Intro

Discover the benefits of HMO health plans, including affordable premiums, comprehensive coverage, and network providers, to make informed decisions about your healthcare needs and options.

The Health Maintenance Organization (HMO) health plan has been a cornerstone of the healthcare system for decades, offering a unique approach to healthcare delivery that emphasizes preventive care, cost containment, and comprehensive coverage. With its roots in the 1970s, the HMO model has evolved over the years, adapting to changing healthcare needs and regulatory requirements. In this article, we will delve into the world of HMO health plans, exploring their benefits, working mechanisms, and key aspects that make them an attractive option for individuals, families, and employers.

The importance of understanding HMO health plans cannot be overstated, as they play a crucial role in shaping the healthcare landscape. By providing a coordinated and comprehensive approach to healthcare, HMOs aim to improve health outcomes, reduce costs, and enhance patient satisfaction. As the healthcare industry continues to evolve, it is essential to examine the role of HMOs in this context, including their strengths, weaknesses, and future prospects.

The HMO health plan is a type of health insurance that provides coverage for a wide range of healthcare services, from routine check-ups and preventive care to hospitalizations and specialist treatments. At its core, the HMO model is designed to promote preventive care, encouraging individuals to take an active role in maintaining their health and well-being. By providing access to a network of healthcare providers, HMOs facilitate the delivery of high-quality, cost-effective care that meets the unique needs of each patient.

How Hmo Health Plans Work

To understand how HMO health plans work, it is essential to examine the key components of the model. These include:

- Network of providers: HMOs establish a network of healthcare providers, including primary care physicians, specialists, hospitals, and other healthcare facilities.

- Preventive care: HMOs emphasize preventive care, encouraging members to engage in routine check-ups, screenings, and health promotion activities.

- Referrals: In many HMO plans, members are required to obtain referrals from their primary care physician before seeing a specialist.

- Cost-sharing: HMO members typically pay a portion of the costs for healthcare services, including copayments, coinsurance, and deductibles.

Benefits Of Hmo Health Plans

The benefits of HMO health plans are numerous, making them an attractive option for individuals, families, and employers. Some of the key advantages include:- Cost savings: HMOs often offer lower premiums and out-of-pocket costs compared to other types of health insurance.

- Comprehensive coverage: HMOs provide coverage for a wide range of healthcare services, including preventive care, hospitalizations, and specialist treatments.

- Coordinated care: HMOs facilitate coordinated care, ensuring that members receive seamless, high-quality care from a network of healthcare providers.

- Preventive care emphasis: HMOs emphasize preventive care, encouraging members to engage in routine check-ups, screenings, and health promotion activities.

Types Of Hmo Health Plans

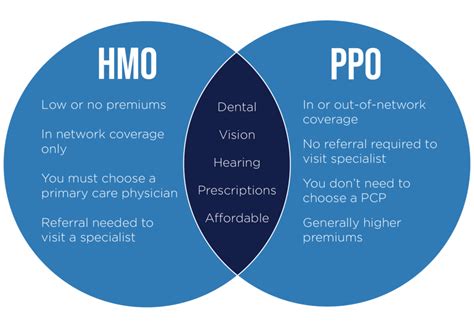

- Traditional HMO: This type of HMO plan requires members to receive care from in-network providers, with limited coverage for out-of-network services.

- Point-of-Service (POS) HMO: This type of HMO plan allows members to receive care from both in-network and out-of-network providers, with different levels of coverage and cost-sharing.

- Open-Access HMO: This type of HMO plan does not require referrals from primary care physicians, allowing members to see specialists directly.

Choosing The Right Hmo Health Plan

Choosing the right HMO health plan can be a daunting task, especially with the numerous options available. To make an informed decision, it is essential to consider several factors, including:- Network of providers: Ensure that the HMO plan includes a network of healthcare providers that meet your needs and preferences.

- Coverage and benefits: Evaluate the coverage and benefits offered by the HMO plan, including preventive care, hospitalizations, and specialist treatments.

- Cost-sharing: Consider the out-of-pocket costs associated with the HMO plan, including copayments, coinsurance, and deductibles.

- Referral requirements: Determine if the HMO plan requires referrals from primary care physicians before seeing specialists.

Advantages And Disadvantages Of Hmo Health Plans

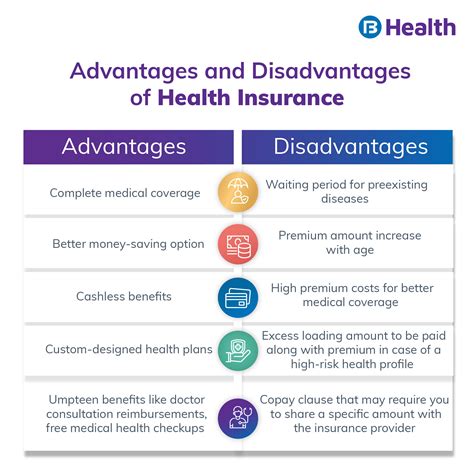

- Cost savings: HMOs often offer lower premiums and out-of-pocket costs compared to other types of health insurance.

- Comprehensive coverage: HMOs provide coverage for a wide range of healthcare services, including preventive care, hospitalizations, and specialist treatments.

- Coordinated care: HMOs facilitate coordinated care, ensuring that members receive seamless, high-quality care from a network of healthcare providers.

However, HMO health plans also have some drawbacks, including:

- Limited provider choice: HMOs often limit the choice of healthcare providers, requiring members to receive care from in-network providers.

- Referral requirements: Some HMO plans require referrals from primary care physicians before seeing specialists, which can be inconvenient and time-consuming.

- Out-of-network costs: HMOs often charge higher costs for out-of-network services, which can be a significant burden for members who need to see specialists or receive care from out-of-network providers.

Future Of Hmo Health Plans

The future of HMO health plans is uncertain, with the healthcare landscape undergoing significant changes. Some of the trends that are likely to shape the future of HMOs include:- Value-based care: The shift towards value-based care, which emphasizes quality and outcomes over volume and fees, is likely to impact the HMO model.

- Consumerism: The growing demand for consumer-centric healthcare, which emphasizes patient choice and empowerment, may lead to changes in the HMO model.

- Technological advancements: The increasing use of technology, including telehealth and digital health platforms, is likely to transform the HMO model and improve access to care.

Conclusion And Next Steps

We invite you to share your thoughts and experiences with HMO health plans in the comments section below. If you have any questions or need further clarification on any aspect of HMO health plans, please do not hesitate to ask. Additionally, we encourage you to share this article with others who may benefit from this information.

What is an HMO health plan?

+An HMO health plan is a type of health insurance that provides coverage for a wide range of healthcare services, from routine check-ups and preventive care to hospitalizations and specialist treatments.

How do HMO health plans work?

+HMO health plans operate on a network-based model, where members receive care from a designated group of healthcare providers who have contracted with the HMO.

What are the benefits of HMO health plans?

+The benefits of HMO health plans include cost savings, comprehensive coverage, coordinated care, and an emphasis on preventive care.