Intro

Discover affordable family insurance plans with comprehensive coverage, flexible premiums, and tailored benefits, ensuring financial security and peace of mind for your loved ones, including health, life, and dental insurance options.

The importance of having health insurance cannot be overstated, especially for families. With the rising costs of medical care, having a safety net in place can help alleviate financial burdens and provide peace of mind. However, finding affordable family insurance plans can be a daunting task, especially for those on a tight budget. Many families struggle to balance the need for comprehensive coverage with the need to keep costs low. Fortunately, there are options available for those seeking affordable family insurance plans. In this article, we will explore the various options and factors to consider when selecting a family insurance plan.

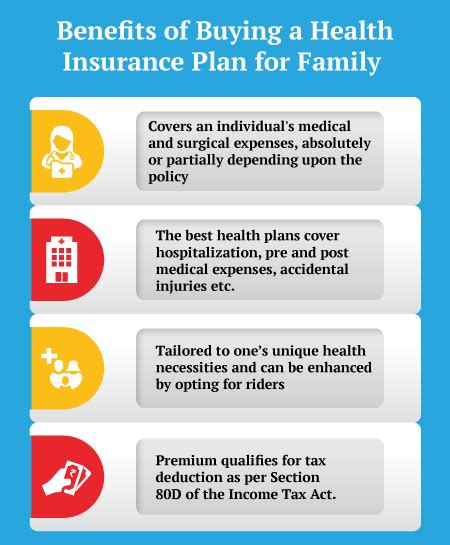

Having health insurance is essential for families, as it provides financial protection against unexpected medical expenses. Without insurance, a single accident or illness can lead to financial ruin. Moreover, having insurance encourages families to seek preventive care, which can help prevent more serious health issues down the line. With the numerous options available, it can be overwhelming to navigate the world of family insurance plans. However, by understanding the different types of plans, their benefits, and what to look for, families can make informed decisions and find affordable coverage that meets their needs.

The current healthcare landscape is complex, and navigating the various options can be challenging. The Affordable Care Act (ACA) has expanded access to health insurance for millions of Americans, including families. However, the ACA has also introduced new terminology, such as "metal tiers" and "networks," which can be confusing for those unfamiliar with the system. Furthermore, the rising costs of healthcare have led to an increase in out-of-pocket expenses, making it even more crucial for families to find affordable insurance plans. In the following sections, we will delve into the world of family insurance plans, exploring the different types, benefits, and factors to consider when selecting a plan.

Affordable Family Insurance Plans Overview

Types of Family Insurance Plans

In addition to the above-mentioned plans, there are other options available, such as catastrophic plans and short-term plans. Catastrophic plans are designed for young adults or those who cannot afford other types of coverage. These plans have lower premiums but higher deductibles and limited benefits. Short-term plans, as the name suggests, provide temporary coverage for a specified period, usually up to 12 months. These plans can be useful for those between jobs or waiting for other coverage to begin.Benefits of Family Insurance Plans

How to Choose the Right Plan

When selecting a family insurance plan, there are several factors to consider. First and foremost, families should assess their healthcare needs and budget. They should consider the number of family members, their ages, and any pre-existing conditions. Families should also research the different types of plans available, including HMO, PPO, and EPO plans, and weigh the pros and cons of each. Additionally, they should review the plan's network, including the providers and hospitals included, as well as the plan's benefits, such as preventive care and additional services.Factors to Consider When Selecting a Plan

Cost-Saving Strategies

For families on a tight budget, there are several cost-saving strategies to consider. One option is to opt for a higher deductible plan, which can lower premiums. However, this means that families will need to pay more out-of-pocket expenses before the insurance kicks in. Another option is to take advantage of tax-advantaged savings options, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). These accounts allow families to set aside pre-tax dollars for medical expenses, which can help reduce their taxable income.Affordable Family Insurance Plans Options

Government Assistance Programs

For low-income families, there are several government assistance programs available. Medicaid, for example, provides comprehensive coverage for eligible families, including children, pregnant women, and parents. The Children's Health Insurance Program (CHIP) also provides coverage for children in low-income families. Additionally, the ACA has introduced new tax credits and subsidies, which can help families purchase insurance plans through the marketplaces.Family Insurance Plans and Pre-Existing Conditions

Special Considerations for Families with Pre-Existing Conditions

Families with pre-existing conditions should carefully review the plan's benefits and limitations. They should also research the plan's provider network, including the quality and reputation of the providers and hospitals included. Additionally, families should consider the plan's customer service and support, including the availability of online resources and phone support. Families with pre-existing conditions may also want to explore government assistance programs, such as Medicaid or CHIP, which can provide comprehensive coverage.Conclusion and Next Steps

What is the difference between an HMO and a PPO plan?

+An HMO plan requires policyholders to receive care from a specific network of providers, while a PPO plan offers more flexibility, allowing policyholders to see any healthcare provider, both in and out of network.

How do I know if I am eligible for Medicaid or CHIP?

+To determine eligibility for Medicaid or CHIP, families can visit their state's Medicaid website or contact their local Medicaid office. They will need to provide information about their income, family size, and other factors to determine eligibility.

Can I purchase a family insurance plan through the ACA marketplace?

+Yes, families can purchase insurance plans through the ACA marketplace. The marketplace offers a range of plans from different insurance companies, and families can compare and purchase plans during the open enrollment period or during a special enrollment period if they experience a qualifying life event.