Intro

Discover what a PPO plan is, its benefits, and how it works, including network providers, deductibles, and copays, to make informed decisions about your healthcare coverage and insurance options.

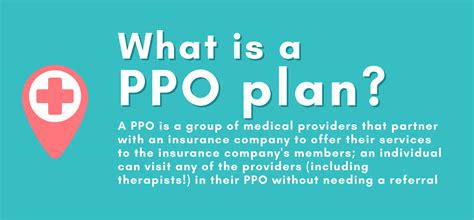

The Preferred Provider Organization (PPO) plan is a type of health insurance plan that offers a network of healthcare providers who have agreed to provide services to plan members at a discounted rate. PPO plans are designed to provide flexibility and choice to members, allowing them to receive care from both in-network and out-of-network providers. In this article, we will delve into the details of PPO plans, their benefits, and how they work.

PPO plans are one of the most popular types of health insurance plans, and for good reason. They offer a wide range of benefits, including access to a large network of healthcare providers, lower out-of-pocket costs, and the flexibility to see any healthcare provider, both in-network and out-of-network. With a PPO plan, members can receive care from any healthcare provider, but they will typically pay less for care received from in-network providers.

The importance of understanding PPO plans cannot be overstated. With the rising cost of healthcare, it is essential to have a health insurance plan that provides comprehensive coverage and flexibility. PPO plans offer just that, and they are an excellent option for individuals and families who want to have control over their healthcare choices. In this article, we will explore the benefits and drawbacks of PPO plans, how they work, and what to expect from these plans.

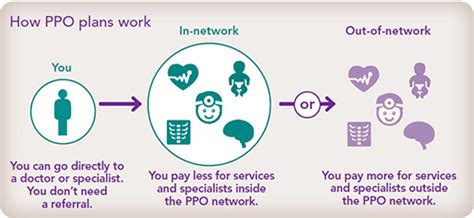

How PPO Plans Work

To understand how PPO plans work, let's consider an example. Suppose John has a PPO plan with a $20 copayment for in-network primary care visits. If John visits an in-network primary care physician, he will pay $20 for the visit. However, if John visits an out-of-network primary care physician, he may pay $50 or more for the visit. This is because out-of-network providers do not have a contract with the insurance company, and therefore, they do not offer discounted rates.

Benefits of PPO Plans

These benefits make PPO plans an attractive option for individuals and families who want to have control over their healthcare choices. With a PPO plan, members can receive care from any healthcare provider, and they will typically pay less for care received from in-network providers.

Types of PPO Plans

Each type of PPO plan has its own unique features and benefits. When choosing a PPO plan, it's essential to consider factors such as premium costs, deductible amounts, copayments, and coinsurance rates.

How to Choose a PPO Plan

By considering these factors, you can choose a PPO plan that meets your healthcare needs and budget.

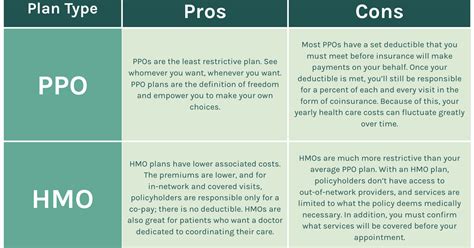

Advantages and Disadvantages of PPO Plans

However, PPO plans also have some disadvantages, including:

- Higher premium costs than other types of health insurance plans

- Higher out-of-pocket costs for out-of-network care

- More complex and difficult to understand than other types of health insurance plans

It's essential to weigh the advantages and disadvantages of PPO plans when deciding whether they are right for you.

PPO Plans and Preventive Care

Preventive care is essential for maintaining good health and preventing illnesses. With a PPO plan, you can receive preventive care services from any healthcare provider, both in-network and out-of-network.

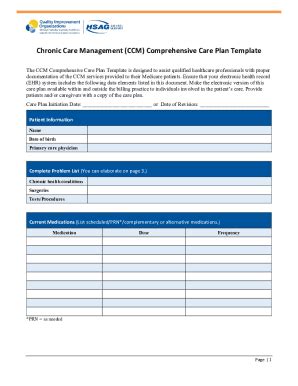

PPO Plans and Chronic Care Management

Chronic care management is essential for individuals with chronic conditions. With a PPO plan, you can receive chronic care management services from any healthcare provider, both in-network and out-of-network.

PPO Plans and Mental Health Services

Mental health services are essential for maintaining good mental health and preventing mental health conditions. With a PPO plan, you can receive mental health services from any healthcare provider, both in-network and out-of-network.

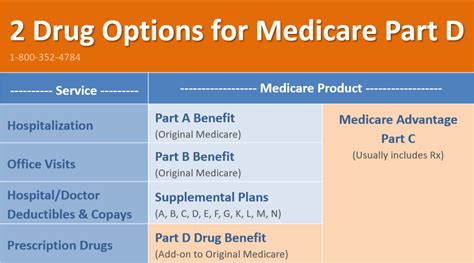

PPO Plans and Prescription Medications

Prescription medications are essential for treating a wide range of health conditions. With a PPO plan, you can receive prescription medications from any pharmacy, both in-network and out-of-network.

Conclusion and Final Thoughts

In conclusion, PPO plans are a type of health insurance plan that offers flexibility and choice to members. They provide access to a large network of healthcare providers, lower out-of-pocket costs, and comprehensive coverage for a wide range of healthcare services. While PPO plans have several advantages, they also have some disadvantages, including higher premium costs and more complex plan designs.If you are considering a PPO plan, it's essential to weigh the advantages and disadvantages and choose a plan that meets your healthcare needs and budget. Remember to consider factors such as premium costs, deductible amounts, copayments, and coinsurance rates when choosing a plan.

We hope this article has provided you with a comprehensive understanding of PPO plans and how they work. If you have any questions or comments, please feel free to share them below. We would love to hear from you and help you make informed decisions about your healthcare.

What is a PPO plan?

+A PPO plan is a type of health insurance plan that offers flexibility and choice to members. It provides access to a large network of healthcare providers, lower out-of-pocket costs, and comprehensive coverage for a wide range of healthcare services.

How do PPO plans work?

+PPO plans work by creating a network of healthcare providers who have agreed to provide services to plan members at a discounted rate. When a member receives care from an in-network provider, they will typically pay a lower copayment or coinsurance than they would if they received care from an out-of-network provider.

What are the benefits of PPO plans?

+PPO plans offer several benefits, including access to a large network of healthcare providers, lower out-of-pocket costs, flexibility to see any healthcare provider, and comprehensive coverage for a wide range of healthcare services.

How do I choose a PPO plan?

+When choosing a PPO plan, consider factors such as premium costs, deductible amounts, copayments, and coinsurance rates. It's also essential to consider the size and quality of the network, as well as the plan's coverage for preventive care, chronic care management, mental health services, and prescription medications.

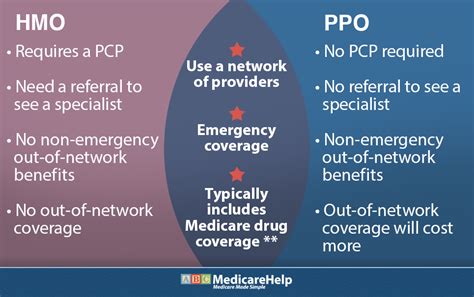

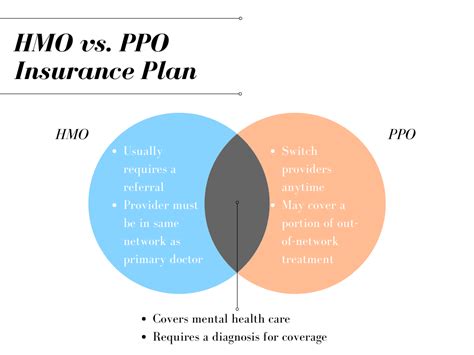

What is the difference between a PPO plan and an HMO plan?

+A PPO plan offers more flexibility than an HMO plan, allowing members to receive care from any healthcare provider, both in-network and out-of-network. HMO plans, on the other hand, require members to receive care from in-network providers, except in emergency situations.