Intro

The 1095 tax form is a crucial document for individuals and families who have obtained health insurance through the Health Insurance Marketplace or other sources. This form provides essential information about the type of health coverage you had during the tax year, which is necessary for filing your tax return. The 1095 tax form comes in different versions, including 1095-A, 1095-B, and 1095-C, each serving a specific purpose. Understanding the 1095 tax form and its requirements can be overwhelming, but with the right guidance, you can navigate the process with ease.

The importance of the 1095 tax form cannot be overstated. It helps the government verify that you have met the minimum essential coverage requirements under the Affordable Care Act (ACA). Without this form, you may face penalties or delays in processing your tax return. Moreover, the 1095 tax form provides vital information about your health insurance premiums, which can be used to claim tax credits or deductions. In this article, we will delve into the world of the 1095 tax form, exploring its different types, benefits, and requirements. We will also provide you with valuable tips and insights to help you navigate the process of obtaining and using this form.

The 1095 tax form is a complex document, and understanding its intricacies can be challenging. However, by breaking down the process into manageable chunks, you can gain a deeper understanding of the form and its requirements. The first step is to determine which type of 1095 tax form you need to obtain. If you have health insurance through the Health Insurance Marketplace, you will receive a 1095-A form. On the other hand, if you have health insurance through your employer or a private insurance company, you will receive a 1095-B or 1095-C form. Each type of form serves a specific purpose, and understanding the differences between them is crucial for accurate tax filing.

Understanding the 1095 Tax Form Types

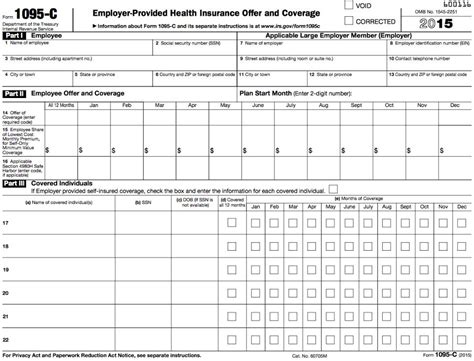

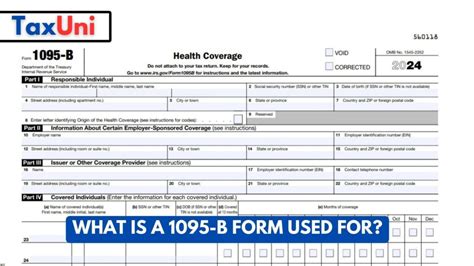

The 1095 tax form comes in three main types: 1095-A, 1095-B, and 1095-C. Each type of form provides different information about your health insurance coverage. The 1095-A form is used to report health insurance coverage obtained through the Health Insurance Marketplace. This form will show the months you had coverage, the type of coverage you had, and the amount of premiums you paid. The 1095-B form is used to report health insurance coverage obtained through a private insurance company or an employer. This form will show the months you had coverage and the type of coverage you had. The 1095-C form is used to report health insurance coverage offered by an employer. This form will show the months you had coverage, the type of coverage you had, and the amount of premiums you paid.

Benefits of the 1095 Tax Form

The 1095 tax form provides several benefits to individuals and families. One of the primary benefits is that it helps you claim tax credits or deductions for your health insurance premiums. If you have obtained health insurance through the Health Insurance Marketplace, you may be eligible for the premium tax credit. This credit can help reduce the amount of taxes you owe or increase your refund. Additionally, the 1095 tax form provides proof of health insurance coverage, which is necessary for avoiding penalties under the ACA.Filing Your Tax Return with the 1095 Tax Form

Filing your tax return with the 1095 tax form requires careful attention to detail. The first step is to gather all the necessary documents, including your 1095 tax form, W-2 forms, and any other relevant tax documents. Next, you will need to determine which tax filing status you qualify for and which tax credits or deductions you are eligible for. You can use tax software or consult with a tax professional to help you navigate the process. When filling out your tax return, be sure to accurately report the information from your 1095 tax form, including the months you had coverage and the amount of premiums you paid.

Common Mistakes to Avoid

When filing your tax return with the 1095 tax form, there are several common mistakes to avoid. One of the most common mistakes is failing to report the correct information from your 1095 tax form. This can lead to delays in processing your tax return or even penalties. Another common mistake is failing to claim tax credits or deductions for which you are eligible. This can result in paying more taxes than you owe or missing out on valuable tax savings.Tips for Obtaining and Using the 1095 Tax Form

Here are five tips for obtaining and using the 1095 tax form:

- Tip 1: Determine which type of 1095 tax form you need to obtain. If you have health insurance through the Health Insurance Marketplace, you will need to obtain a 1095-A form. If you have health insurance through your employer or a private insurance company, you will need to obtain a 1095-B or 1095-C form.

- Tip 2: Make sure to carefully review your 1095 tax form for accuracy. Check the months you had coverage, the type of coverage you had, and the amount of premiums you paid.

- Tip 3: Use your 1095 tax form to claim tax credits or deductions for which you are eligible. If you have obtained health insurance through the Health Insurance Marketplace, you may be eligible for the premium tax credit.

- Tip 4: Keep your 1095 tax form with your other tax documents, such as your W-2 forms and any other relevant tax documents.

- Tip 5: Consult with a tax professional if you have questions or concerns about obtaining or using your 1095 tax form.

Additional Resources

If you need additional help or guidance with the 1095 tax form, there are several resources available. You can visit the official website of the Internal Revenue Service (IRS) for more information about the 1095 tax form and its requirements. You can also consult with a tax professional or use tax software to help you navigate the process.Conclusion and Next Steps

In conclusion, the 1095 tax form is a crucial document for individuals and families who have obtained health insurance through the Health Insurance Marketplace or other sources. By understanding the different types of 1095 tax forms, their benefits, and requirements, you can navigate the process with ease. Remember to carefully review your 1095 tax form for accuracy, use it to claim tax credits or deductions for which you are eligible, and keep it with your other tax documents. If you have questions or concerns, consult with a tax professional or use tax software to help you navigate the process.

Final Thoughts

The 1095 tax form is an essential document for tax filing, and understanding its intricacies can help you avoid penalties and claim valuable tax savings. By following the tips and guidelines outlined in this article, you can ensure a smooth and successful tax filing experience. Remember to stay informed about any changes to the 1095 tax form and its requirements, and consult with a tax professional if you have any questions or concerns.What is the purpose of the 1095 tax form?

+The 1095 tax form is used to report health insurance coverage and provide proof of minimum essential coverage under the Affordable Care Act (ACA).

Which type of 1095 tax form do I need to obtain?

+The type of 1095 tax form you need to obtain depends on how you obtained your health insurance. If you have health insurance through the Health Insurance Marketplace, you will need to obtain a 1095-A form. If you have health insurance through your employer or a private insurance company, you will need to obtain a 1095-B or 1095-C form.

How do I use my 1095 tax form to claim tax credits or deductions?

+You can use your 1095 tax form to claim tax credits or deductions for which you are eligible. If you have obtained health insurance through the Health Insurance Marketplace, you may be eligible for the premium tax credit. Consult with a tax professional or use tax software to help you navigate the process.

We hope this article has provided you with valuable insights and information about the 1095 tax form. If you have any further questions or concerns, please do not hesitate to comment below. Share this article with your friends and family to help them navigate the complex world of tax filing. Remember to stay informed about any changes to the 1095 tax form and its requirements, and consult with a tax professional if you have any questions or concerns.