Intro

Compare HMO vs PPO plans, understanding network, deductible, and copay differences, to choose the best health insurance option for your needs, considering flexibility, costs, and coverage.

When it comes to health insurance, there are numerous options available, each with its own set of benefits and drawbacks. Two of the most popular types of health insurance plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans. Understanding the differences between these two types of plans is crucial in making an informed decision about which one is best for you and your family. In this article, we will delve into the world of HMO and PPO plans, exploring their characteristics, advantages, and disadvantages.

The importance of choosing the right health insurance plan cannot be overstated. With the rising costs of medical care, having a comprehensive health insurance plan can help protect you from financial ruin in the event of an unexpected illness or injury. Moreover, a good health insurance plan can provide you with access to quality healthcare, preventive care, and specialized treatments. Whether you are an individual, a family, or an employer looking to provide health insurance to your employees, understanding the differences between HMO and PPO plans is essential.

In recent years, the healthcare landscape has undergone significant changes, with the Affordable Care Act (ACA) introducing new regulations and requirements for health insurance plans. As a result, health insurance plans have become more complex, with a wider range of options available to consumers. HMO and PPO plans are two of the most popular types of health insurance plans, and they offer distinct benefits and drawbacks. By understanding the characteristics of each plan, you can make an informed decision about which one is best for your needs.

What is an HMO Plan?

An HMO plan is a type of health insurance plan that provides coverage for medical services within a specific network of healthcare providers. HMO plans are designed to provide comprehensive and coordinated care to members, with an emphasis on preventive care and early intervention. In an HMO plan, members typically select a primary care physician (PCP) who serves as their gatekeeper, coordinating their care and referring them to specialists as needed. HMO plans often have lower premiums than PPO plans, but they may have more restrictive network requirements and higher out-of-pocket costs for out-of-network care.

One of the key benefits of HMO plans is their focus on preventive care. HMO plans often cover routine check-ups, screenings, and vaccinations, which can help prevent illnesses and detect health problems early. Additionally, HMO plans may offer wellness programs and health education resources to help members manage chronic conditions and maintain a healthy lifestyle. However, HMO plans may have limited flexibility, as members are typically required to receive care from within the network, except in emergency situations.

How HMO Plans Work

HMO plans work by creating a network of healthcare providers who agree to provide care to members at a discounted rate. Members select a PCP who coordinates their care and refers them to specialists as needed. HMO plans often have a narrower network of providers than PPO plans, which can make it more difficult to find a provider who is part of the network. However, HMO plans may offer more comprehensive coverage for preventive care and chronic condition management.

Some of the key features of HMO plans include:

- Lower premiums compared to PPO plans

- Emphasis on preventive care and early intervention

- Narrower network of providers

- Requirement to select a primary care physician (PCP)

- Higher out-of-pocket costs for out-of-network care

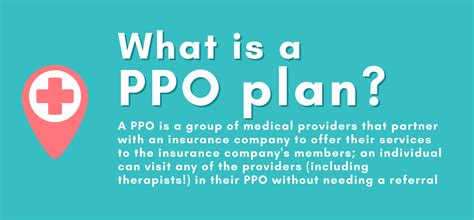

What is a PPO Plan?

A PPO plan is a type of health insurance plan that provides coverage for medical services both within and outside of a specific network of healthcare providers. PPO plans are designed to offer more flexibility and freedom of choice than HMO plans, with members able to receive care from any provider, both in-network and out-of-network. PPO plans often have higher premiums than HMO plans, but they may offer more comprehensive coverage and lower out-of-pocket costs for out-of-network care.

One of the key benefits of PPO plans is their flexibility. PPO plans allow members to receive care from any provider, without the need for a referral from a PCP. This can be particularly useful for members who have existing relationships with healthcare providers or who need to see a specialist without a referral. Additionally, PPO plans may offer more comprehensive coverage for out-of-network care, which can be beneficial for members who travel frequently or who need to receive care from a provider who is not part of the network.

How PPO Plans Work

PPO plans work by creating a network of healthcare providers who agree to provide care to members at a discounted rate. Members can receive care from any provider, both in-network and out-of-network, without the need for a referral from a PCP. PPO plans often have a broader network of providers than HMO plans, which can make it easier to find a provider who is part of the network. However, PPO plans may have higher premiums and higher out-of-pocket costs for out-of-network care.

Some of the key features of PPO plans include:

- Higher premiums compared to HMO plans

- More flexibility and freedom of choice

- Broader network of providers

- No requirement to select a primary care physician (PCP)

- Lower out-of-pocket costs for out-of-network care

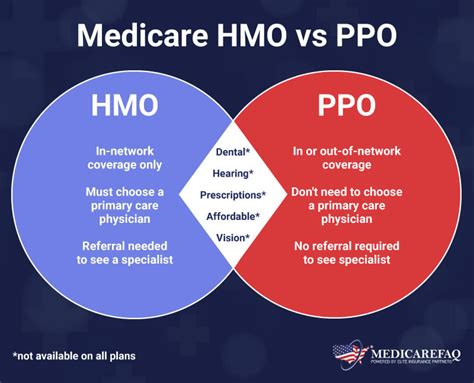

Key Differences Between HMO and PPO Plans

When it comes to choosing between an HMO and a PPO plan, there are several key differences to consider. Here are some of the main differences between the two types of plans:

- Network: HMO plans have a narrower network of providers than PPO plans, which can make it more difficult to find a provider who is part of the network.

- Referrals: HMO plans require members to select a PCP who coordinates their care and refers them to specialists as needed. PPO plans do not require referrals.

- Out-of-network care: HMO plans often have higher out-of-pocket costs for out-of-network care, while PPO plans may offer more comprehensive coverage for out-of-network care.

- Premiums: HMO plans often have lower premiums than PPO plans, but may have higher out-of-pocket costs for out-of-network care.

- Flexibility: PPO plans offer more flexibility and freedom of choice than HMO plans, with members able to receive care from any provider, both in-network and out-of-network.

Choosing Between HMO and PPO Plans

Choosing between an HMO and a PPO plan depends on your individual needs and circumstances. If you prioritize affordability and are willing to receive care from within a narrower network of providers, an HMO plan may be a good choice. On the other hand, if you value flexibility and freedom of choice, and are willing to pay higher premiums for more comprehensive coverage, a PPO plan may be a better option.

Some questions to consider when choosing between an HMO and a PPO plan include:

- Do you have existing relationships with healthcare providers that you would like to continue?

- Do you need to receive care from a specialist without a referral from a PCP?

- Are you willing to pay higher premiums for more comprehensive coverage?

- Do you prioritize affordability and are willing to receive care from within a narrower network of providers?

Benefits and Drawbacks of HMO Plans

HMO plans offer several benefits, including:

- Lower premiums: HMO plans often have lower premiums than PPO plans, making them a more affordable option for individuals and families.

- Emphasis on preventive care: HMO plans often cover routine check-ups, screenings, and vaccinations, which can help prevent illnesses and detect health problems early.

- Coordinated care: HMO plans often provide coordinated care, with members receiving care from a PCP who refers them to specialists as needed.

However, HMO plans also have some drawbacks, including:

- Limited flexibility: HMO plans often have a narrower network of providers, which can make it more difficult to find a provider who is part of the network.

- Higher out-of-pocket costs for out-of-network care: HMO plans often have higher out-of-pocket costs for out-of-network care, which can be a significant expense for members who need to receive care from a provider who is not part of the network.

Benefits and Drawbacks of PPO Plans

PPO plans offer several benefits, including:

- More flexibility and freedom of choice: PPO plans allow members to receive care from any provider, both in-network and out-of-network, without the need for a referral from a PCP.

- More comprehensive coverage: PPO plans often offer more comprehensive coverage for out-of-network care, which can be beneficial for members who travel frequently or who need to receive care from a provider who is not part of the network.

- Lower out-of-pocket costs for out-of-network care: PPO plans often have lower out-of-pocket costs for out-of-network care, which can be a significant benefit for members who need to receive care from a provider who is not part of the network.

However, PPO plans also have some drawbacks, including:

- Higher premiums: PPO plans often have higher premiums than HMO plans, which can be a significant expense for individuals and families.

- More complex: PPO plans can be more complex than HMO plans, with members needing to navigate a broader network of providers and understand the differences between in-network and out-of-network care.

Conclusion and Next Steps

In conclusion, choosing between an HMO and a PPO plan depends on your individual needs and circumstances. By understanding the characteristics of each plan, you can make an informed decision about which one is best for you and your family. Whether you prioritize affordability, flexibility, or comprehensive coverage, there is a health insurance plan that can meet your needs.

If you are considering purchasing a health insurance plan, we encourage you to do your research and compare the different options available. Look for plans that offer comprehensive coverage, flexible network options, and affordable premiums. Additionally, consider your individual needs and circumstances, and choose a plan that meets your unique requirements.

We hope that this article has provided you with a comprehensive understanding of HMO and PPO plans, and has helped you to make an informed decision about which type of plan is best for you. If you have any further questions or would like to learn more about health insurance plans, please do not hesitate to contact us.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of flexibility and freedom of choice. HMO plans have a narrower network of providers and require members to select a primary care physician (PCP) who coordinates their care and refers them to specialists as needed. PPO plans, on the other hand, allow members to receive care from any provider, both in-network and out-of-network, without the need for a referral from a PCP.

Which type of plan is best for individuals who prioritize affordability?

+HMO plans are often the most affordable option for individuals who prioritize affordability. HMO plans typically have lower premiums than PPO plans, but may have higher out-of-pocket costs for out-of-network care.

Can I change from an HMO plan to a PPO plan?

+Yes, you can change from an HMO plan to a PPO plan, but you may need to wait until the next open enrollment period or experience a qualifying life event, such as a change in employment or the birth of a child. It is best to check with your health insurance provider to determine the specific rules and requirements for changing plans.