHPs, including their benefits, limitations, and potential drawbacks.

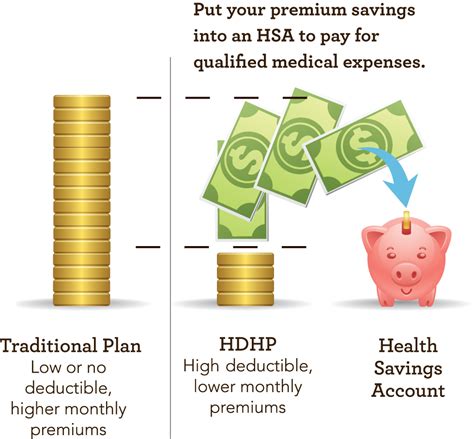

The concept of HDHPs is simple: in exchange for lower monthly premiums, policyholders agree to pay a higher deductible, which is the amount they must pay out-of-pocket before their insurance coverage kicks in. This can be a daunting prospect, especially for those who are used to more traditional health insurance plans with lower deductibles. However, HDHPs also offer a range of benefits, including lower premiums, access to Health Savings Accounts (HSAs), and greater control over healthcare spending. As we explore the world of HDHPs, we'll examine these benefits in more detail, as well as the potential drawbacks and limitations of these plans.

What is a High Deductible Health Plan?

Key Characteristics of HDHPs

To qualify as an HDHP, a plan must meet certain criteria, including: * A higher deductible than traditional plans * Lower monthly premiums * Access to a Health Savings Account (HSA) * A maximum out-of-pocket limit, which is the maximum amount that policyholders must pay for healthcare expenses in a given year * Preventive care services, such as annual check-ups and screenings, are typically covered without requiring policyholders to meet the deductibleBenefits of High Deductible Health Plans

How HDHPs Work

Here's an example of how an HDHP might work: * Policyholder chooses an HDHP with a $2,000 deductible and a $5,000 maximum out-of-pocket limit. * Policyholder pays monthly premiums of $300. * Policyholder receives medical care and is billed $1,500. * Policyholder pays the $1,500 bill out-of-pocket, as they have not yet met their deductible. * Policyholder continues to receive medical care and eventually meets their deductible. * After meeting the deductible, the insurance company begins to pay for covered services, and the policyholder is responsible for paying a copayment or coinsurance.Drawbacks of High Deductible Health Plans

Who Are HDHPs Suitable For?

HDHPs are not suitable for everyone, but they can be a good option for: * Healthy individuals who do not require frequent medical care * Individuals and families who are looking to reduce their healthcare expenses * Those who are eligible for an HSA and want to take advantage of the tax benefits * Individuals and families who are willing and able to pay for services until they meet their deductibleHealth Savings Accounts (HSAs)

How HSAs Work

Here's an example of how an HSA might work: * Policyholder chooses an HDHP and opens an HSA. * Policyholder contributes $1,000 to their HSA. * Policyholder receives medical care and is billed $500. * Policyholder uses their HSA to pay for the $500 bill. * Policyholder continues to contribute to their HSA and uses the funds to pay for qualified medical expenses.Comparison of HDHPs and Traditional Health Insurance Plans

Key Differences

The key differences between HDHPs and traditional health insurance plans are: * Deductible: HDHPs have higher deductibles than traditional health insurance plans. * Premiums: HDHPs typically have lower monthly premiums than traditional health insurance plans. * HSA eligibility: HDHPs are eligible for HSAs, while traditional health insurance plans are not. * Provider networks: HDHPs may have limited provider networks, while traditional health insurance plans may have broader networks.Conclusion and Next Steps

If you're considering an HDHP, here are some next steps:

- Research different HDHP options and compare their features and benefits.

- Consider your healthcare needs and expenses to determine if an HDHP is right for you.

- Open an HSA to take advantage of the tax benefits and use the funds to pay for qualified medical expenses.

- Review and understand the terms of your HDHP, including the deductible, copayment, and coinsurance.

What is a High Deductible Health Plan?

+A High Deductible Health Plan is a type of health insurance plan that requires policyholders to pay a higher deductible than traditional plans.

What are the benefits of HDHPs?

+The benefits of HDHPs include lower monthly premiums, access to Health Savings Accounts (HSAs), and greater control over healthcare spending.

How do HSAs work?

+HSAs are a type of savings account that is designed to help individuals and families pay for qualified medical expenses. Contributions are tax-deductible, and funds can be used to pay for qualified medical expenses.

What is the difference between an HDHP and a traditional health insurance plan?

+The main difference between an HDHP and a traditional health insurance plan is the deductible. HDHPs have higher deductibles than traditional health insurance plans, but typically offer lower monthly premiums.

Who are HDHPs suitable for?

+HDHPs are suitable for healthy individuals and families who are looking to reduce their healthcare expenses. They may not be suitable for individuals and families who require frequent medical care or have high healthcare expenses.