Intro

Discover 5 ways to affordable health coverage, including subsidized plans, short-term insurance, and cost-sharing options, to reduce medical expenses and access quality healthcare with budget-friendly solutions and flexible alternatives.

The rising cost of healthcare has become a significant concern for many individuals and families around the world. As medical expenses continue to increase, it can be challenging for people to access quality healthcare without breaking the bank. However, there are ways to obtain affordable health coverage, and it's essential to explore these options to ensure you and your loved ones receive the medical care you need. In this article, we'll delve into the importance of affordable health coverage and discuss five ways to make healthcare more accessible.

The lack of affordable health coverage can have severe consequences, including delayed or foregone medical care, financial burdens, and even bankruptcy. Furthermore, individuals without health insurance are more likely to experience poor health outcomes, including higher mortality rates. On the other hand, having affordable health coverage can provide peace of mind, financial security, and access to necessary medical care. It's crucial to understand the options available and make informed decisions about your health insurance.

The search for affordable health coverage can be overwhelming, especially with the numerous options available. However, by understanding the different types of health insurance and their benefits, you can make an informed decision that suits your needs and budget. From government-sponsored programs to private insurance plans, there are various ways to obtain affordable health coverage. In the following sections, we'll explore five ways to make healthcare more accessible and discuss the benefits and drawbacks of each option.

Affordable Health Coverage Options

When it comes to affordable health coverage, there are several options to consider. These options include government-sponsored programs, private insurance plans, employer-sponsored plans, and more. Each option has its benefits and drawbacks, and it's essential to understand these differences to make an informed decision. In this section, we'll explore the various affordable health coverage options and discuss their advantages and disadvantages.

Government-Sponsored Programs

Government-sponsored programs, such as Medicaid and the Children's Health Insurance Program (CHIP), provide affordable health coverage to low-income individuals and families. These programs offer comprehensive coverage, including doctor visits, hospital stays, and prescription medications. To be eligible for these programs, individuals must meet specific income and eligibility requirements. Government-sponsored programs are an excellent option for those who cannot afford private insurance plans.Private Insurance Plans

Private insurance plans are another option for affordable health coverage. These plans are offered by insurance companies and can be purchased individually or through an employer. Private insurance plans offer a range of benefits, including doctor visits, hospital stays, and prescription medications. However, these plans can be more expensive than government-sponsored programs and may have higher deductibles and copays.

Employer-Sponsored Plans

Employer-sponsored plans are a common option for affordable health coverage. These plans are offered by employers as a benefit to their employees and often provide comprehensive coverage, including doctor visits, hospital stays, and prescription medications. Employer-sponsored plans can be more affordable than private insurance plans, as the employer typically contributes to the premium costs. However, these plans may have limitations, such as limited provider networks and higher deductibles.Short-Term Limited-Duration Insurance

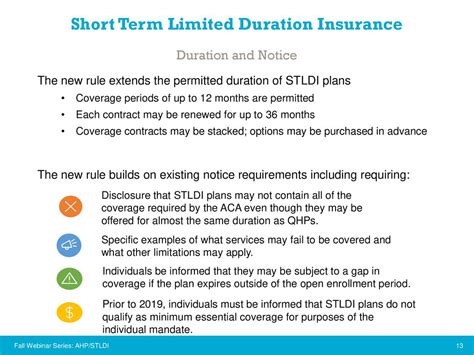

Short-term limited-duration insurance (STLDI) plans are temporary health insurance plans that provide coverage for a limited period, typically up to 12 months. These plans are designed for individuals who are between jobs, waiting for other coverage to start, or need temporary coverage. STLDI plans are often less expensive than major medical plans but may have limited benefits and higher deductibles.

Health Maintenance Organizations (HMOs)

Health Maintenance Organizations (HMOs) are a type of health insurance plan that provides comprehensive coverage, including doctor visits, hospital stays, and prescription medications. HMOs typically require individuals to receive medical care from a specific network of providers, which can help control costs. HMOs can be more affordable than other types of health insurance plans, but they may have limitations, such as limited provider networks and higher copays.5 Ways to Affordable Health Coverage

Now that we've discussed the various affordable health coverage options, let's explore five ways to make healthcare more accessible. These ways include:

- Subsidies and Tax Credits: The Affordable Care Act (ACA) provides subsidies and tax credits to help individuals and families afford health insurance. These subsidies can help reduce premium costs and make healthcare more accessible.

- Cost-Sharing Reductions: Cost-sharing reductions (CSRs) are discounts on deductibles, copays, and coinsurance that can help make healthcare more affordable. CSRs are available to individuals and families who qualify for subsidies and can help reduce out-of-pocket costs.

- Catastrophic Plans: Catastrophic plans are a type of health insurance plan that provides limited coverage, including doctor visits, hospital stays, and prescription medications. These plans are designed for young adults and individuals who cannot afford other types of health insurance.

- Association Health Plans: Association Health Plans (AHPs) are a type of health insurance plan that allows small businesses and self-employed individuals to band together to purchase health insurance. AHPs can provide more affordable health coverage options for small businesses and self-employed individuals.

- Community Health Centers: Community Health Centers (CHCs) are non-profit health clinics that provide comprehensive primary care services, including doctor visits, dental care, and mental health services. CHCs can provide affordable health coverage options for individuals and families who cannot afford other types of health insurance.

Benefits of Affordable Health Coverage

Affordable health coverage provides numerous benefits, including:

- Financial Protection: Affordable health coverage can provide financial protection against unexpected medical expenses, which can help prevent financial burdens and bankruptcy.

- Access to Necessary Care: Affordable health coverage can provide access to necessary medical care, including doctor visits, hospital stays, and prescription medications.

- Improved Health Outcomes: Affordable health coverage can lead to improved health outcomes, as individuals are more likely to receive necessary medical care and follow treatment plans.

- Reduced Stress and Anxiety: Affordable health coverage can reduce stress and anxiety related to medical expenses and provide peace of mind.

Challenges and Limitations

While affordable health coverage provides numerous benefits, there are also challenges and limitations to consider. These challenges include:- Limited Provider Networks: Some health insurance plans may have limited provider networks, which can limit access to necessary medical care.

- Higher Deductibles and Copays: Some health insurance plans may have higher deductibles and copays, which can make healthcare less affordable.

- Limited Benefits: Some health insurance plans may have limited benefits, which can leave individuals with unexpected medical expenses.

Conclusion and Next Steps

In conclusion, affordable health coverage is essential for individuals and families to access necessary medical care without breaking the bank. By understanding the various affordable health coverage options and exploring the five ways to make healthcare more accessible, individuals can make informed decisions about their health insurance. While there are challenges and limitations to consider, affordable health coverage can provide numerous benefits, including financial protection, access to necessary care, improved health outcomes, and reduced stress and anxiety.

To take the next step, we invite you to comment below and share your thoughts on affordable health coverage. What are your experiences with health insurance, and what do you think are the most critical factors in making healthcare more accessible? Share this article with your friends and family, and let's work together to make healthcare more affordable and accessible for everyone.

What is affordable health coverage?

+Affordable health coverage refers to health insurance plans that provide comprehensive coverage at a reasonable cost. These plans can be purchased individually, through an employer, or through government-sponsored programs.

How do I qualify for subsidies and tax credits?

+To qualify for subsidies and tax credits, individuals and families must meet specific income and eligibility requirements. These requirements vary depending on the type of health insurance plan and the state in which you reside.

What are the benefits of affordable health coverage?

+Affordable health coverage provides numerous benefits, including financial protection, access to necessary care, improved health outcomes, and reduced stress and anxiety.

How do I choose the right health insurance plan?

+To choose the right health insurance plan, individuals should consider their health needs, budget, and lifestyle. It's essential to research and compares different health insurance plans to find the one that best meets your needs.

What are the challenges and limitations of affordable health coverage?

+While affordable health coverage provides numerous benefits, there are also challenges and limitations to consider, including limited provider networks, higher deductibles and copays, and limited benefits.